Recurring Payments

NACH mandate for Businesses

A guide on NACH mandate – the underlying infrastructure to collect recurring payments in India.

Get In TouchRecurring payments are intrinsic to many businesses. However, India has lacked a convenient way to process them due to restrictions on two-factor authentication (2FA).

To rectify this issue, RBI introduced ECS mandates. But, due to its manual and prolonged process, it limited extensive adoption.

NACH, initiated by the NPCI, aimed to reduce processing time, and make the whole system digital. Hence, NACH / e Mandate was introduced.

Recurring Payment

Recurring payments or Subscriptions are automatic payments, where a customer authorizes a service provider to debit fixed or variable amounts at regular intervals.

-

Content

-

SaaS

-

Utility

-

Retail & eCommerce

-

Financial Services

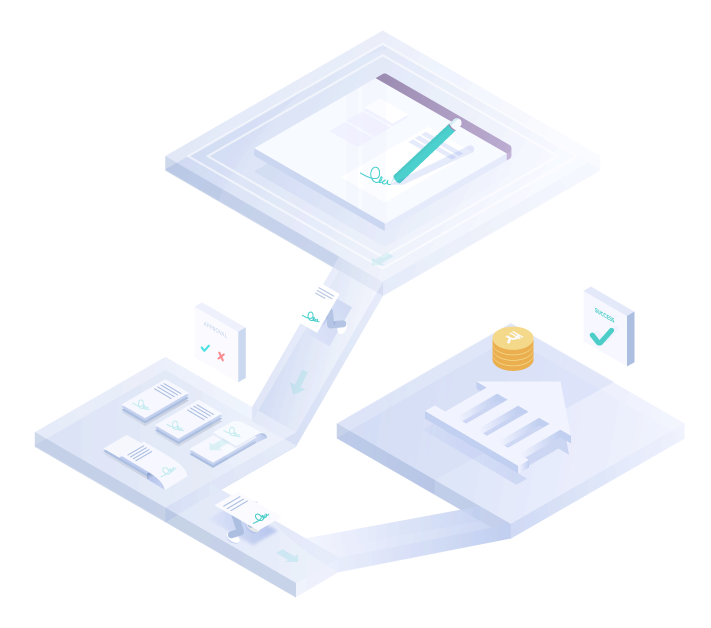

ECS mandate V/S NACH mandate

Systematic Investment Planning (SIP) is one of the most common and preferred ways of investing in mutual funds. Let’s do a process comparison, that shows us the perks of NACH mandate over ECS.

ECS Mandate

-

01

Customer pens mandate details.

-

02

Customer submits form to fund house.

-

03

Fund house couriers form to destination bank.

-

04

Bank verifies form and signature.

-

05

Bank registers debit instruction in system.

-

06

Process & confirmation takes 25-30 days.

NACH mandate

-

01

Customer fills mandate details online.

-

02

Customer redirected to destination bank’s website.

-

03

Customer authenticates using net banking credentials.

-

04

Bank verifies the account number.

-

05

Bank previews mandate to accept or reject.

-

06

Customer accepts mandate

-

07

Mandate confirmed at the end of the day.

Benefits of NACH mandate

Merchants

Customer retention

With just one-time digital authentication,it allows you to auto-debit your customer’s account at the start of every billing cycle

Reduction in administrative costs

NACH mandate drastically reduces the cost related to invoicing and having to keep up and chase late payments from customers.

Security

Your customer’s data is safe, as the PCI compliance will be strictly managed by your payment solutions provider.

Customers

Undisturbed services

No constant payment reminders, authenticate your subscription once and enjoy uninterrupted service at any time.

Flexible options

With a variety of options, inclusions and easy termination, it provides an optimal user experience.

Simplicity

Authentication using NACH mandate is a simple process. All you need is your Net Banking credentials, and you’re good to go.

Cashfree Subscription Management

Cashfree Subscription Management powers you to enable recurring payment schedule, control the billing cycle and get instant alerts on subscription activity.

All you have to do is link Subscription plans that suit your business model and customers, let Cashfree take care of the rest.

Available on

Collect payments

Collect payments

Recurring payments

Recurring payments

Verify identity

Verify identity

Ecommerce

Ecommerce  Education

Education  NBFC Lending

NBFC Lending  Insurance

Insurance