Last updated

23th Jan, 2026

Introduction

This document is an electronic record in terms of the Information Technology Act, 2000 and rules thereunder as applicable and amended from time to time, including the Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules, 2021. This electronic record is generated by an electronic system and does not require any physical or digital signatures.

These Terms and Conditions (“Terms”) govern the usage of “Cashfree Pay” which is a Prepaid Payment Instrument (“Cashfree Pay”) issued by Cashfree Payments India Private Limited (“Cashfree”) a company incorporated under the Companies Act, 2013 having its registered office at 1st floor, Essae Vaishnavi Summit, 7th Main, 80 Feet Road, Koramangala 3rd Block, Bangalore, Karnataka, India, 560034 (“Cashfree” or “Issuer”). Cashfree is duly authorized by the Reserve Bank of India (RBI) to issue and operate prepaid instruments in terms of the Payments and Settlement Systems Act, 2007 and directions, rules and regulations which are issued thereunder.

These Terms include Cashfree’s Privacy Policy and Customer Grievance Redressal Policy and You are advised to read such policies to understand your rights and obligations for availing Cashfree Pay services. Cashfree may from time to time notify additional policies which become applicable to the usage of Cashfree Pay services (“Policies”).

By registering for, using, or maintaining Cashfree Pay or downloading any website / mobile applications through which Cashfree Pay is provided, by you (hereinafter “You” / “Your” “User” / “Customer”) acknowledge having read, understood and accepted these Terms including all the Policies referred herein and agree to abide by the same. We encourage you to read the terms and conditions carefully before proceeding to avail the Cashfree Pay services as the same constitutes a binding agreement between You and Cashfree governing the usage of such services. If You do not accept these terms, please do not avail the Cashfree Pay services.

You further acknowledge and agree that Cashfree may, at its sole discretion, add to, modify or amend these Terms (including the Policies which are notified herein) from time to time and all such changes shall be communicated to all customers availing the Cashfree Pay services . The Terms (together with the Policies) shall be made available on Cashfree’s website [https://www.cashfree.com/]. Cashfree may further publish notices of general nature which are applicable to the Customers on its website or communicated through email / SMS communications or through any other mode as may be decided by Cashfree. Such notices would have the same effect as a notice served individually to each customer. You shall be provided a period of 30 days from the issue of the notice, within which You shall have the right to close your PPI Account or discontinue availing the services, failing which, all such Terms (with modifications) shall be deemed to be accepted from the effective date mentioned in the notice. You shall be responsible to keep yourself updated and regularly check the terms and conditions, notices, communications so sent and/or uploaded on Cashfree website from time to time

Definitions

“App” or “Website”: shall mean the Merchant owned and operated mobile application or the website through which Customers may avail the PPI and services connected therewith.

“Applicable Law” shall mean any statute, law, regulation, master direction, circular, guideline, ordinance, rule, judgment, notification, order, decree, injunction, arbitral award, bye-law, directive, requirement or other governmental restriction or any similar form of decision by any governmental authority having the force of law.

Cashfree Pay: shall mean a prepaid payment instrument issued by Cashfree that facilitates purchase of goods and services in partnership with its Merchant or under a co-branding arrangement and is made available through the App or Website.

Customer: shall mean any erson who obtains and uses Cashfree Pay services.

Cashfree Pay: shall mean a prepaid payment instrument issued by Cashfree that facilitates purchase of goods and services in partnership with its Merchant or under a co-branding arrangement and is made available through the App or Website.

KYC: Know Your Customer as per the RBI Master Direction – Know Your Customer (KYC) Direction, 2016 RBI/DBR/2015-16/18 Master Direction DBR.AML.BC.No.81/14.01.001/2015-16.RBI norms

Full KYC PPI: shall mean such prepaid payment instrument that are issued after completing Know Your Customer (KYC) of the Customer. The Full KYC PPIs shall be used for purchase of goods and services, funds transfer or cash withdrawal.

Merchant: shall mean an entity that accepts Cashfree Pay as an instrument for online and/or offline purchase of goods and/or services.

Types of Cashfree Pay wallets

Cashfree issues and operates the following types of prepaid instruments to its customers under the brand name “Cashfree Pay”

Gift Wallet - This is a type of prepaid instrument which is used for undertaking purchases against the value stored therein from a specific Merchant only. Cashfree enters into arrangements with Merchants desirous of issuing Gift PPIs for their Customers. Upon issuance and activation, Customer may utilise the balances stored in such Gift PPIs for undertaking payment transactions on such Merchant’s website or mobile applications.

Small PPI - This is a type of pre-paid instrument which can be availed by Customers via a group of clearly identified Merchants having tie-ups with Cashfree for undertaking purchases / transactions against value stored therein .

Registration and Account Activation

Gift Wallet

Cashfree onboards Merchants for facilitating Gift Wallets to such Merchant’s Customers. Customers in turn are required to register with such Merchants and provide such details as may be requested by such Merchant. Please note that sharing of information by the Customers with the Merchants will be governed by terms and conditions as available on the Merchant’s websites / mobile applications (including privacy policies as notified therein) in addition to these Terms. The Merchant’s terms may specify additional restrictions such as restriction on goods / services which can be purchased, limits on number of transactions or amounts etc. You are advised to read such terms and conditions before availing the Gift Wallets.

For issuance of such Gift Wallets, Cashfree shall authenticate the mobile numbers or any other details as may be required by Cashfree of the Customers which are received from the Merchant. Customer may further be required to provide additional details (please refer to Privacy Policy) for account activation. Once such Gift Wallet is issued, Cashfree or the Merchant shall communicate the activation of the Gift Wallet for such Customers through SMS / Email or any modes of communication.

Small PPI

i. Customers may apply for a Small PPI wallet while undertaking a transaction flow with certain onboarded Merchants where Cashfree also provides other services. Customers are required to provide contact details such as name, email and mobile number and raise a request for availing Cashfree’s Small PPI wallet.

ii. Where a Customer opts to avail Small PPI, such Customer will be provided a link to complete their onboarding journey by provide such information and documents as may be requested through the link. Once such information is received, the documents are validated by Cashfree and the Small PPI wallet is enabled. Details of Small PPI will be provided to Customers through email and SMS. The Small PPI will be linked to the mobile number shared by the Customer.

iii. Please note that only one Small PPI Wallet can be enabled for a Customer at any given time and Cashfree may decline issuance of a Small PPI Wallet where it is observed that the Customer is an existing customer.

General

i. Cashfree reserves the right to reject request for issuance of Cashfree Pay or otherwise suspend any services provided through Cashfree Pay as per its internal policies and risk frameworks including where any details furnished by You are found to be false, incorrect, misleading or suspicious.

ii. You specifically authorise, and provide your consent to, Cashfree to collect, retain, store, process any information or data as may be provided by You or as may be received by Cashfree from any Merchants for the purpose of account activation, provision of Cashfree Pay services, resolution of queries, fraud and risk monitoring, analytics and transaction monitoring purposes. You further acknowledge that all such information as may be received by Cashfree may be shared with third parties including service providers of Cashfree providing services including services related to account verification, document verification, risk analytics, cloud computing and storage, audit, legal services etc. Cashfree may from time to time also develop and market various promotional offers by itself or on behalf of its Merchants for Customer. You provide your consent to Cashfree to processing of your data / information by Cashfree to create and provide specific and targeted promotional offers. Such promotional offers may be subject to specific terms and conditions, including eligibility criteria, validity periods and other terms as may be separately notified by Cashfree.

Accessibility

Customers of Cashfree Pay can access the account related information of their Cashfree Pay services by visiting the Cashfree website https://www.cashfree.com/customers/dashboard. Customers may log in through the credentials which are provided by Cashfree at the time of account activation.

Representations and Warranties

You represent and warrant that:

You are at least 18 years old;

You are a citizen or a legal resident of India;

You have full legal capacity and authority to agree and bind yourself to these Terms;

You are not barred or otherwise legally prohibited from accessing or using the Service;

All information that you provide for issuance of Cashfree Pay is complete, true, and correct and shall continue to be complete, true, and correct while you use Cashfree Pay;

You are not politically exposed (PEP) or related to a PEP. If you are a PEP or related to a PEP, you undertake to notify Cashfree by writing to the Nodal Officer (details provided below) prior to availing the Cashfree Pay services;

You will not load the Small PPI with proceeds or source of funds which are directly or indirectly related to Cryptocurrencies, VDA (Virtual Digital Assets), Foreign Currencies/ Foreign Exchange, Gambling, Gaming, Pornography or any other activity which is prohibited under applicable laws.

You will not spend funds that are on Cashfree Pay for undertaking any transactions which are directly or indirectly related to Cryptocurrencies, VDA (Virtual Digital Assets), unauthorised Foreign Currencies/unauthorised Foreign Exchange, Gambling, Gaming or any other activity which is prohibited under applicable laws.

You have not fabricated or forged any KYC documents or user details submitted and they are genuine in nature.

You shall not interfere with another Customer’s use and enjoyment of the Platform or any other individual's User and enjoyment of similar services.

Usage of PPI

While using Cashfree Pay to purchase goods or services from the Merchant, the Customer is subject to the terms and conditions for availment of products and services as specified by the Merchant. Cashfree is not responsible for the quality, merchantibility, warranties, fitness for purpose or delivery of the products or services by Merchant. In addition, issues pertaining to Merchant’s products or services including refund return, exchange or cancellation policies and disputes redressal with respect to the Merchant’s products or services shall be governed by the terms and conditions as may be available on the Merchant’s website / mobile applications.

While Cashfree adopts stringent policies at the time of onboarding of any Merchants and continuously monitors the risks associated with such Merchants, Cashfree does not assume responsibility for the quality, delivery, merchantability or fitness for any purpose of such Merchant’s products and services. If you have any grievances associated with the transactions for purchase of goods and services undertaken using Cashfree Pay, you may notify Cashfree in accordance with the Grievance Redressal process as specified below. .

The Customer specifically acknowledges that Cashfree shall not be liable, and you agree not to seek to hold Cashfree liable, for the conduct of the Merchant.

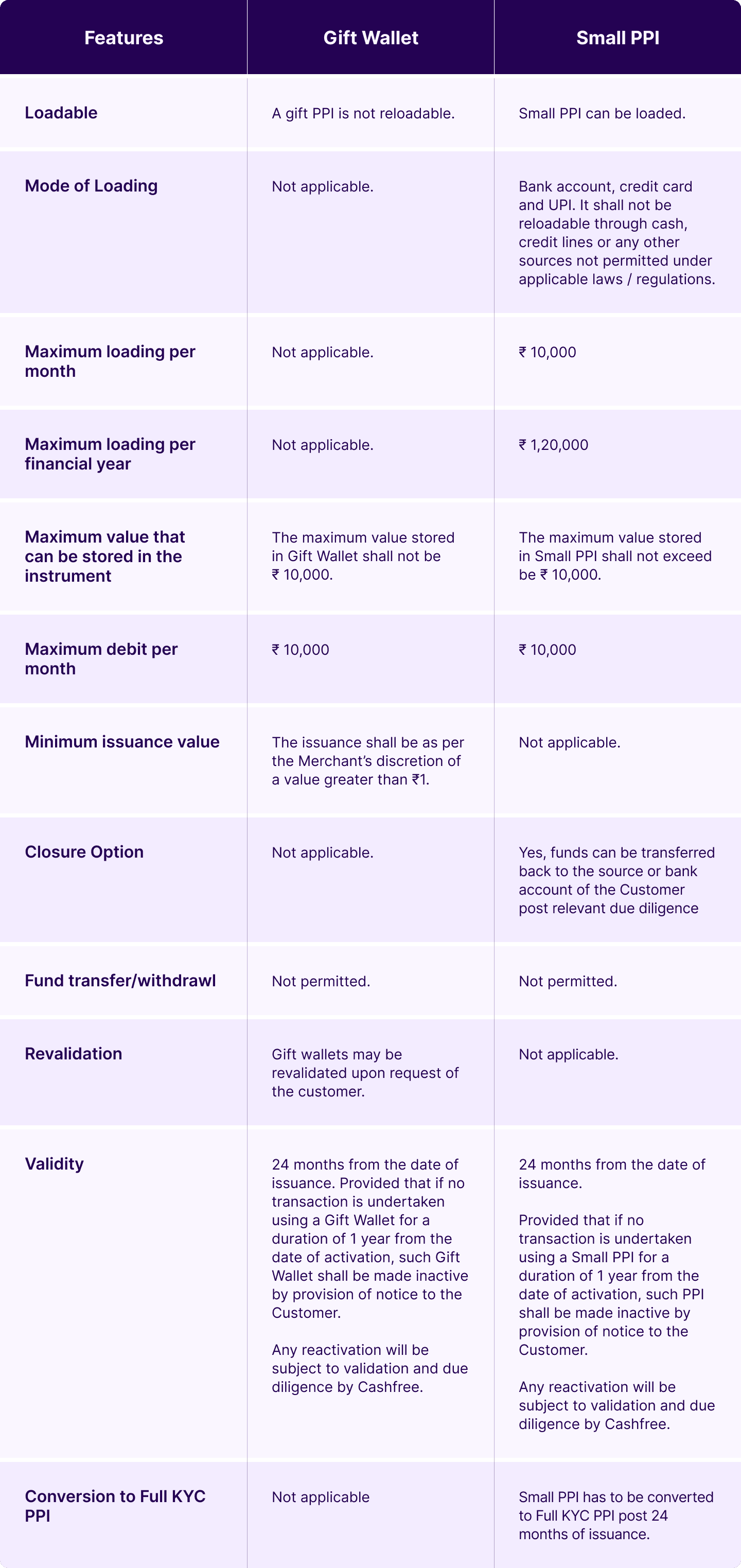

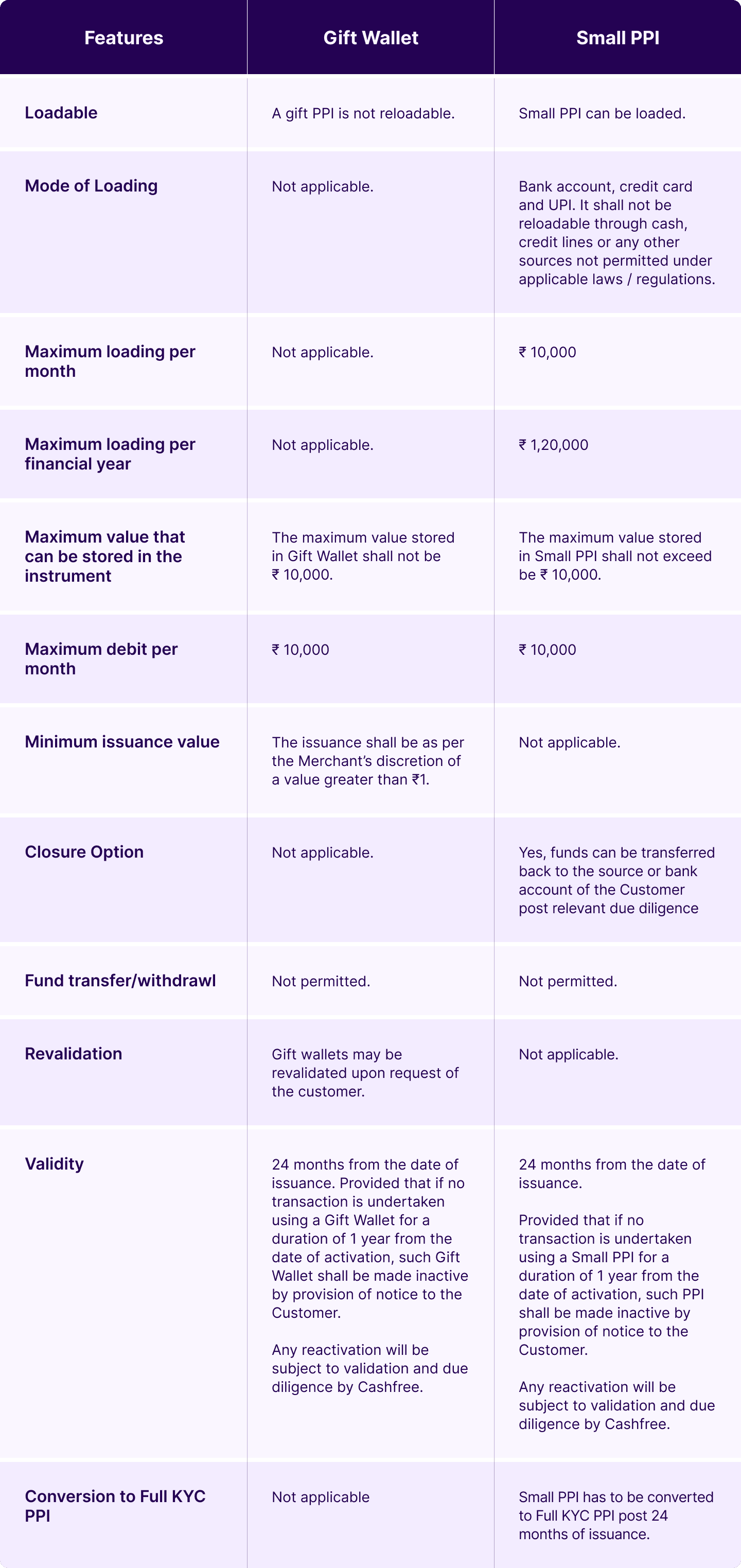

Key Features

Introduction

This document is an electronic record in terms of the Information Technology Act, 2000 and rules thereunder as applicable and amended from time to time, including the Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules, 2021. This electronic record is generated by an electronic system and does not require any physical or digital signatures.

These Terms and Conditions (“Terms”) govern the usage of “Cashfree Pay” which is a Prepaid Payment Instrument (“Cashfree Pay”) issued by Cashfree Payments India Private Limited (“Cashfree”) a company incorporated under the Companies Act, 2013 having its registered office at 1st floor, Essae Vaishnavi Summit, 7th Main, 80 Feet Road, Koramangala 3rd Block, Bangalore, Karnataka, India, 560034 (“Cashfree” or “Issuer”). Cashfree is duly authorized by the Reserve Bank of India (RBI) to issue and operate prepaid instruments in terms of the Payments and Settlement Systems Act, 2007 and directions, rules and regulations which are issued thereunder.

These Terms include Cashfree’s Privacy Policy and Customer Grievance Redressal Policy and You are advised to read such policies to understand your rights and obligations for availing Cashfree Pay services. Cashfree may from time to time notify additional policies which become applicable to the usage of Cashfree Pay services (“Policies”).

By registering for, using, or maintaining Cashfree Pay or downloading any website / mobile applications through which Cashfree Pay is provided, by you (hereinafter “You” / “Your” “User” / “Customer”) acknowledge having read, understood and accepted these Terms including all the Policies referred herein and agree to abide by the same. We encourage you to read the terms and conditions carefully before proceeding to avail the Cashfree Pay services as the same constitutes a binding agreement between You and Cashfree governing the usage of such services. If You do not accept these terms, please do not avail the Cashfree Pay services.

You further acknowledge and agree that Cashfree may, at its sole discretion, add to, modify or amend these Terms (including the Policies which are notified herein) from time to time and all such changes shall be communicated to all customers availing the Cashfree Pay services . The Terms (together with the Policies) shall be made available on Cashfree’s website [https://www.cashfree.com/]. Cashfree may further publish notices of general nature which are applicable to the Customers on its website or communicated through email / SMS communications or through any other mode as may be decided by Cashfree. Such notices would have the same effect as a notice served individually to each customer. You shall be provided a period of 30 days from the issue of the notice, within which You shall have the right to close your PPI Account or discontinue availing the services, failing which, all such Terms (with modifications) shall be deemed to be accepted from the effective date mentioned in the notice. You shall be responsible to keep yourself updated and regularly check the terms and conditions, notices, communications so sent and/or uploaded on Cashfree website from time to time

Definitions

“App” or “Website”: shall mean the Merchant owned and operated mobile application or the website through which Customers may avail the PPI and services connected therewith.

“Applicable Law” shall mean any statute, law, regulation, master direction, circular, guideline, ordinance, rule, judgment, notification, order, decree, injunction, arbitral award, bye-law, directive, requirement or other governmental restriction or any similar form of decision by any governmental authority having the force of law.

Cashfree Pay: shall mean a prepaid payment instrument issued by Cashfree that facilitates purchase of goods and services in partnership with its Merchant or under a co-branding arrangement and is made available through the App or Website.

Customer: shall mean any erson who obtains and uses Cashfree Pay services.

Cashfree Pay: shall mean a prepaid payment instrument issued by Cashfree that facilitates purchase of goods and services in partnership with its Merchant or under a co-branding arrangement and is made available through the App or Website.

KYC: Know Your Customer as per the RBI Master Direction – Know Your Customer (KYC) Direction, 2016 RBI/DBR/2015-16/18 Master Direction DBR.AML.BC.No.81/14.01.001/2015-16.RBI norms.

Full KYC PPI: shall mean such prepaid payment instrument that are issued after completing Know Your Customer (KYC) of the Customer. The Full KYC PPIs shall be used for purchase of goods and services, funds transfer or cash withdrawal.

Merchant: shall mean an entity that accepts Cashfree Pay as an instrument for online and/or offline purchase of goods and/or services.

Types of Cashfree Pay wallets

Cashfree issues and operates the following types of prepaid instruments to its customers under the brand name “Cashfree Pay”

Gift Wallet - This is a type of prepaid instrument which is used for undertaking purchases against the value stored therein from a specific Merchant only. Cashfree enters into arrangements with Merchants desirous of issuing Gift PPIs for their Customers. Upon issuance and activation, Customer may utilise the balances stored in such Gift PPIs for undertaking payment transactions on such Merchant’s website or mobile applications.

Small PPI - This is a type of pre-paid instrument which can be availed by Customers via a group of clearly identified Merchants having tie-ups with Cashfree for undertaking purchases / transactions against value stored therein.

Registration and Account Activation

Gift Wallet

Cashfree onboards Merchants for facilitating Gift Wallets to such Merchant’s Customers. Customers in turn are required to register with such Merchants and provide such details as may be requested by such Merchant. Please note that sharing of information by the Customers with the Merchants will be governed by terms and conditions as available on the Merchant’s websites / mobile applications (including privacy policies as notified therein) in addition to these Terms. The Merchant’s terms may specify additional restrictions such as restriction on goods / services which can be purchased, limits on number of transactions or amounts etc. You are advised to read such terms and conditions before availing the Gift Wallets.

For issuance of such Gift Wallets, Cashfree shall authenticate the mobile numbers or any other details as may be required by Cashfree of the Customers which are received from the Merchant. Customer may further be required to provide additional details (please refer to Privacy Policy) for account activation. Once such Gift Wallet is issued, Cashfree or the Merchant shall communicate the activation of the Gift Wallet for such Customers through SMS / Email or any modes of communication.

Small PPI

i. Customers may apply for a Small PPI wallet while undertaking a transaction flow with certain onboarded Merchants where Cashfree also provides other services. Customers are required to provide contact details such as name, email and mobile number and raise a request for availing Cashfree’s Small PPI wallet.

ii. Where a Customer opts to avail Small PPI, such Customer will be provided a link to complete their onboarding journey by provide such information and documents as may be requested through the link. Once such information is received, the documents are validated by Cashfree and the Small PPI wallet is enabled. Details of Small PPI will be provided to Customers through email and SMS. The Small PPI will be linked to the mobile number shared by the Customer.

iii. Please note that only one Small PPI Wallet can be enabled for a Customer at any given time and Cashfree may decline issuance of a Small PPI Wallet where it is observed that the Customer is an existing customer.

General

i. Cashfree reserves the right to reject request for issuance of Cashfree Pay or otherwise suspend any services provided through Cashfree Pay as per its internal policies and risk frameworks including where any details furnished by You are found to be false, incorrect, misleading or suspicious.

ii. You specifically authorise, and provide your consent to, Cashfree to collect, retain, store, process any information or data as may be provided by You or as may be received by Cashfree from any Merchants for the purpose of account activation, provision of Cashfree Pay services, resolution of queries, fraud and risk monitoring, analytics and transaction monitoring purposes. You further acknowledge that all such information as may be received by Cashfree may be shared with third parties including service providers of Cashfree providing services including services related to account verification, document verification, risk analytics, cloud computing and storage, audit, legal services etc. Cashfree may from time to time also develop and market various promotional offers by itself or on behalf of its Merchants for Customer. You provide your consent to Cashfree to processing of your data / information by Cashfree to create and provide specific and targeted promotional offers. Such promotional offers may be subject to specific terms and conditions, including eligibility criteria, validity periods and other terms as may be separately notified by Cashfree.

Accessibility

Customers of Cashfree Pay can access the account related information of their Cashfree Pay services by visiting the Cashfree website https://www.cashfree.com/customers/dashboard. Customers may log in through the credentials which are provided by Cashfree at the time of account activation.

Representations and Warranties

You represent and warrant that:

You are at least 18 years old;

You are a citizen or a legal resident of India;

You have full legal capacity and authority to agree and bind yourself to these Terms;

You are not barred or otherwise legally prohibited from accessing or using the Service;

All information that you provide for issuance of Cashfree Pay is complete, true, and correct and shall continue to be complete, true, and correct while you use Cashfree Pay;

You are not politically exposed (PEP) or related to a PEP. If you are a PEP or related to a PEP, you undertake to notify Cashfree by writing to the Nodal Officer (details provided below) prior to availing the Cashfree Pay services;

You will not load the Small PPI with proceeds or source of funds which are directly or indirectly related to Cryptocurrencies, VDA (Virtual Digital Assets), Foreign Currencies/ Foreign Exchange, Gambling, Gaming, Pornography or any other activity which is prohibited under applicable laws.

You will not spend funds that are on Cashfree Pay for undertaking any transactions which are directly or indirectly related to Cryptocurrencies, VDA (Virtual Digital Assets), unauthorised Foreign Currencies/unauthorised Foreign Exchange, Gambling, Gaming or any other activity which is prohibited under applicable laws.

You have not fabricated or forged any KYC documents or user details submitted and they are genuine in nature.

You shall not interfere with another Customer’s use and enjoyment of the Platform or any other individual's User and enjoyment of similar services.

Usage of PPI

While using Cashfree Pay to purchase goods or services from the Merchant, the Customer is subject to the terms and conditions for availment of products and services as specified by the Merchant. Cashfree is not responsible for the quality, merchantibility, warranties, fitness for purpose or delivery of the products or services by Merchant. In addition, issues pertaining to Merchant’s products or services including refund return, exchange or cancellation policies and disputes redressal with respect to the Merchant’s products or services shall be governed by the terms and conditions as may be available on the Merchant’s website / mobile applications.

While Cashfree adopts stringent policies at the time of onboarding of any Merchants and continuously monitors the risks associated with such Merchants, Cashfree does not assume responsibility for the quality, delivery, merchantability or fitness for any purpose of such Merchant’s products and services. If you have any grievances associated with the transactions for purchase of goods and services undertaken using Cashfree Pay, you may notify Cashfree in accordance with the Grievance Redressal process as specified below. .

The Customer specifically acknowledges that Cashfree shall not be liable, and you agree not to seek to hold Cashfree liable, for the conduct of the Merchant.

Key Features

Introduction

This document is an electronic record in terms of the Information Technology Act, 2000 and rules thereunder as applicable and amended from time to time, including the Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules, 2021. This electronic record is generated by an electronic system and does not require any physical or digital signatures.

These Terms and Conditions (“Terms”) govern the usage of “Cashfree Pay” which is a Prepaid Payment Instrument (“Cashfree Pay”) issued by Cashfree Payments India Private Limited (“Cashfree”) a company incorporated under the Companies Act, 2013 having its registered office at 1st floor, Essae Vaishnavi Summit, 7th Main, 80 Feet Road, Koramangala 3rd Block, Bangalore, Karnataka, India, 560034 (“Cashfree” or “Issuer”). Cashfree is duly authorized by the Reserve Bank of India (RBI) to issue and operate prepaid instruments in terms of the Payments and Settlement Systems Act, 2007 and directions, rules and regulations which are issued thereunder.

These Terms include Cashfree’s Privacy Policy and Customer Grievance Redressal Policy and You are advised to read such policies to understand your rights and obligations for availing Cashfree Pay services. Cashfree may from time to time notify additional policies which become applicable to the usage of Cashfree Pay services (“Policies”).

By registering for, using, or maintaining Cashfree Pay or downloading any website / mobile applications through which Cashfree Pay is provided, by you (hereinafter “You” / “Your” “User” / “Customer”) acknowledge having read, understood and accepted these Terms including all the Policies referred herein and agree to abide by the same. We encourage you to read the terms and conditions carefully before proceeding to avail the Cashfree Pay services as the same constitutes a binding agreement between You and Cashfree governing the usage of such services. If You do not accept these terms, please do not avail the Cashfree Pay services.

You further acknowledge and agree that Cashfree may, at its sole discretion, add to, modify or amend these Terms (including the Policies which are notified herein) from time to time and all such changes shall be communicated to all customers availing the Cashfree Pay services . The Terms (together with the Policies) shall be made available on Cashfree’s website [https://www.cashfree.com/]. Cashfree may further publish notices of general nature which are applicable to the Customers on its website or communicated through email / SMS communications or through any other mode as may be decided by Cashfree. Such notices would have the same effect as a notice served individually to each customer. You shall be provided a period of 30 days from the issue of the notice, within which You shall have the right to close your PPI Account or discontinue availing the services, failing which, all such Terms (with modifications) shall be deemed to be accepted from the effective date mentioned in the notice. You shall be responsible to keep yourself updated and regularly check the terms and conditions, notices, communications so sent and/or uploaded on Cashfree website from time to time

Definitions

“App” or “Website”: shall mean the Merchant owned and operated mobile application or the website through which Customers may avail the PPI and services connected therewith.

“Applicable Law” shall mean any statute, law, regulation, master direction, circular, guideline, ordinance, rule, judgment, notification, order, decree, injunction, arbitral award, bye-law, directive, requirement or other governmental restriction or any similar form of decision by any governmental authority having the force of law.

Cashfree Pay: shall mean a prepaid payment instrument issued by Cashfree that facilitates purchase of goods and services in partnership with its Merchant or under a co-branding arrangement and is made available through the App or Website.

Customer: shall mean any erson who obtains and uses Cashfree Pay services.

Cashfree Pay: shall mean a prepaid payment instrument issued by Cashfree that facilitates purchase of goods and services in partnership with its Merchant or under a co-branding arrangement and is made available through the App or Website.

KYC: Know Your Customer as per the RBI Master Direction – Know Your Customer (KYC) Direction, 2016 RBI/DBR/2015-16/18 Master Direction DBR.AML.BC.No.81/14.01.001/2015-16.RBI norms.

Full KYC PPI: shall mean such prepaid payment instrument that are issued after completing Know Your Customer (KYC) of the Customer. The Full KYC PPIs shall be used for purchase of goods and services, funds transfer or cash withdrawal.

Merchant: shall mean an entity that accepts Cashfree Pay as an instrument for online and/or offline purchase of goods and/or services.

Types of Cashfree Pay wallets

Cashfree issues and operates the following types of prepaid instruments to its customers under the brand name “Cashfree Pay”

Gift Wallet - This is a type of prepaid instrument which is used for undertaking purchases against the value stored therein from a specific Merchant only. Cashfree enters into arrangements with Merchants desirous of issuing Gift PPIs for their Customers. Upon issuance and activation, Customer may utilise the balances stored in such Gift PPIs for undertaking payment transactions on such Merchant’s website or mobile applications.

Small PPI - This is a type of pre-paid instrument which can be availed by Customers via a group of clearly identified Merchants having tie-ups with Cashfree for undertaking purchases / transactions against value stored therein .

Registration and Account Activation

Gift Wallet

Cashfree onboards Merchants for facilitating Gift Wallets to such Merchant’s Customers. Customers in turn are required to register with such Merchants and provide such details as may be requested by such Merchant. Please note that sharing of information by the Customers with the Merchants will be governed by terms and conditions as available on the Merchant’s websites / mobile applications (including privacy policies as notified therein) in addition to these Terms. The Merchant’s terms may specify additional restrictions such as restriction on goods / services which can be purchased, limits on number of transactions or amounts etc. You are advised to read such terms and conditions before availing the Gift Wallets.

For issuance of such Gift Wallets, Cashfree shall authenticate the mobile numbers or any other details as may be required by Cashfree of the Customers which are received from the Merchant. Customer may further be required to provide additional details (please refer to Privacy Policy) for account activation. Once such Gift Wallet is issued, Cashfree or the Merchant shall communicate the activation of the Gift Wallet for such Customers through SMS / Email or any modes of communication.

Small PPI

i. Customers may apply for a Small PPI wallet while undertaking a transaction flow with certain onboarded Merchants where Cashfree also provides other services. Customers are required to provide contact details such as name, email and mobile number and raise a request for availing Cashfree’s Small PPI wallet.

ii. Where a Customer opts to avail Small PPI, such Customer will be provided a link to complete their onboarding journey by provide such information and documents as may be requested through the link. Once such information is received, the documents are validated by Cashfree and the Small PPI wallet is enabled. Details of Small PPI will be provided to Customers through email and SMS. The Small PPI will be linked to the mobile number shared by the Customer.

iii. Please note that only one Small PPI Wallet can be enabled for a Customer at any given time and Cashfree may decline issuance of a Small PPI Wallet where it is observed that the Customer is an existing customer.

General

i. Cashfree reserves the right to reject request for issuance of Cashfree Pay or otherwise suspend any services provided through Cashfree Pay as per its internal policies and risk frameworks including where any details furnished by You are found to be false, incorrect, misleading or suspicious.

ii. You specifically authorise, and provide your consent to, Cashfree to collect, retain, store, process any information or data as may be provided by You or as may be received by Cashfree from any Merchants for the purpose of account activation, provision of Cashfree Pay services, resolution of queries, fraud and risk monitoring, analytics and transaction monitoring purposes. You further acknowledge that all such information as may be received by Cashfree may be shared with third parties including service providers of Cashfree providing services including services related to account verification, document verification, risk analytics, cloud computing and storage, audit, legal services etc. Cashfree may from time to time also develop and market various promotional offers by itself or on behalf of its Merchants for Customer. You provide your consent to Cashfree to processing of your data / information by Cashfree to create and provide specific and targeted promotional offers. Such promotional offers may be subject to specific terms and conditions, including eligibility criteria, validity periods and other terms as may be separately notified by Cashfree.

Accessibility

Customers of Cashfree Pay can access the account related information of their Cashfree Pay services by visiting the Cashfree website https://www.cashfree.com/customers/dashboard. Customers may log in through the credentials which are provided by Cashfree at the time of account activation.

Representations and Warranties

You represent and warrant that:

You are at least 18 years old;

You are a citizen or a legal resident of India;

You have full legal capacity and authority to agree and bind yourself to these Terms;

You are not barred or otherwise legally prohibited from accessing or using the Service;

All information that you provide for issuance of Cashfree Pay is complete, true, and correct and shall continue to be complete, true, and correct while you use Cashfree Pay;

You are not politically exposed (PEP) or related to a PEP. If you are a PEP or related to a PEP, you undertake to notify Cashfree by writing to the Nodal Officer (details provided below) prior to availing the Cashfree Pay services;

You will not load the Small PPI with proceeds or source of funds which are directly or indirectly related to Cryptocurrencies, VDA (Virtual Digital Assets), Foreign Currencies/ Foreign Exchange, Gambling, Gaming, Pornography or any other activity which is prohibited under applicable laws.

You will not spend funds that are on Cashfree Pay for undertaking any transactions which are directly or indirectly related to Cryptocurrencies, VDA (Virtual Digital Assets), unauthorised Foreign Currencies/unauthorised Foreign Exchange, Gambling, Gaming or any other activity which is prohibited under applicable laws.

You have not fabricated or forged any KYC documents or user details submitted and they are genuine in nature.

You shall not interfere with another Customer’s use and enjoyment of the Platform or any other individual's User and enjoyment of similar services.

Usage of PPI

While using Cashfree Pay to purchase goods or services from the Merchant, the Customer is subject to the terms and conditions for availment of products and services as specified by the Merchant. Cashfree is not responsible for the quality, merchantibility, warranties, fitness for purpose or delivery of the products or services by Merchant. In addition, issues pertaining to Merchant’s products or services including refund return, exchange or cancellation policies and disputes redressal with respect to the Merchant’s products or services shall be governed by the terms and conditions as may be available on the Merchant’s website / mobile applications.

While Cashfree adopts stringent policies at the time of onboarding of any Merchants and continuously monitors the risks associated with such Merchants, Cashfree does not assume responsibility for the quality, delivery, merchantability or fitness for any purpose of such Merchant’s products and services. If you have any grievances associated with the transactions for purchase of goods and services undertaken using Cashfree Pay, you may notify Cashfree in accordance with the Grievance Redressal process as specified below. .

The Customer specifically acknowledges that Cashfree shall not be liable, and you agree not to seek to hold Cashfree liable, for the conduct of the Merchant.

Key Features

Please note that the features of the PPI as specified above are subject to change which may take place on account of changes in applicable laws, regulatory requirements or internal policy decisions. Any such changes shall be duly communicated to the Customers through email/ SMS communications or updates in these terms and conditions.

Customer Obligations

The Customer agrees and undertakes that:

You hereby agree to use Cashfree Pay in accordance with Applicable Law and further agree not to use it for any unlawful purpose. You will not undertake or encourage any illegal, criminal, money laundering, terrorist activities or any other activity that is in violation of Applicable Laws while using Cashfree Pay.

You are solely responsible for maintaining the security and confidentiality of your password/PIN/credentials associated with your Cashfree Pay and immediately notify us of any loss or theft of your instrument, or authentication data or if any fraud/abuse is detected, any unauthorised use, any other breach of security etc. with respect to Cashfree Pay.

You shall be responsible in case of any compromise of your password/PIN/credentials and transaction done due to such compromise of security and confidentiality of your password/PIN/credentials and other related sensitive information.

You shall extend all cooperation to us in our defence of any proceedings that may be initiated against Cashfree due to a breach of your obligations or covenants under these Terms.

You shall not by electronic or other means circumvent, disable, or otherwise interfere with security-related features or trick, defraud, or mislead us and other users, especially in any attempt to learn sensitive information.

You shall not engage in any automated use of the system, such as using scripts, or using any data mining, robots, or similar data gathering and extraction tools.

You shall not attempt to impersonate another user or person or use the username of another Customer.

You shall not decipher, decompile, disassemble, or reverse engineer any of the software comprising or in any way making up a part of the services by Cashfree.

You shall not infringe any patent, trademark, copyright or other proprietary rights, trade secrets or privacy of a third party.

You agree that You shall use the promotional offers only for the lawful purposes and not to derive any monetary gain. You further agree and acknowledge that You shall be eligible to receive a refund only up to the actual amount paid / loaded by you.

Pricing

Presently no charges are being imposed by Cashfree on the Customers for the issuance or use of Cashfree Pay services. However, Cashfree shall have the right to impose such charges in relation to the usage of Cashfree Pay. These charges may be levied at different stages eg. while loading/ re-loading of any Cashfree Pay, use of such Cashfree Pay on Merchant sites for undertaking transaction fees etc.

In the event Cashfree, in its discretion, levies any such charges or fees for issuance or operation of Cashfree Pay Cashfree shall duly communicate such charges to Customers through SMS, email notification, updation of website terms and conditions or such other means as Cashfree reasonably determines.

The Customer shall have to bear any statutory taxes, goods and service tax, all other duties, if any, in connection with Cashfree Pay as may be levied from time to time by a Governmental Authority in respect of or in connection with the transactions undertaken with the use of Cashfree Pay.

Validity

As stated above, Gift Wallet and Small PPI shall be valid for a period of two years from the date of its issuance provided that if no transaction is undertaken using Cashfree Pay for a duration of 1 year from the date of activation, Cashfree Pay shall be made inactive by provision of notice to the Customer. Cashfree shall notify the customers via SMS/ Email or any other communication channels 45 days prior to the deactivation of Cashfree issued prepaid instruments. Cashfree shall provide the Customer with an option to provide details of the bank account for the transfer of the balance amount lying in Cashfree Pay at the time of deactivation.

The Customer could approach Cashfree for transfer of balance amount post expiry of Cashfree Pay, however, such transfer shall take place only to a verified bank account of the Customer.

Refunds

Cashfree shall maintain the complete details of refund transactions and the Customer shall be able to view the same on Cashfree Pay which is made available on Cashfree’s platform or website.

Refunds in case of a Gift Wallet shall be as per the terms and conditions of the Merchant and the Customer shall have to contact the Merchant in case they seek to obtain a refund.

Termination / Suspension of Services

Cashfree shall have the right to immediately terminate or suspend Cashfree Pay with or without notice to the Customer in the following events:

if the Customer is in breach of the Terms;

if the Customer furnishes any false or incorrect or inaccurate information;

in the event of any suspicious or fraudulent activity reported or identified on Cashfree Pay;

any legal or regulatory requirements as may be applicable

Escrow Account

PPI balances held by the Customer are held in an escrow account with a bank which is operated by Cashfree for settling the funds in connection with the Services.

Intellectual Property Rights

All rights, title and interest in and to the Intellectual Property Rights owned by Cashfree or in the PPI (as the case may be) are the sole and exclusive property of Cashfree.

Nothing contained in these Terms and Conditions shall be construed as a grant of any right, title or interest in or to the aforesaid Intellectual Property Rights.

Indemnification

You hereby undertake and agree to indemnify, protect against liability and hold harmless Cashfree, its affiliates, and their respective directors, employees, officers, agents, representatives, contractors and sub-contractors against all actions, proceedings, claims, liabilities (including statutory liabilities), penalties, demands and costs (including without limitation, legal costs of Cashfree on a solicitor/attorney and own client basis), awards, damages, losses and/or expenses, however, arising in relation to:

any claim or proceeding brought by law enforcement authorities, regulators, or any other person against Cashfree in respect of any act, deed, negligence, omission, misrepresentation, default, misconduct, fraud by You in relation to the use of Cashfree Pay;

any breach of these Terms, the Privacy Policy, or any other terms, conditions, policies or guidelines provided by Cashfree in relation to the Cashfree Pay;

any wrongful or improper use of Cashfree website or Cashfree platform or any other Cashfree Property; or

any violation of the third-party rights.

Limitation on Liability

Cashfree shall have no liability for any unauthorized transactions occurring on any PPI and the Customer hereby absolves Cashfree (including their respective Affiliates) therefrom.

Customer Liability of Unauthorised Transactions

The Customer’s liability shall be determined as per the below table for an Unauthorised Transaction. A transaction shall be referred to as an Unauthorised Transaction in the below circumstances:

which is not initiated by the Customer

is carried out by a third party without the Customer’s knowledge or consent

may result from fraud, security breach, device compromise or identity theft

leaked credentials used for a transaction

In the event that any Unauthorised Transaction is undertaken on account of (i) contributory fraud / negligence / deficiency on the part of the Cashfree or (ii) on account of third party breach not attributable to Customer or Cashfree and where such Unauthorised Transaction is informed by Customer to Cashfree within 3 days of the transaction, the Customer shall not be liable for such Unauthorised Transactions.

In other cases, Customers shall continue to be liable for Unauthorised Transactions as per Cashfree’s internal policies. Cashfree reserves the right to waive off any liability of the Customers in such circumstances as per its internal policies.

Grievance Redressal

Cashfree is committed to ensuring transparency, fairness, and timely redress of customer grievances related to the usage of these instruments. Cashfree shall be responsible to resolve Customer’s query, feedback or complaint, pertaining to the transactions they may have processed or attempted to process using Cashfree’s platform as per the Customer Grievance Redressal Policy available at https://www.cashfree.com/grievance-redressal-policy/. Cashfree has designated a Grievance to handle all complaints and grievances. Details of the Nodal Officer and escalation contacts are as given below:

Nodal Officer – Grievance Redressal-

Cashfree Payments India Pvt Ltd,

Vaishnavi Summit, No. 6/B, Summit,

80 Feet Rd, Koramangala 1A Block,

Koramangala 3 Block, Koramangala,

Bengaluru, Karnataka 560034

Email ID: grievances@cashfree.com

Governing Law and Jurisdiction

These Terms and any dispute or claim in relation to these Terms shall be governed by and construed in accordance with the laws of India.

The Parties agree that all disputes arising out of or in connection with these Terms shall be subject to the exclusive jurisdiction of the courts in Bangalore, Karnataka.

19. Miscellaneous

Assignment: Cashfree shall have the right to assign its rights or obligations under these Terms without any prior written consent to any person in such manner and on such terms and conditions as may be decided by Cashfree. The Customer shall not have the right to assign rights or obligations under these Terms. The Customer, his heirs, legal representatives, executors, administrators and successors shall be bound by these Terms.

Disclaimer or Warranties: To the maximum extent permitted by Applicable Laws and except as stated in the Agreement; Cashfree Pay is provided on “as is” basis and Cashfree disclaims all warranties, express or implied, written, or oral, including but not limited to warranties of merchantability and fitness of the good or services provided by the Merchant. Cashfree does not make any warranty with respect to Cashfree Pay accessibility in a timely, secure, error-free and uninterrupted manner and that Cashfree Pay or the App/ the Website and any related services are free from computer viruses, malicious, destructive or corrupting code.

Notices: All notices and other communications required or permitted to be given under these Terms shall be in writing and shall be delivered or sent by personal delivery, electronic mail, or registered or courier or certified mail (return receipt requested) to the relevant Party at the registered address. The notices and communications sent in such manner shall, unless the contrary is proven, be deemed to have been duly received on the date of personal delivery, two Business Days following delivery, upon confirmation of transmission by the sender’s electronic mail device or ten (10) business days following mailing by registered or certified mail (return receipt requested postage prepaid to be sent to the address and email ID).

Relationship between the Parties: Each party under these Terms are on a principal to principal basis. Nothing contained in these Terms shall constitute or imply any partnership, joint venture, agency, fiduciary relationship, employer-employee, principal employer - contractor or other relationship other than the contractual relationship expressly provided under the Terms.

Frequently Asked Questions

What is the Cashfree Prepaid Wallet and how does it work?

Cashfree’s prepaid wallet is a digital wallet issued under RBI guidelines, enabling users to store funds securely and make payments across partner platforms and services.Can I send money from my wallet to my bank account or someone else?

Withdrawals or peer-to-peer transfers are currently not supported for semi-closed loop and Gift wallets. The wallet is intended for making payments only.How can I track the activity on my Cashfree Wallet?

You can view all wallet-related transactions by visiting the Transactions section on your Cashfree Customer Portal.Will the money in my wallet expire if unused?

Wallet balances currently have an expiration of 2 years. Expiry timelines may be revised from time to time in the future if mandated by regulatory authorities. You can withdraw the residual amount in your source bank account and close the prepaid wallet at any point if requiredAre there any charges for using or adding funds to the wallet?

No, adding money or using your wallet for payments does not attract any fees at the moment.What’s the maximum amount I can hold in my wallet?

As per RBI regulatory norms, your semi closed loop wallet cannot exceed a balance of ₹10,000 per month and ₹1,20,000 in a year.Can I update the mobile number linked to my Cashfree Wallet?

Unfortunately, the mobile number is tied to your wallet account and cannot be changed once registered. You can close the prepaid wallet and request for a new wallet with the updated phone number.How is my data and money kept safe?

Cashfree uses industry-grade encryption and is compliant with regulatory standards to ensure your personal and financial information is fully protected.How can I avoid scams or fraud while using the wallet?

Stay safe by following these tips:Do not share your wallet OTP or credentials with anyone.

Always verify the authenticity of payment links and websites before making payments.

Avoid clicking on suspicious SMS or email links.

In case of doubt, reach out to our official support channel instead of responding directly.

Please note that the features of the PPI as specified above are subject to change which may take place on account of changes in applicable laws, regulatory requirements or internal policy decisions. Any such changes shall be duly communicated to the Customers through email/ SMS communications or updates in these terms and conditions.

Customer Obligations

The Customer agrees and undertakes that:

You hereby agree to use Cashfree Pay in accordance with Applicable Law and further agree not to use it for any unlawful purpose. You will not undertake or encourage any illegal, criminal, money laundering, terrorist activities or any other activity that is in violation of Applicable Laws while using Cashfree Pay.

You are solely responsible for maintaining the security and confidentiality of your password/PIN/credentials associated with your Cashfree Pay and immediately notify us of any loss or theft of your instrument, or authentication data or if any fraud/abuse is detected, any unauthorised use, any other breach of security etc. with respect to Cashfree Pay.

You shall be responsible in case of any compromise of your password/PIN/credentials and transaction done due to such compromise of security and confidentiality of your password/PIN/credentials and other related sensitive information.

You shall extend all cooperation to us in our defence of any proceedings that may be initiated against Cashfree due to a breach of your obligations or covenants under these Terms.

You shall not by electronic or other means circumvent, disable, or otherwise interfere with security-related features or trick, defraud, or mislead us and other users, especially in any attempt to learn sensitive information.

You shall not engage in any automated use of the system, such as using scripts, or using any data mining, robots, or similar data gathering and extraction tools.

You shall not attempt to impersonate another user or person or use the username of another Customer.

You shall not decipher, decompile, disassemble, or reverse engineer any of the software comprising or in any way making up a part of the services by Cashfree.

You shall not infringe any patent, trademark, copyright or other proprietary rights, trade secrets or privacy of a third party.

Pricing

Presently no charges are being imposed by Cashfree on the Customers for the issuance or use of Cashfree Pay services. However, Cashfree shall have the right to impose such charges in relation to the usage of Cashfree Pay. These charges may be levied at different stages eg. while loading/ re-loading of any Cashfree Pay, use of such Cashfree Pay on Merchant sites for undertaking transaction fees etc.

In the event Cashfree, in its discretion, levies any such charges or fees for issuance or operation of Cashfree Pay Cashfree shall duly communicate such charges to Customers through SMS, email notification, updation of website terms and conditions or such other means as Cashfree reasonably determines.

The Customer shall have to bear any statutory taxes, goods and service tax, all other duties, if any, in connection with Cashfree Pay as may be levied from time to time by a Governmental Authority in respect of or in connection with the transactions undertaken with the use of Cashfree Pay.

Validity

As stated above, Gift Wallet and Small PPI shall be valid for a period of two years from the date of its issuance provided that if no transaction is undertaken using Cashfree Pay for a duration of 1 year from the date of activation, Cashfree Pay shall be made inactive by provision of notice to the Customer.. Cashfree shall notify the customers via SMS/ Email or any other communication channels 45 days prior to the deactivation of Cashfree issued prepaid instruments. Cashfree shall provide the Customer with an option to provide details of the bank account for the transfer of the balance amount lying in Cashfree Pay at the time of deactivation.

The Customer could approach Cashfree for transfer of balance amount post expiry of Cashfree Pay, however, such transfer shall take place only to a verified bank account of the Customer.

Refunds

Cashfree shall maintain the complete details of refund transactions and the Customer shall be able to view the same on Cashfree Pay which is made available on Cashfree’s platform or website.

Refunds in case of a Gift Wallet shall be as per the terms and conditions of the Merchant and the Customer shall have to contact the Merchant in case they seek to obtain a refund.

Termination / Suspension of Services

Cashfree shall have the right to immediately terminate or suspend Cashfree Pay with or without notice to the Customer in the following events:

if the Customer is in breach of the Terms;

if the Customer furnishes any false or incorrect or inaccurate information;

in the event of any suspicious or fraudulent activity reported or identified on Cashfree Pay;

any legal or regulatory requirements as may be applicable

Escrow Account

PPI balances held by the Customer are held in an escrow account with a bank which is operated by Cashfree for settling the funds in connection with the Services.

Intellectual Property Rights

All rights, title and interest in and to the Intellectual Property Rights owned by Cashfree or in the PPI (as the case may be) are the sole and exclusive property of Cashfree.

Nothing contained in these Terms and Conditions shall be construed as a grant of any right, title or interest in or to the aforesaid Intellectual Property Rights.

Indemnification

You hereby undertake and agree to indemnify, protect against liability and hold harmless Cashfree, its affiliates, and their respective directors, employees, officers, agents, representatives, contractors and sub-contractors against all actions, proceedings, claims, liabilities (including statutory liabilities), penalties, demands and costs (including without limitation, legal costs of Cashfree on a solicitor/attorney and own client basis), awards, damages, losses and/or expenses, however, arising in relation to:

any claim or proceeding brought by law enforcement authorities, regulators, or any other person against Cashfree in respect of any act, deed, negligence, omission, misrepresentation, default, misconduct, fraud by You in relation to the use of Cashfree Pay;

any breach of these Terms, the Privacy Policy, or any other terms, conditions, policies or guidelines provided by Cashfree in relation to the Cashfree Pay;

any wrongful or improper use of Cashfree website or Cashfree platform or any other Cashfree Property; or

any violation of the third-party rights.

Limitation on Liability

Cashfree shall have no liability for any unauthorized transactions occurring on any PPI and the Customer hereby absolves Cashfree (including their respective Affiliates) therefrom.

Customer Liability of Unauthorised Transactions

The Customer’s liability shall be determined as per the below table for an Unauthorised Transaction. A transaction shall be referred to as an Unauthorised Transaction in the below circumstances:

which is not initiated by the Customer

is carried out by a third party without the Customer’s knowledge or consent

may result from fraud, security breach, device compromise or identity theft

leaked credentials used for a transaction

In the event that any Unauthorised Transaction is undertaken on account of (i) contributory fraud / negligence / deficiency on the part of the Cashfree or (ii) on account of third party breach (not attributable to Customer or Cashfree and where such Unauthorised Transaction is informed by Customer to Cashfree within 3 days of the transaction, the Customer shall not be liable for such Unauthorised Transactions.

In other cases, Customers shall continue to be liable for Unauthorised Transactions as per Cashfree’s internal policies. Cashfree reserves the right to waive off any liability of the Customers in such circumstances as per its internal policies.

Grievance Redressal

Cashfree is committed to ensuring transparency, fairness, and timely redress of customer grievances related to the usage of these instruments. Cashfree shall be responsible to resolve Customer’s query, feedback or complaint, pertaining to the transactions they may have processed or attempted to process using Cashfree’s platform as per the Customer Grievance Redressal Policy available at https://www.cashfree.com/grievance-redressal-policy/. Cashfree has designated a Grievance to handle all complaints and grievances. Details of the Nodal Officer and escalation contacts are as given below:

Nodal Officer – Grievance Redressal-

Cashfree Payments India Pvt Ltd,

Vaishnavi Summit, No. 6/B, Summit,

80 Feet Rd, Koramangala 1A Block,

Koramangala 3 Block, Koramangala,

Bengaluru, Karnataka 560034

Email ID: grievances@cashfree.com

Governing Law and Jurisdiction

These Terms and any dispute or claim in relation to these Terms shall be governed by and construed in accordance with the laws of India.

The Parties agree that all disputes arising out of or in connection with these Terms shall be subject to the exclusive jurisdiction of the courts in Bangalore, Karnataka.

Miscellaneous

Assignment: Cashfree shall have the right to assign its rights or obligations under these Terms without any prior written consent to any person in such manner and on such terms and conditions as may be decided by Cashfree. The Customer shall not have the right to assign rights or obligations under these Terms. The Customer, his heirs, legal representatives, executors, administrators and successors shall be bound by these Terms.

Disclaimer or Warranties: To the maximum extent permitted by Applicable Laws and except as stated in the Agreement; Cashfree Pay is provided on “as is” basis and Cashfree disclaims all warranties, express or implied, written, or oral, including but not limited to warranties of merchantability and fitness of the good or services provided by the Merchant. Cashfree does not make any warranty with respect to Cashfree Pay accessibility in a timely, secure, error-free and uninterrupted manner and that Cashfree Pay or the App/ the Website and any related services are free from computer viruses, malicious, destructive or corrupting code.

Notices: All notices and other communications required or permitted to be given under these Terms shall be in writing and shall be delivered or sent by personal delivery, electronic mail, or registered or courier or certified mail (return receipt requested) to the relevant Party at the registered address. The notices and communications sent in such manner shall, unless the contrary is proven, be deemed to have been duly received on the date of personal delivery, two Business Days following delivery, upon confirmation of transmission by the sender’s electronic mail device or ten (10) business days following mailing by registered or certified mail (return receipt requested postage prepaid to be sent to the address and email ID.

Relationship between the Parties: Each party under these Terms are on a principal to principal basis. Nothing contained in these Terms shall constitute or imply any partnership, joint venture, agency, fiduciary relationship, employer-employee, principal employer - contractor or other relationship other than the contractual relationship expressly provided under the Terms.

Frequently Asked Questions

What is the Cashfree Prepaid Wallet and how does it work?

Cashfree’s prepaid wallet is a digital wallet issued under RBI guidelines, enabling users to store funds securely and make payments across partner platforms and services.Can I send money from my wallet to my bank account or someone else?

Withdrawals or peer-to-peer transfers are currently not supported for semi-closed loop and Gift wallets. The wallet is intended for making payments only.How can I track the activity on my Cashfree Wallet?

You can view all wallet-related transactions by visiting the Transactions section on your Cashfree Customer Portal.Will the money in my wallet expire if unused?

Wallet balances currently have an expiration of 2 years. Expiry timelines may be revised from time to time in the future if mandated by regulatory authorities. You can withdraw the residual amount in your source bank account and close the prepaid wallet at any point if requiredAre there any charges for using or adding funds to the wallet?

No, adding money or using your wallet for payments does not attract any fees at the moment.What’s the maximum amount I can hold in my wallet?

As per RBI regulatory norms, your semi closed loop wallet cannot exceed a balance of ₹10,000 per month and ₹1,20,000 in a year.Can I update the mobile number linked to my Cashfree Wallet?

Unfortunately, the mobile number is tied to your wallet account and cannot be changed once registered. You can close the prepaid wallet and request for a new wallet with the updated phone number.How is my data and money kept safe?

Cashfree uses industry-grade encryption and is compliant with regulatory standards to ensure your personal and financial information is fully protected.How can I avoid scams or fraud while using the wallet?

Stay safe by following these tips:Do not share your wallet OTP or credentials with anyone.

Always verify the authenticity of payment links and websites before making payments.

Avoid clicking on suspicious SMS or email links.

In case of doubt, reach out to our official support channel instead of responding directly.

Please note that the features of the PPI as specified above are subject to change which may take place on account of changes in applicable laws, regulatory requirements or internal policy decisions. Any such changes shall be duly communicated to the Customers through email/ SMS communications or updates in these terms and conditions.

Customer Obligations

The Customer agrees and undertakes that:

You hereby agree to use Cashfree Pay in accordance with Applicable Law and further agree not to use it for any unlawful purpose. You will not undertake or encourage any illegal, criminal, money laundering, terrorist activities or any other activity that is in violation of Applicable Laws while using Cashfree Pay.

You are solely responsible for maintaining the security and confidentiality of your password/PIN/credentials associated with your Cashfree Pay and immediately notify us of any loss or theft of your instrument, or authentication data or if any fraud/abuse is detected, any unauthorised use, any other breach of security etc. with respect to Cashfree Pay.

You shall be responsible in case of any compromise of your password/PIN/credentials and transaction done due to such compromise of security and confidentiality of your password/PIN/credentials and other related sensitive information.

You shall extend all cooperation to us in our defence of any proceedings that may be initiated against Cashfree due to a breach of your obligations or covenants under these Terms.

You shall not by electronic or other means circumvent, disable, or otherwise interfere with security-related features or trick, defraud, or mislead us and other users, especially in any attempt to learn sensitive information.

You shall not engage in any automated use of the system, such as using scripts, or using any data mining, robots, or similar data gathering and extraction tools.

You shall not attempt to impersonate another user or person or use the username of another Customer.

You shall not decipher, decompile, disassemble, or reverse engineer any of the software comprising or in any way making up a part of the services by Cashfree.

You shall not infringe any patent, trademark, copyright or other proprietary rights, trade secrets or privacy of a third party.

Pricing

Presently no charges are being imposed by Cashfree on the Customers for the issuance or use of Cashfree Pay services. However, Cashfree shall have the right to impose such charges in relation to the usage of Cashfree Pay. These charges may be levied at different stages eg. while loading/ re-loading of any Cashfree Pay, use of such Cashfree Pay on Merchant sites for undertaking transaction fees etc.

In the event Cashfree, in its discretion, levies any such charges or fees for issuance or operation of Cashfree Pay Cashfree shall duly communicate such charges to Customers through SMS, email notification, updation of website terms and conditions or such other means as Cashfree reasonably determines.

The Customer shall have to bear any statutory taxes, goods and service tax, all other duties, if any, in connection with Cashfree Pay as may be levied from time to time by a Governmental Authority in respect of or in connection with the transactions undertaken with the use of Cashfree Pay.

Validity

As stated above, Gift Wallet and Small PPI shall be valid for a period of two years from the date of its issuance provided that if no transaction is undertaken using Cashfree Pay for a duration of 1 year from the date of activation, Cashfree Pay shall be made inactive by provision of notice to the Customer.. Cashfree shall notify the customers via SMS/ Email or any other communication channels 45 days prior to the deactivation of Cashfree issued prepaid instruments. Cashfree shall provide the Customer with an option to provide details of the bank account for the transfer of the balance amount lying in Cashfree Pay at the time of deactivation.

The Customer could approach Cashfree for transfer of balance amount post expiry of Cashfree Pay, however, such transfer shall take place only to a verified bank account of the Customer.

Refunds

Cashfree shall maintain the complete details of refund transactions and the Customer shall be able to view the same on Cashfree Pay which is made available on Cashfree’s platform or website.

Refunds in case of a Gift Wallet shall be as per the terms and conditions of the Merchant and the Customer shall have to contact the Merchant in case they seek to obtain a refund.

Termination / Suspension of Services

Cashfree shall have the right to immediately terminate or suspend Cashfree Pay with or without notice to the Customer in the following events:

if the Customer is in breach of the Terms;

if the Customer furnishes any false or incorrect or inaccurate information;

in the event of any suspicious or fraudulent activity reported or identified on Cashfree Pay;

any legal or regulatory requirements as may be applicable

Escrow Account

PPI balances held by the Customer are held in an escrow account with a bank which is operated by Cashfree for settling the funds in connection with the Services.

Intellectual Property Rights

All rights, title and interest in and to the Intellectual Property Rights owned by Cashfree or in the PPI (as the case may be) are the sole and exclusive property of Cashfree.

Nothing contained in these Terms and Conditions shall be construed as a grant of any right, title or interest in or to the aforesaid Intellectual Property Rights.

Indemnification

You hereby undertake and agree to indemnify, protect against liability and hold harmless Cashfree, its affiliates, and their respective directors, employees, officers, agents, representatives, contractors and sub-contractors against all actions, proceedings, claims, liabilities (including statutory liabilities), penalties, demands and costs (including without limitation, legal costs of Cashfree on a solicitor/attorney and own client basis), awards, damages, losses and/or expenses, however, arising in relation to:

any claim or proceeding brought by law enforcement authorities, regulators, or any other person against Cashfree in respect of any act, deed, negligence, omission, misrepresentation, default, misconduct, fraud by You in relation to the use of Cashfree Pay;

any breach of these Terms, the Privacy Policy, or any other terms, conditions, policies or guidelines provided by Cashfree in relation to the Cashfree Pay;

any wrongful or improper use of Cashfree website or Cashfree platform or any other Cashfree Property; or

any violation of the third-party rights.

Limitation on Liability

Cashfree shall have no liability for any unauthorized transactions occurring on any PPI and the Customer hereby absolves Cashfree (including their respective Affiliates) therefrom.

Customer Liability of Unauthorised Transactions

The Customer’s liability shall be determined as per the below table for an Unauthorised Transaction. A transaction shall be referred to as an Unauthorised Transaction in the below circumstances:

which is not initiated by the Customer

is carried out by a third party without the Customer’s knowledge or consent

may result from fraud, security breach, device compromise or identity theft

leaked credentials used for a transaction

In the event that any Unauthorised Transaction is undertaken on account of (i) contributory fraud / negligence / deficiency on the part of the Cashfree or (ii) on account of third party breach (not attributable to Customer or Cashfree and where such Unauthorised Transaction is informed by Customer to Cashfree within 3 days of the transaction, the Customer shall not be liable for such Unauthorised Transactions.

In other cases, Customers shall continue to be liable for Unauthorised Transactions as per Cashfree’s internal policies. Cashfree reserves the right to waive off any liability of the Customers in such circumstances as per its internal policies.

Grievance Redressal

Cashfree is committed to ensuring transparency, fairness, and timely redress of customer grievances related to the usage of these instruments. Cashfree shall be responsible to resolve Customer’s query, feedback or complaint, pertaining to the transactions they may have processed or attempted to process using Cashfree’s platform as per the Customer Grievance Redressal Policy available at https://www.cashfree.com/grievance-redressal-policy/. Cashfree has designated a Grievance to handle all complaints and grievances. Details of the Nodal Officer and escalation contacts are as given below:

Nodal Officer – Grievance Redressal-

Cashfree Payments India Pvt Ltd,

Vaishnavi Summit, No. 6/B, Summit,

80 Feet Rd, Koramangala 1A Block,

Koramangala 3 Block, Koramangala,

Bengaluru, Karnataka 560034

Email ID: grievances@cashfree.com

Governing Law and Jurisdiction

These Terms and any dispute or claim in relation to these Terms shall be governed by and construed in accordance with the laws of India.

The Parties agree that all disputes arising out of or in connection with these Terms shall be subject to the exclusive jurisdiction of the courts in Bangalore, Karnataka.

Miscellaneous

Assignment: Cashfree shall have the right to assign its rights or obligations under these Terms without any prior written consent to any person in such manner and on such terms and conditions as may be decided by Cashfree. The Customer shall not have the right to assign rights or obligations under these Terms. The Customer, his heirs, legal representatives, executors, administrators and successors shall be bound by these Terms.

Disclaimer or Warranties: To the maximum extent permitted by Applicable Laws and except as stated in the Agreement; Cashfree Pay is provided on “as is” basis and Cashfree disclaims all warranties, express or implied, written, or oral, including but not limited to warranties of merchantability and fitness of the good or services provided by the Merchant. Cashfree does not make any warranty with respect to Cashfree Pay accessibility in a timely, secure, error-free and uninterrupted manner and that Cashfree Pay or the App/ the Website and any related services are free from computer viruses, malicious, destructive or corrupting code.

Notices: All notices and other communications required or permitted to be given under these Terms shall be in writing and shall be delivered or sent by personal delivery, electronic mail, or registered or courier or certified mail (return receipt requested) to the relevant Party at the registered address. The notices and communications sent in such manner shall, unless the contrary is proven, be deemed to have been duly received on the date of personal delivery, two Business Days following delivery, upon confirmation of transmission by the sender’s electronic mail device or ten (10) business days following mailing by registered or certified mail (return receipt requested postage prepaid to be sent to the address and email ID.

Relationship between the Parties: Each party under these Terms are on a principal to principal basis. Nothing contained in these Terms shall constitute or imply any partnership, joint venture, agency, fiduciary relationship, employer-employee, principal employer - contractor or other relationship other than the contractual relationship expressly provided under the Terms.

Frequently Asked Questions

What is the Cashfree Prepaid Wallet and how does it work?

Cashfree’s prepaid wallet is a digital wallet issued under RBI guidelines, enabling users to store funds securely and make payments across partner platforms and services.Can I send money from my wallet to my bank account or someone else?

Withdrawals or peer-to-peer transfers are currently not supported for semi-closed loop and Gift wallets. The wallet is intended for making payments only.How can I track the activity on my Cashfree Wallet?

You can view all wallet-related transactions by visiting the Transactions section on your Cashfree Customer Portal.Will the money in my wallet expire if unused?

Wallet balances currently have an expiration of 2 years. Expiry timelines may be revised from time to time in the future if mandated by regulatory authorities. You can withdraw the residual amount in your source bank account and close the prepaid wallet at any point if requiredAre there any charges for using or adding funds to the wallet?

No, adding money or using your wallet for payments does not attract any fees at the moment.What’s the maximum amount I can hold in my wallet?

As per RBI regulatory norms, your semi closed loop wallet cannot exceed a balance of ₹10,000 per month and ₹1,20,000 in a year.Can I update the mobile number linked to my Cashfree Wallet?