Cashfree turns 10! Celebrate with 1.6%* gateway fee for new merchants – limited period!

Step 1

Quick and easy sign-up

Complete your KYC and get started

Step 2

Local collection accounts

Get your account details for international currencies

Step 3

Simplified collection process

Share account details and receive funds hassle-free

Step 4

Seamless tracking and compliance

Monitor transactions and receive e-FIRA promptly

GTP customers can get started with the solution right away with a seamless digital KYC process. This saves about 70% of time otherwise spent on complete manual KYC process.

This partnership facilitates exporters in obtaining auto-generated e-FIRA within 24 hours. This significantly improves the ease and efficiency of international trade for Indian exporters.

Exporters can receive international payments in over 15 currencies and the amount collected will be converted into INR and deposited into their local Indian bank accounts within 2 working days.

Get a dedicated account manager for your GTP and Cashfree Payments accounts to help you smoothly get onboard and start transacting in a jiffy.

Cashfree Payments enable GTP customers to expand their domestic business globally, drawing in international customers to boost sales.

Suitable for all businesses

With GTP & Cashfree Payments partnerships:

Receiving international payments simplified for goods export thereby reducing complexities associated with currency conversions and global money transfers.

Effortlessly receiving secure international payments, expanding their reach and facilitating seamless cross-border transactions.

Empowers industries with diverse portfolios, such as 70% agro, Ayurvedic, Apparel, Handicraft, and Metal, by facilitating efficient international payments, fostering global expansion for businesses with varied product offerings.

Facilitates international payments for Freelancers, IT consultants, Service exporters, and Digital agencies as well.

Have more questions?

Visit our support page

Minimal processing fees, No hidden charges, or forex markups

Obtain a guaranteed e-FIRA within 24 hours

Empower international sales with the ability to settle transactions in INR

Facilitate transactions in 15+ currencies across 180+ countries

Share your global collection account details with your international clients over email, SMS or WhatsApp

Enable your buyers to make payments using local rails like Automated clearing house (ACH), Single Euro Payments Area (SEPA)

Have more questions?

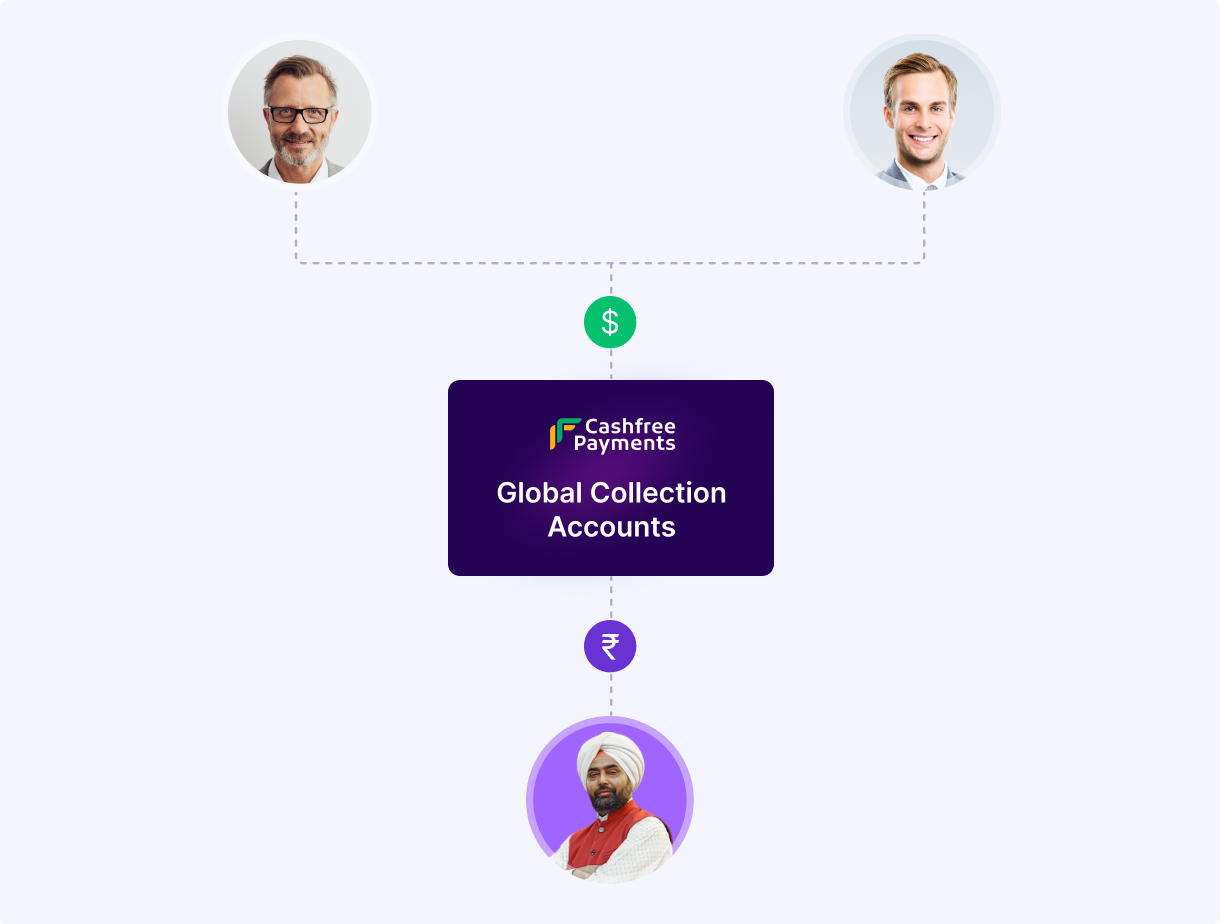

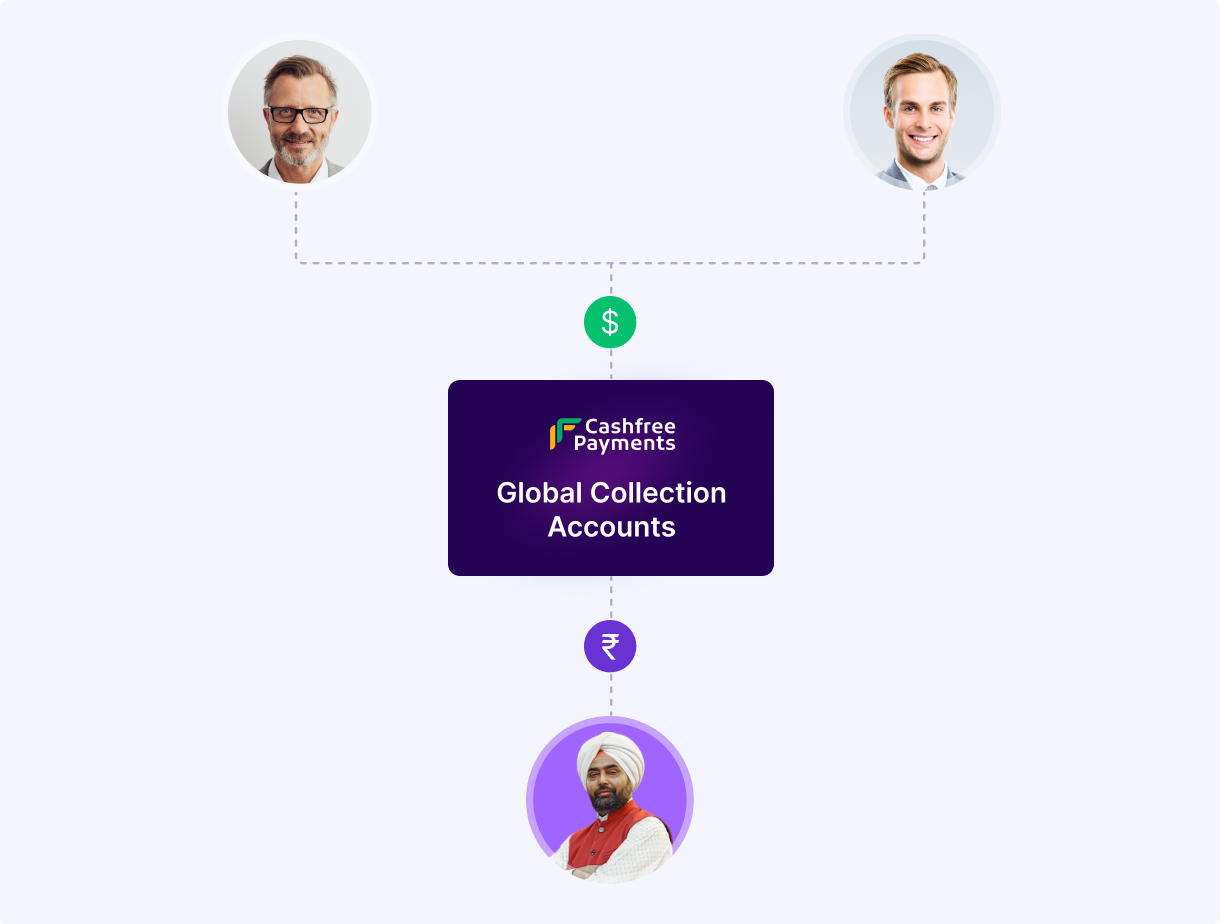

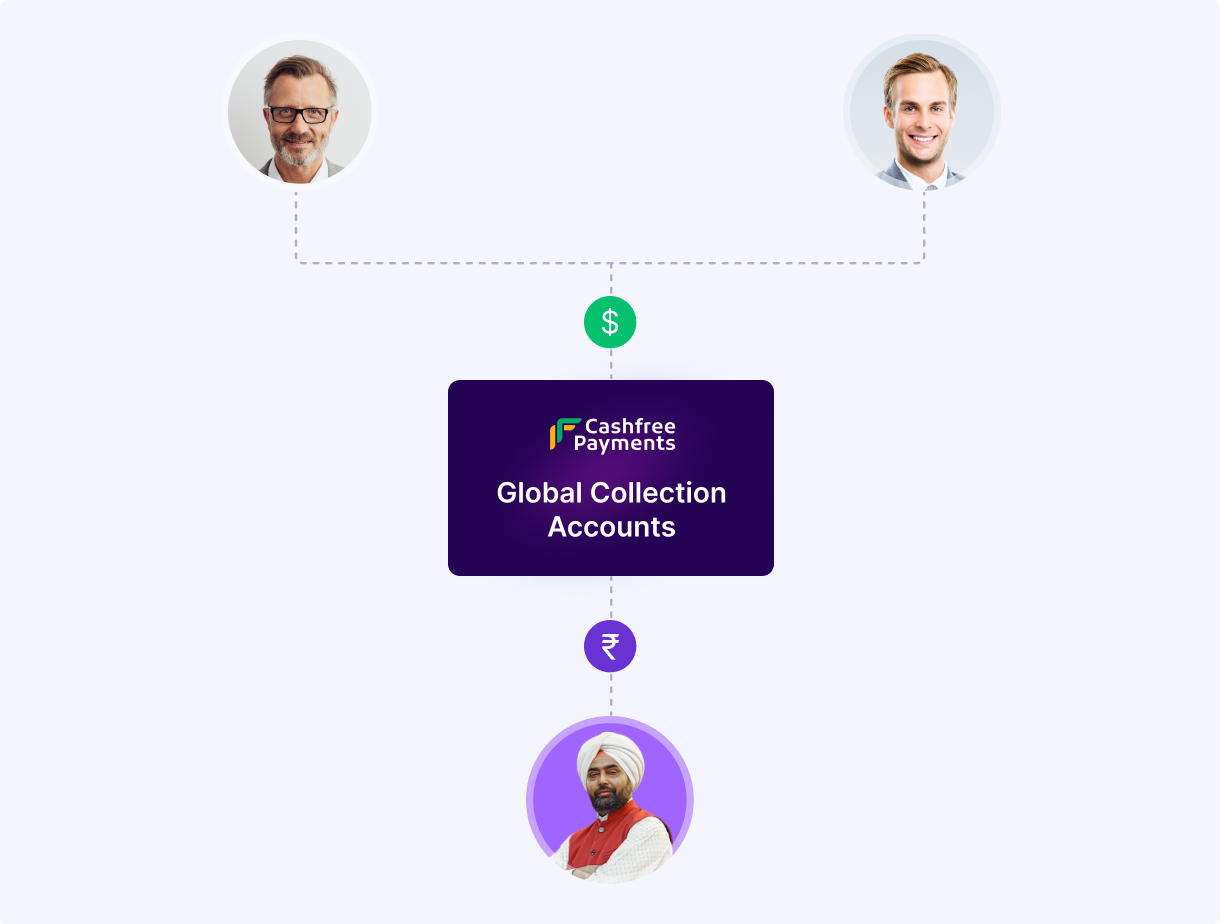

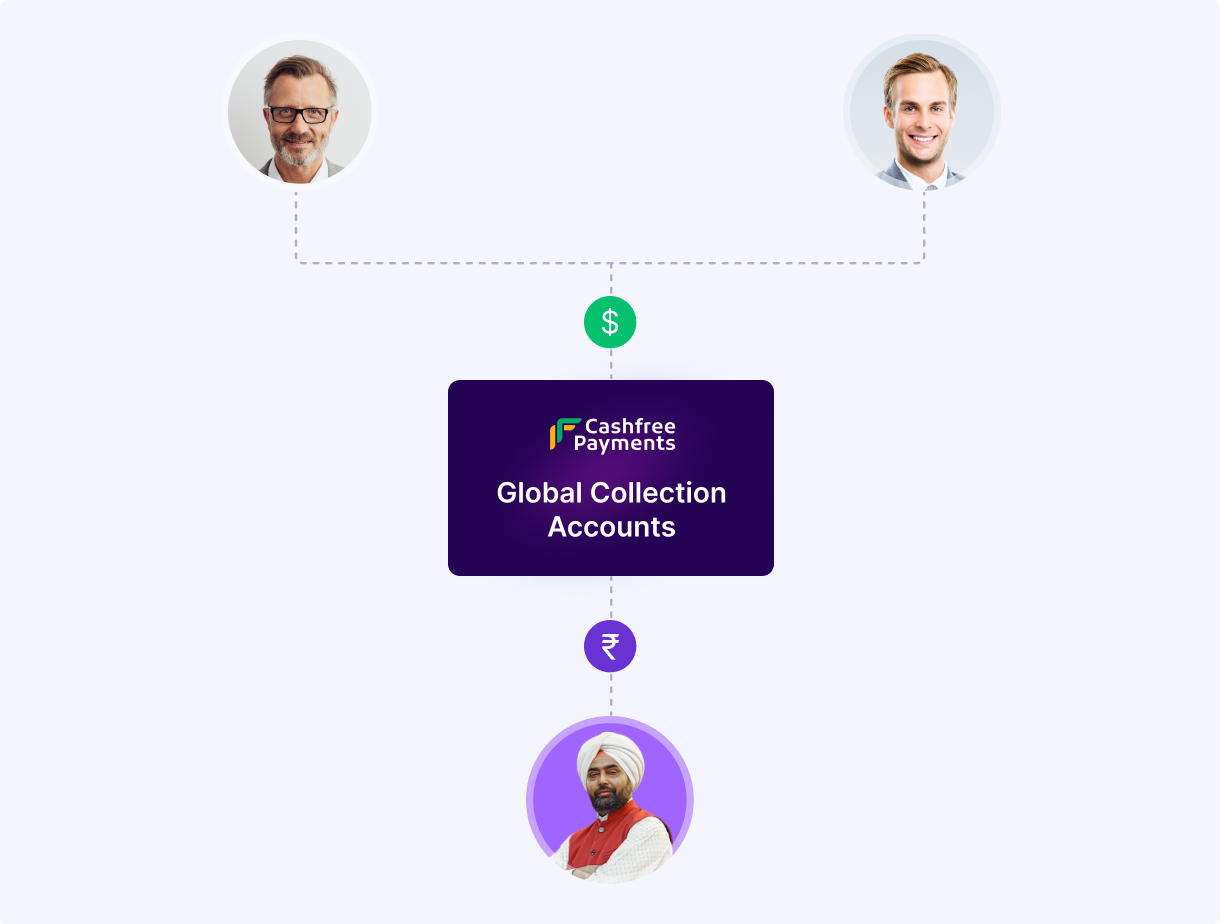

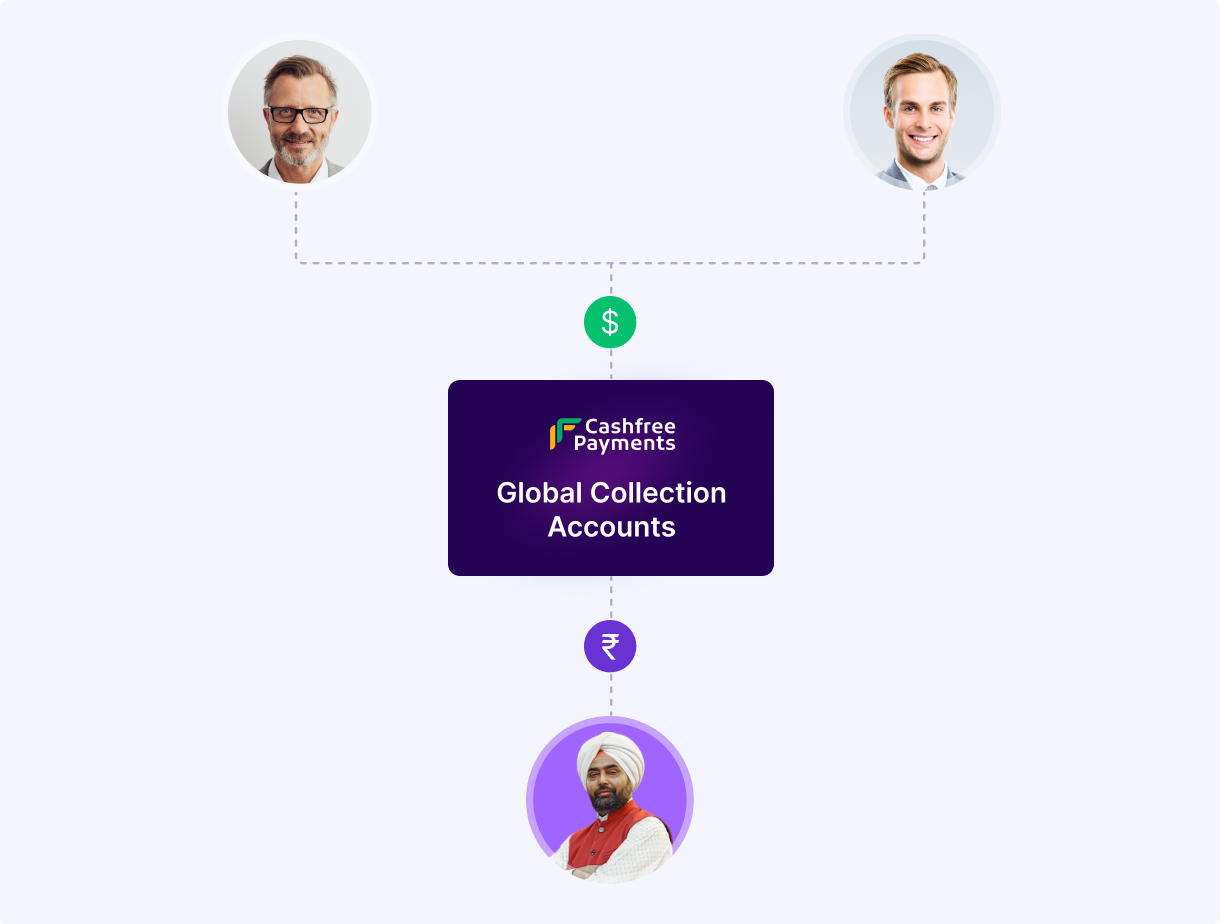

Global Collections is a technology payments platform built for exporters who want to receive international payments. This solution is recommended for exporters who are dealing in goods or services having invoice value of up to USD 10,000.

Traditionally exporters in India have been receiving payments via SWIFT. With Global Collections solutions, the exporters can get 5 dedicated local accounts - in 4 currencies namely USD, GBP, EUR and CAD and a Global SWIFT Account to accept payments in 30+ currencies.

Payers/importers can make cross-border payments as easy as domestic payments by using local rails like ACH, SEPA, EFT and Faster payments and the amount is credited to the respective local collection account.

Exporters can receive these payments in the importer’s or payer’s home currency without the exporter having to open a bank account in foreign countries saving his/her time, effort and money.

Just like there is NEFT in India, there is ACH in the US, SEPA in Europe region, EFT in Canada and Faster payments in UK.

Using the Global Collections solution, exporters get a dedicated collection account each in USD, GBP, EUR and CAD and a SWIFT account to receive payments in other currencies. This way an exporter can get paid via payer’s local rails instead of SWIFT.

Example: A payer residing in the US can initiate an ACH transfer into the receiver’s (Indian exporter’s) local receiving USD account.

⚫ High-valued goods like Jewellery

⚫ Petroleum, Oils and Lubricants (POL)

⚫ Pharma products including equipment

⚫ Other line of businesses as per discretion of Cashfree Payments

Here’s the list of purpose codes to be followed for OPGSP transactions.