This Festive Season get Lifetime Free* flowWise AccessSign up now!

digital lending solution

for NBFCs and Fintechsdigital lending guidelines

.Secure

Scalable

Compliant

digital lending business

Managed Escrow Solution for NBFCs and LSPs

NBFCs

Get fully managed escrow set-up with multiple banking partners

Get access to detailed and customized MIS report

Enable LSPs to manage complete disbursement & repayment cycle on Cashfree Payment's Dashboard or use our APIs

Get access to loans, disbursed statements and balance for each LSP on your escrow

LSPs

Manage multiple NBFC relationships through our solution

Ensure visibility and ability to manage the loan cycle for your customer base

Get access to dashboard and APIs for disbursement and repayment on NBFC escrow

Get access to detailed and customized MIS report for loans originated and repaid for your customers

instant loan disbursals

directly from your current or escrow accounts with Cashfree Payments’ APIsDisburse loans from multiple accounts

Powerful merchant dashboard

Disburse loans

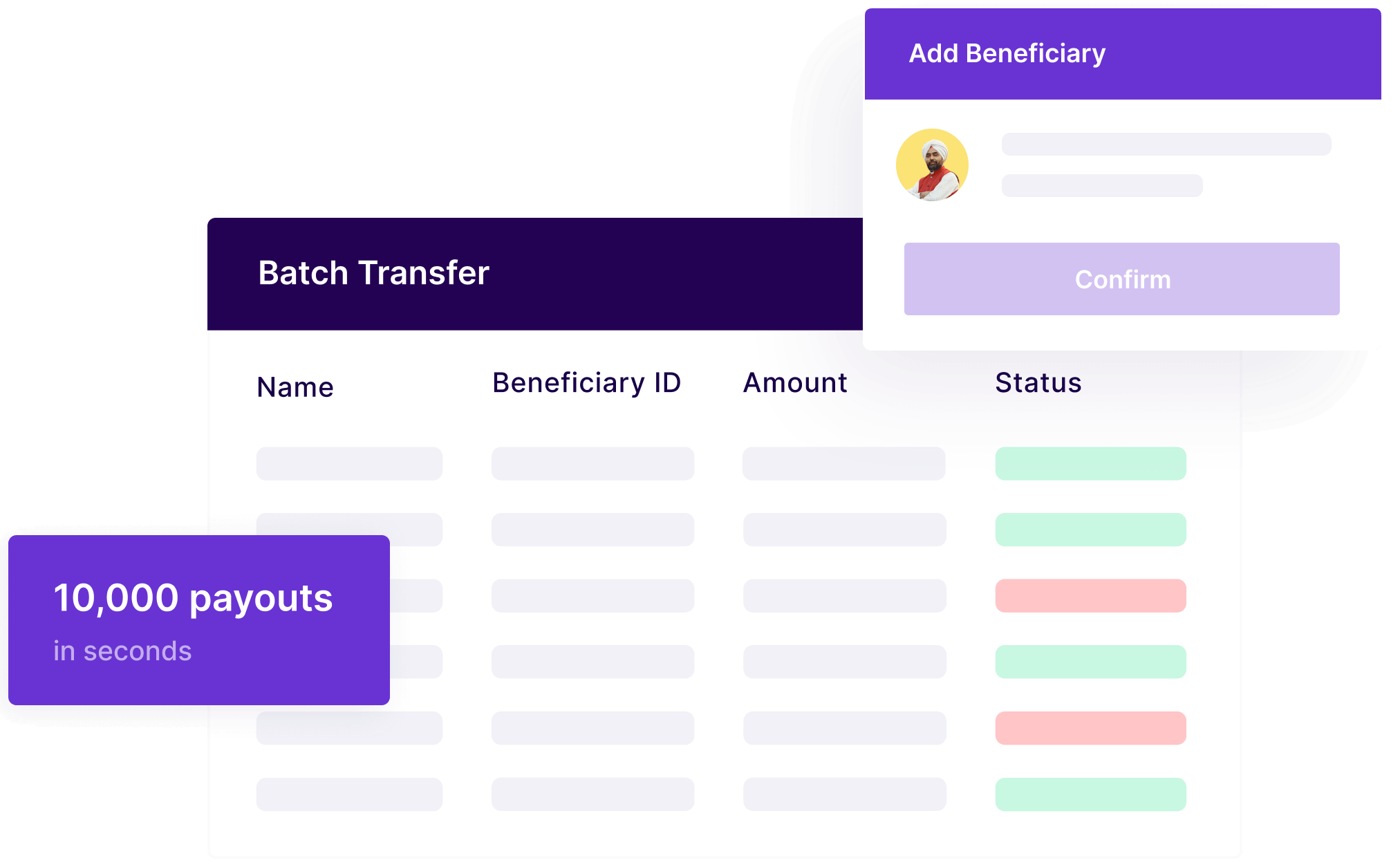

and make other payments directly from your connected business accountAdd borrowers and make up to 10,000 payouts in seconds from NBFC escrow

Track transfer status and reasons for failure in real time

Generate custom reports for deeper analysis

business loan disbursals

and effectiveloan solutions

to all, by simply integrating direct Payouts in their Loan Origination System, eSthenos. With this, Northern Arc could:Collections and reconciliation

Recurring payments

Split payments

Real-time reports

Risk Mitigation

Real time risk management with powerful risk engine

Set transaction limits

API level security checks

Fraud detection

Have more questions?

Visit our support pageYes

With the digitisation of lending, collaborations between entities are common. For instance, regulated entities (REs) like banks or NBFC may partner with:

- Non-bank companies that provide Digital Lending Applications (DLAs)

- Lending Service Providers (LSPs) that undertake sections of the lending process. These LSPs and DLAs do not provide capital nor carry credit risks. This may lead to unregistered lending and anonymised shadow lending.

Can’t use pass-through accounts for fund flow: Disbursals and collections will flow straight from the RE’s bank account to the borrower’s bank account.

BNPL models disbursing to PPI discontinued: BNPL Models that disbursed funds through PPI (prepaid cards, m-wallets) are discontinued. Funds should be disbursed directly to the bank account of the borrower.

Direct disbursals to merchants allowed for specific cases: These use cases include invoice discounting, supply chain financing, consumer durable financing, and even BNPL.

Exceptions for co-lending models: Pool accounts can be still used for for the flow of funds between multiple co-lending REs.

First Loss Default Guarantee (FLDG) use under examination: First Loss Default Guarantee (FLDG) models allow LSPs to offer a first loss guarantee up to a certain percentage of the loan, allowing it to bear some of the risk. Until further notice, arrangements need to adhere to securitisation norms.

Cashfree Payments’ tailored solution enables NBFCs to open and operate Escrow accounts with partner banks and trustees, with a dashboard and API stack for loan disbursements directly to borrowers, efficient reconciliation, borrower identity & bank account verification.

This solution will facilitate both Digital lending and Co-lending use cases and will enable both lenders and LSPs to comply with the recent guidelines on digital lending with minimal changes to their existing workflow. Cashfree Payments also enables lenders to provide seamless repayment options such as e-NACH, UPI AutoPay and identity verification products like Bank Account, GSTIN, PAN, Aadhar verification, thereby giving a full-stack solution for NBFCs and their LSPs.

An escrow account in India is a bank account with conditions on ownership of funds. In simple terms, it is a safe house for assets while the transaction process is still ongoing. An escrow agent is a mediator who holds this escrow account. Consider them an intermediary between the buyer and the seller. Interestingly, an escrow account is not just limited to funds. It can be used for different types of assets like money, stocks, funds etc.

You may need an escrow account in case of:

- A large transaction (between two or more parties)

- that have some legal obligations attached to them

- which need to be fulfilled before the release of the payment or an asset.Here’s an example: Let’s say you are a construction builder and aim to sell apartments. Now, let’s assume that you aim to get these apartments booked by customers before they are ready to move in. Naturally, there are transaction risks.

- The customer may not want to pay the full amount before possession

- There is a risk of scams (money bring redirected to other avenues)

- Customers may be wary if predetermined conditions are not fulfilled

Here’s where an escrow account in India steps in. It reduces the risk of fraud as it acts as the third party between the two parties. Moreover, it helps control the cash flow between the two parties.

Additionally, since September 2022, escrow accounts have become indispensable for co-lending use cases. According to the digital lending guidelines by RBI, all loan repayment and disbursement must be done directly between the bank account of lender and borrower. This means that no third party pass-through account can be used by banks, NBFCs or lending service providers (LSPs).

However, co-lending use cases are an exception to this rule. In other terms, co-lending players (like banks and NBFCs) can use escrow accounts to pool funds before disbursing to borrowers.

- The buyer and the seller agree before opening the account, which involves the terms and conditions of the buying and selling assets. This agreement is the “Escrow agreement”.

- After reviewing and signing the agreement, the buyer deposits the amount to the escrow account.

- The escrow agent verifies and validates the receipt to both parties.

- The escrow agent regularly monitors the buyer’s account to confirm whether or not the buyer is paying the seller as per the agreed process.

- Subject to the positive response from both parties, the assets under the escrow agent’s control are released at the agreed event or time.

- If there is any disagreement between the two parties, the escrow account in India will move to dispute resolution. The outcome process of the dispute resolution decides what to do with the escrow funds.

However, if you are a co-lending player (NBFC or fintech), you can directly integrate with full stack digital lending service providers, like Cashfree Payments.

This will allow you to integrate and go-live within 3 weeks.

Moreover, Cashfree Payments’ low code APIs & dashboard access can help you in easy loan disbursement & collections as well, in compliance with RBI’s digital lending guidelines.

Have more questions?

Visit our support pageReady to get started?

Collect customer payments, make payouts, manage international payments and so much more. Create your account or contact our experts to explore custom solutions.

Easy onboarding

Dedicated account manager

API access