Table of Contents

In this post, we’ll touch base on what an electronic point of sale (EPOS) system is, how it works, the key benefits it offers to various players.

The electronic point of sale (EPOS) systems are taking over the $9.3 billion POS market by storm.

A bold claim, however, many latest industry reports back it up.

For instance, as per Forbes, nearly 61% of businesses aim to shift to a cloud-based POS system in the coming future. At the same time, 60% of all retailers prefer EPOS over traditional POS systems as they’re cost-effective, simple-to-use, flexible, and highly functional.

However, there’s more to using electronic point of sale systems than this.

Let’s dive deep and find out ourselves.

Starting with the very basic questions – what electronic point of sale system is suited for today’s day and age?

What Is An Electronic Point of Sale (EPOS) System?

An electronic point of sale (EPOS) system is a new-age payment acceptance machine that:

- Enables quick and smooth flow of transactions between terminals

- Helps accept payments using new-age digital payment methods. These include cards, UPI, QR scans, payment links and more

- Serve as an excellent alternative to a physical point of sale machines.

With electronic point of sale systems, any merchant can start accepting payments by simply downloading an EPOS app on an NFC-enabled device.

The application instantly converts the merchant’s device into a point of sale machine. This eliminates the need to buy and maintain a hefty hardware like in the case of a traditional POS system.

Moreover, electronic point of sale systems offers the instant gratification that modern buyers seek.

They’ve also helped a large part of the Indian retail community, especially the MSMEs, to get back on their feet post the COVID-19 pandemic depression.

Please note, the terms EPOS and softPOS are used interchangeably. Their meaning and functionality remain the same.

What Are The Functionalities Of Electronic Point Of Sale Systems?

Electronic point of sale is an excellent combination of hardware and software that make payment acceptance easy, effective, and efficient.

Moreover, unlike traditional till systems with limited functionalities, electronic point of sale systems come with many advanced features. These include,

- Quickly accepting payments and returns

- Generating receipts in real-time

- Storing and processing payment information

- Generating detailed purchase reports

- Managing business inventory

- Offering discounts and promotions

Retailers can even connect electronic point of sale systems to other devices such as:

- Mobile phones

- Tablets

- Barcode scanners

- Receipt printers

This way, they can customise their functionality to suit their individual business needs.

Best of all, electronic point of sale systems ensures that all business transactions stay organised.

Everything is automatically stored in a chronological manner, enabling retailers to generate custom reports to analyse sales and take future business decisions.

What Are The Different Types Of POS Systems

Usually, three types of point of sale systems are used by merchants in today’s time.

- Physical POS systems

- mPOS systems

- SoftPOS/EPOS systems.

While the basic functionality remains the same, they differ in terms of tech and development.

| Physical POS | mPOS | softPOS | |

| Requirements for Payment Acceptance | Requires a physical terminal to commence payment collection | Requires a smartphone, a POS application and a card reader to accept payments | Requires an NFC-enabled smartphone and an application to collect payments |

| Is it Hardware or Software? | Hardware | Hardware | Software |

| Hardware Requirements | Physical Terminal | EMV enabled device (usually called the card reader) | ZERO hardware requirements |

| Installation Requirements | Need for additional hardware and proper installation | Need for additional hardware, but installation is simple | No need for additional hardware or installation |

| Purchase Cost | High purchase and installation cost | Comparatively lower purchase and installation cost | Negligible purchase and installation cost |

| Maintenance Cost | High on maintenance and upgradation cost | Comparatively easy to maintenance and upgradation cost | Very easy to maintain and no upgradation cost |

| Customisation | Custom-creating such systems is not easy | Adding customisations is possible, to an extend | Highly customisable in nature |

| Data Storage | Transactional data stored at the site of the cash register | Cloud Technology | Cloud Technology |

How Does An Electronic Point Of Sale System Work?

The traditional point of sale systems were simple cash registers that were created to prevent/reduce pilferage.

Many advancements in technology and the introduction of new modes of payments encouraged the inception of cloud-based POS systems. They are known to be:

- Increasingly sophisticated and highly versatile

- Customizable depending upon business needs

- Comparatively cheaper

- Feature-rich and easy-to-use

Besides these, modern point of sale systems also helps merchants capture customer information that helps them analyse many critical business metrics.

What’s more, new electronic point of sale systems can be squeezed into small, pocket-sized hardware such as smartphones. These come in handy for merchants and save POS costs as well.

On top of this large retailers, such as supermarkets, can link electronic POS systems to:

- Barcode scanners

- Touchscreen input

- Weighing scales

On the other hand, small retailers, such as grocery shop owners or mini cafes can integrate these EPOS systems with their existing ERPs.

What’s An Electronic Point Of Sale Till System?

Electronic point of sale systems have advanced with time. However, they still serve the same functions as the traditional cash registers.

However, they offer higher functionality at lower costs.

A monitor, tablet, or any terminal is critical to processing purchases and accept payments. This is where all the essential checkout functions take place.

The only difference is that, unlike traditional tills, the terminals of the new electronic point of sale system is linked to a powerful software enabling better functionality.

Given below is a visual representation of traditional versus contemporary point of sale systems.

What Are The Benefits of EPOS Systems?

Unlike their traditional counterparts, contemporary EPOS systems offer several long-term benefits to retailers. Some of these are as follows:

In a time when businesses of all types and sizes are recovering from the aftermath of the COVID-19 pandemic and trying to save as much money as they can, electronic point of sale systems serves as a long-term cost-saving investment.

Electronic point of sale systems can help,

- Generate noticeable savings on accounting

- Increase stock control efficiency

- Serve as a database curator to analyse customers and their behaviours

Promise of SoftPOS- The Modern Electronic Point Of Sale System

The market today is swamped with options.

Many even offer customizations and POS APIs which allow point of sale systems to integrate with different fintech products.

However, at the end of the day, everyone needs a point of sale system that’s handy, efficient and user friendly.

softPOS is one such capability-enabled POS device for the Indian merchant market.

In fact, SoftPOS is often dubbed as the modern electronic point of sale system.

It aims to offer a solution that provides freedom from external hardware integrations and serves as a perfect one-size-fits-all solution for all merchants.

Listed below are some benefits that softPOS will offer to various industry stakeholders.

Small and Medium Businesses (SMBs)

SoftPOS can enable small and medium businesses to:

- Reduce turnaround time

- Enable digital and contactless payments

- Dilute the attached costs

Small and medium businesses like Kirana stores, brick-and-mortar stores, freelancers, NGOs, etc. have suffered hugely in terms of reduced footfall. This was due to the outbreak of the COVID-19 pandemic and its after-shocks.

Since these businesses have smaller budgets, softPOS will serve as an excellent solution to easily and easily accept low ticket-size online payments.

Retail Businesses

Some examples of retail businesses are supermarkets, grocery stores, electronic and hardware stores, etc.

They have to constantly keep a track of their inventory, online and offline orders, inflow and outflow of payments, etc.

Manually managing such activities is highly cumbersome.

Here, the modern electronic point of sale system shows a way out.

SoftPOS enables retailers to conduct all business-related critical activities through this handy solution.

Using the softPOS system, retailers will be able to:

- Manage inventory

- Track sales across various online and offline channels

- Print bills and labels

- Reconcile accounts

- Generate sales reports

- Gain insights into the performance of the business

- Accept payment via multiple payment modes including cards, UPI, QR scan, payment links, etc.

- Provide credit-based payment options such as buy now, pay later, EMIs, etc.

With softPOS, retailers can also accept hasslefree cashless payments without incurring any additional cost on hardware.

Resultantly, they can commence day-to-day business activities effectively and efficiently.

Restaurants

Different types of restaurants have different needs.

These needs extend to POS systems as well.

For instance, a food court may require a self-service kiosk with an easy payment system.

Meanwhile, a high-end restaurant may want to manage orders and integrate the same with kitchen displays.

softPOS systems cater to all such specific needs. It offers a simple and convenient way for all types and sizes of restaurants to bring mobility to their business, especially in terms of payments.

softPOS also serve an amazing solution for food trucks, cloud kitchens, makeshift food outlets, etc.

Some exclusive solutions that softPOS systems offers are as follows.

- Customisable solution

- Manage pricing, special offers, happy hour discountings, etc.

- Customer management, reservations, etc.

- Employee management and scheduling

- Reports and analysis

Service-based Businesses

Service-based businesses ideally comprise entertainment, beauty, and wellness services. The primary focus of such businesses is to

- Manage and schedule appointments

- Provide service details via kiosks along with self-checkout

- Offer on-floor payments

With an increase in at-home services such as beauty treatments, food delivery, medicine delivery etc.

SoftPOS helps such businesses by offering portable and easy-to-use payment accepting solutions.

Delivery Agents

While the at-home deliveries have exponentially increased since the outbreak of the COVID-19 pandemic, a major chunk of orders have also not been processed due to payment in cash.

Many delivery agents refused to accept cash as a precautionary measure.

Now, delivery agents could easily download modern electronic point of sale system apps on their smartphones and efficiently collect payments.

This will not only help delivery agents keep themselves protected from virus transmission but also benefits the businesses to lower costs and process more orders.

Delivery agents can simply ask the customer to scan a QR code or send a payment link via softPOS to their registered mobile number to complete the transaction.

EPOS: Enabling Digital Payments in Offline Spaces

Here’s a view of how the new smart electronic point of sale systems work in India.

The Reserve Bank of India recently announced the launch of a new framework under its digital payments umbrella – offline digital payments.

Under this framework, the citizens of India will now be able to make small value digital payments in the offline mode. Individuals can,

- Make digital payments even with no internet or telecom connectivity

- Use payment instruments or channels like cards, wallets, or mobile devices to make digital payments in offline mode

- Make payments of up to INR 200 per transaction and INR 2000 per instrument until the balance runs out.

Here, electronic point of sale systems can turn offline or COD orders into online orders using QR codes/payment links.

Moreover, they can:

- Enable accepting payments via multiple offline payment instruments

- Record transactions and print receipts

- Send signals/intimations to banks/issuers indicating the merchant credits and consumer debits

- Send transaction messages to consumers when they’re in online mode.

To say, the new electronic point of sale systems are serving as the backbone for the RBI, helping to facilitate such innovative payment methods.

The Esystems are making it simpler and more convenient for merchants and consumers to transact today than almost half-a-decade ago.

3 Common Mistakes To Avoid While Buying Electronic Point Of Sale Systems

While we’ve been heavily vouching about the advantages of why merchants must use an electronic point of sale system. It’s equally important to choose the right EPOS system that proves beneficial in the long run.

Listed below are three common mistakes to avoid while buying an electronic point of sale system.

Not Knowing Your Business Needs

Modern electronic point of sale systems are more than just instruments to accept payments.

Many come equipped with various contemporary functionalities that help carry out critical business tasks easily. For instance,

- Tracking sales and get access to critical business information

- Managing inventory using the POS machine itself

- Automating information collection process

- incorporating discounting system in the machine

While choosing an electronic point of sale system, make a note of the functionalities essential to your business.

Once done, you’ll be able to quickly decide the kind of EPOS system your business needs.

You can also ask for demos from EPOS service providers to understand the instrument’s functionalities and get customisations done accordingly.

Buying The Cheapest Option

This is another common mistake that most merchants make irrespective of the type and size of their business.

Especially if they’re a first-time user.

They believe that buying a cheaper option is always better

- To understand the basic use-case of a device

- Because it goes easy on the pocket

- Because it may be easier to understand than the expensive counterparts.

Why does this mentality needs to change?

While low price electronic point of sale systems look enticing, they come with many hidden costs. This includes constant software updates, need for additional hardware support, and so on.

We’re not vouching for you to buy an expensive EPOS system. Rather make a smart decision. Find an electronic point of sale system that:

- Fits your business needs

- Offers all the basic functionalities your business expects

- Doesn’t make a hole in your pocket

SoftPOS by Cashfree Payments is an excellent option to choose from.

In fact, it is equipped with many modern business functionalities and doesn’t need any external hardware to support the POS system.

Related Read – Supporting digital payments adoption via the promise of softPoS

Not Doing Due Diligence

Third on the list of not doing proper due diligence – neither the product nor the seller.

Before finalising a product, ask yourself a couple of questions.

- Does your Esystem accept payments in all popular payment modes?

- Will the payments be secure? Is your EPOS provider PCI-compliant?

- What are the industry segments that the company caters to?

- What kind of after-sales services does the company offer – technical assistance, support, training, etc.?

- Are there any case studies to refer to understand whether or not your selected sPOS system is effective?

- Does your EPOS provider provide a unified payments system? Do they offer a dashboard, reconciliation services, payment aggregator features and more?

Bottom line: don’t forget to do your research before investing into a payment system.

4 Challenges Pertaining To Use Of Electronic Point Of Sale Systems In India

Electronic point of sale systems are an extraordinary invention.

They’ve practically changed the entire payment acceptance game at merchant level.

However, even such remarkable inventions come with many challenges.

Here is a bird’s eye view of those challenges.

Converting Existing Cards Into Contactless Cards

A majority of cards being used in the Indian market today aren’t equipped with contactless payment facility.

They need to be converted into contactless cards to increase contactless usage at EPOS systems, especially with the pandemic here to stay.

Distribution of NFC-enabled Phones

Similar to cards, many feature phones aren’t NFC-enabled to allow merchants to accept contactless payments via their phones.

To make EPOS a success in the market, it’s essential to ensure widespread distribution of NFC-enabled smartphones or the development of an application that supports NFC payments.

Solving Upgradation Issues

There’s always a long-term challenge behind upgrading.

Smartphones (or other hardware), as well as software (and cloud facilities), need to adapt to the ever-evolving payment acceptance needs.

Increasing The Use Of Smartphones PAN India

As per Statista, approximately only 845 million Indians had smartphones in 2021 as opposed to the country’s total population of 139 billion.

Increasing the use of smartphones and feature phones has become a necessity to ensure the success of EPOS systems in India.

However, the RBI’s focus on offline payments via feature phones is a blessing in disguise.

It’ll be interesting to see how electronic point of sale systems adapt to these challenges.

Explaining softPOS Systems by Cashfree Payments

While multiple service providers are offering highly sophisticated EPOS systems in India, not all have the ability to cater for all types and sizes of business. softPOS by Cashfree Payments solves the problem.

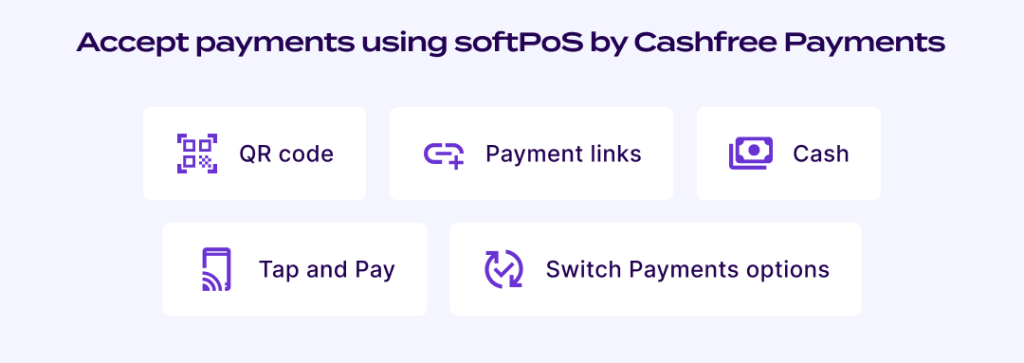

softPOS by Cashfree Payments is an EPOS solution that covers a wide variety of payment options along with the tap and pay feature which differentiates it from its market counterparts.

No matter the kind of business you run, softPOS solution will solve all your payment problems.

- Custom-designed softPOS systems with multiple integration options

- An exhaustive variety of payment options available for customers to choose from

- Highly intuitive dashboard that enables you to manage payments, run reconciliations, generate sales reports, and update inventory.

softPOS systems by Cashfree Payments are transparent, the best services with no hidden charges. It’s a one-stop solution for all your needs.

How To Accept Payments Using softPOS By Cashfree Payments

Most modern-day POS systems, such as one offered by Cashfree Payments, enable retailers to accept payments via different methods. Some of these are as follows.

1. QR Codes

QR codes or quick response codes have become the most common type of payment mode in today’s time.

They’re quite handy and enable quick payments.

In the case of EPOS, to accept payment via QR code, enter the following details to generate a custom QR code.

- Amount be paid by the customer

- Customer mobile number for identification purposes

- Unique invoice number for accounting and reconciliation purposes

- Order Note to capture any additional information

Once done, all a customer needs to do is just scan the custom-generated QR code using applications like GPay PhonePe, Paytm, etc. and make payment.

2. Payment Link

You can send quick payment links to a customer’s phone via SMS or any other messaging platform using the Payment Link feature. Customers can click on the link and process the necessary payment.

The payment link ideally contains the following details.

- The exact amount to be paid by the customer

- Customer mobile number on which the payment link was sent

- Invoice number for accounting and reconciliation purpose

- Order number to capture any additional information

3. Cash

This option, in most cases, is given only to facilitate collection reconciliation in the backend.

In this case, the retailer only needs to enter the amount and the transactions are registered automatically in the system.

4. Tap And Pay

This facility is only available to users using NFC-enabled Android devices.

Retailers can accept card payments from customers via a single tap on their phones.

The collection limit in the case of tap and pay via mobile phones is set at INR 5000 per transaction as per the RBI guidelines.

Moreso, the payment mode conducts a simple biometric check using the smartphone’s in-built fingerprint or pin-code security feature.

Post the biometric check, the customer only needs to enter the payable amount and the rest of the process happens automatically. Transaction status is shared on the customer’s smartphone in a matter of seconds.

5. Switch Payment Option

Many times online payments via Payment Links or QR Codes may not get processed due to various reasons.

In such cases, retailers can switch between payment modes and help customers complete the transaction without starting the transaction all over again.

At present, only a handful of EPOS service providers such as Cashfree Payments offer this feature.

Do these options sound intriguing? Schedule a call to know more.