Go global effortlessly! Accept payments in over 100 currencies from customers worldwide.Learn more

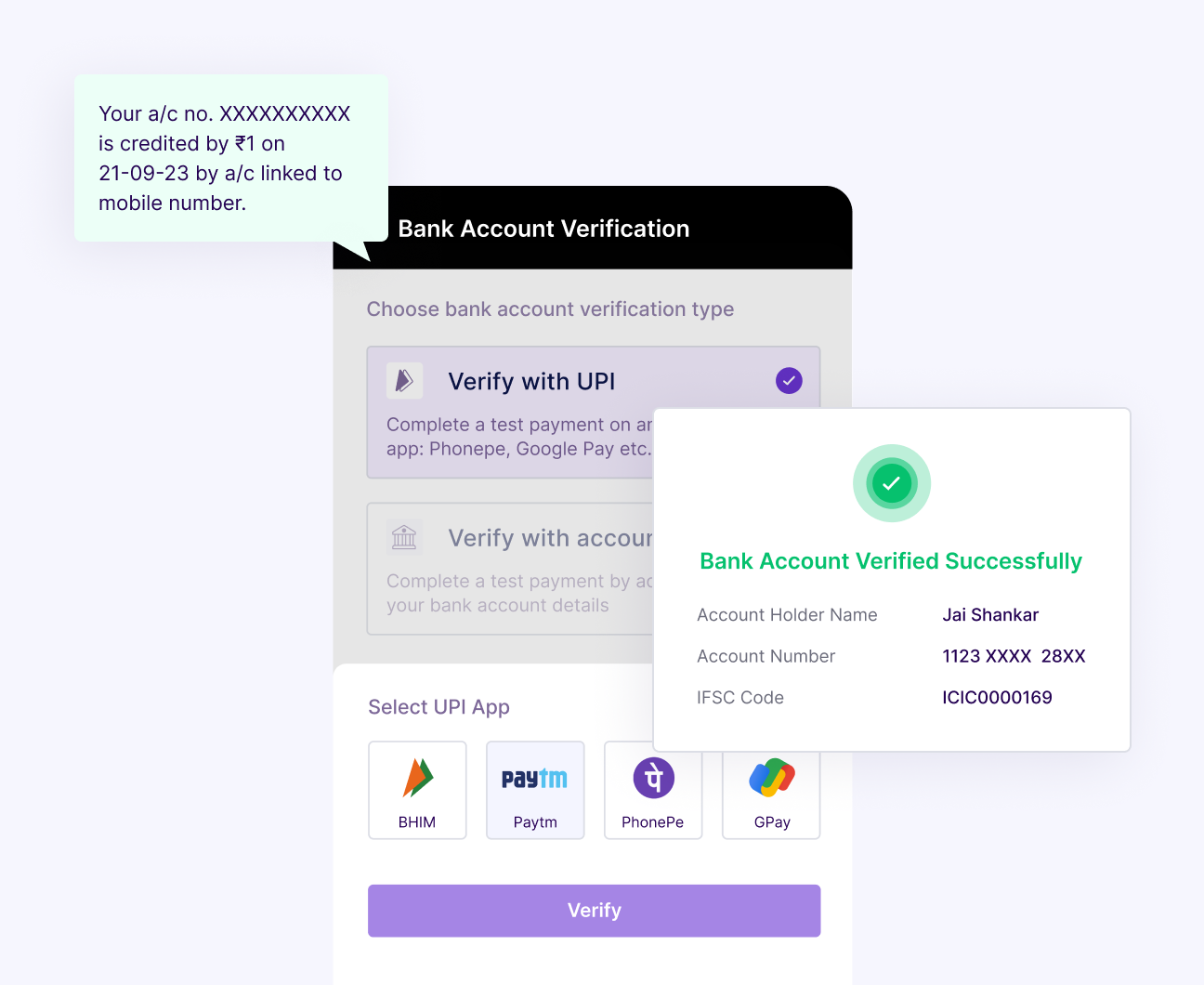

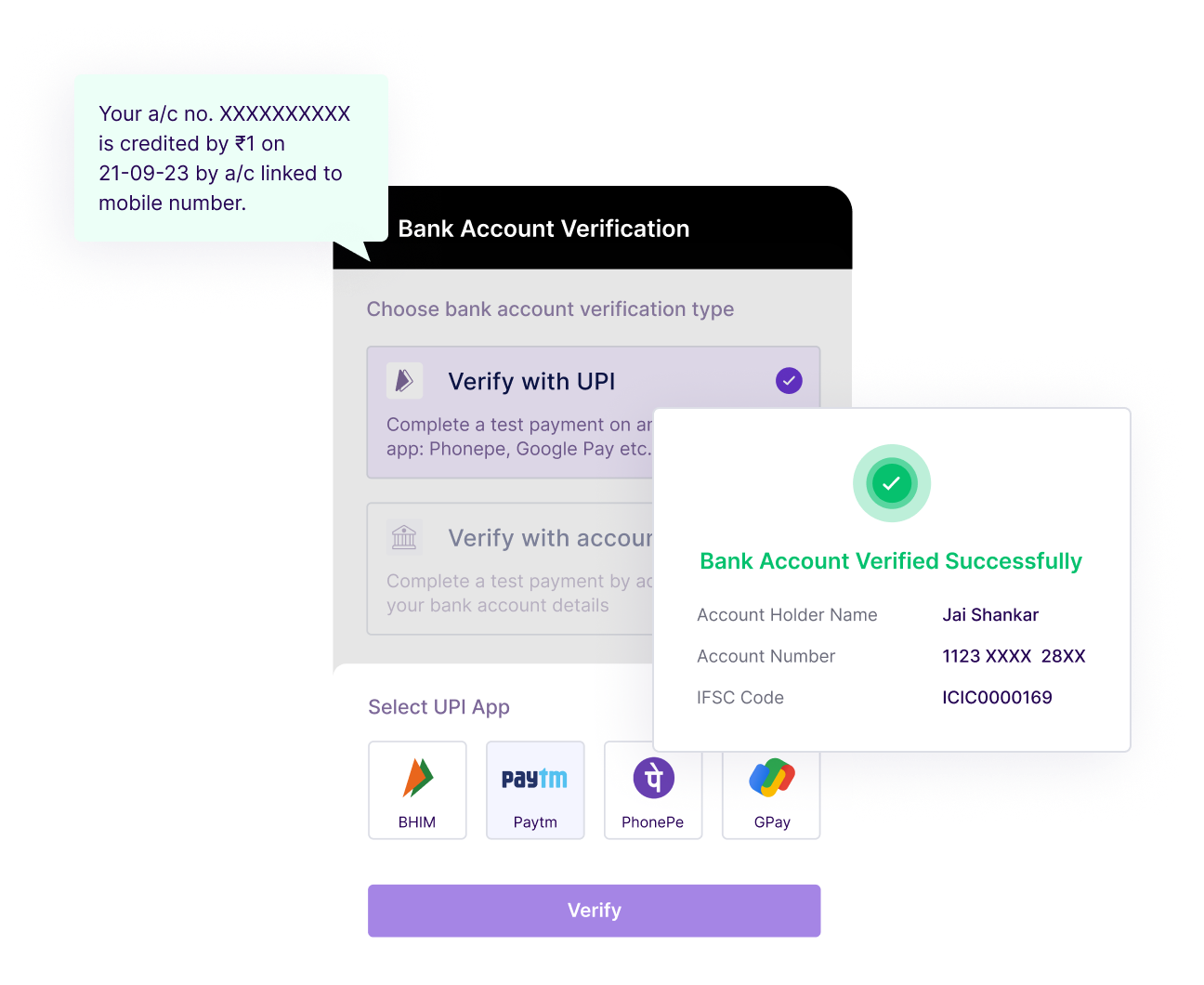

Faster user verification with Penny Drop

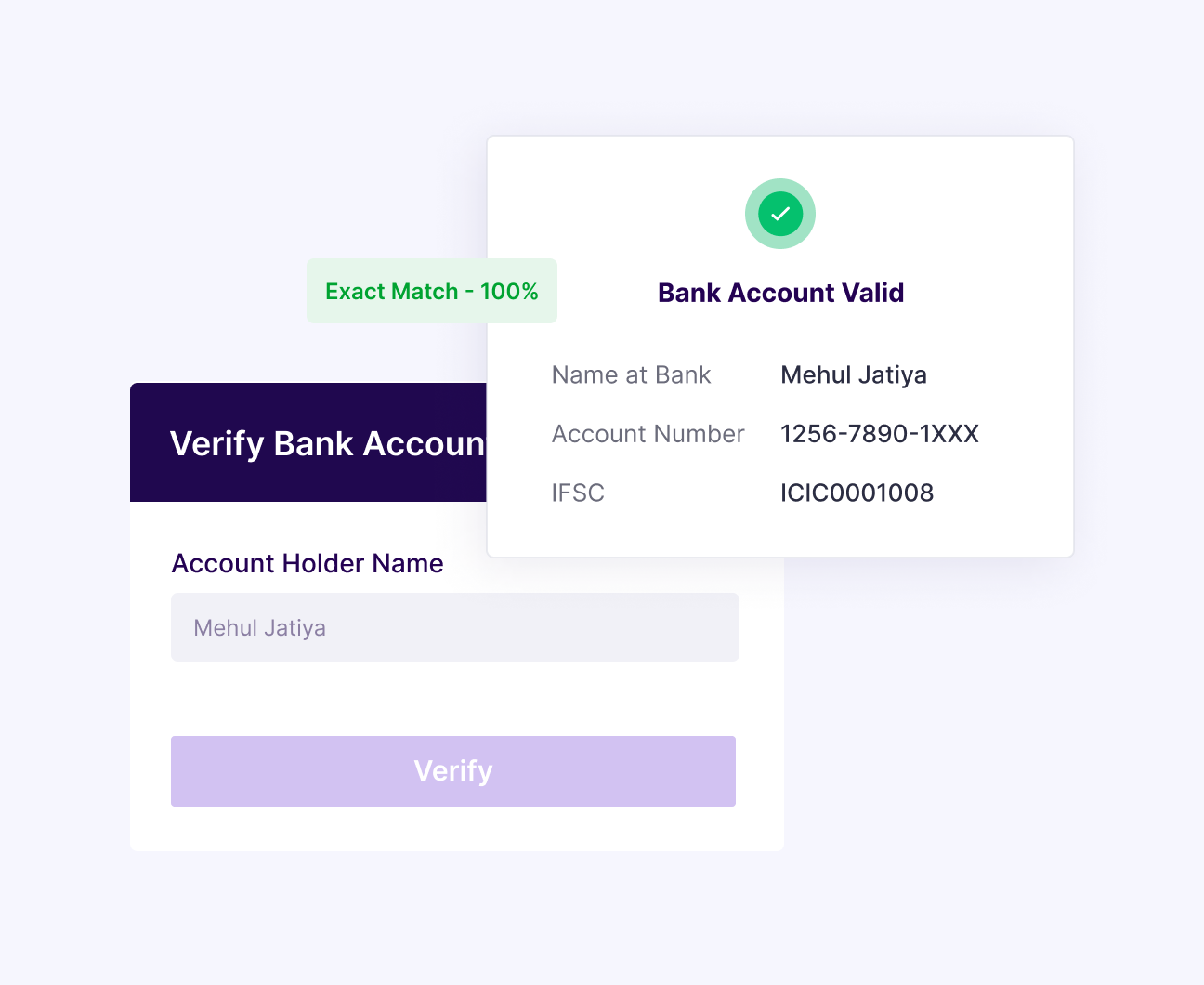

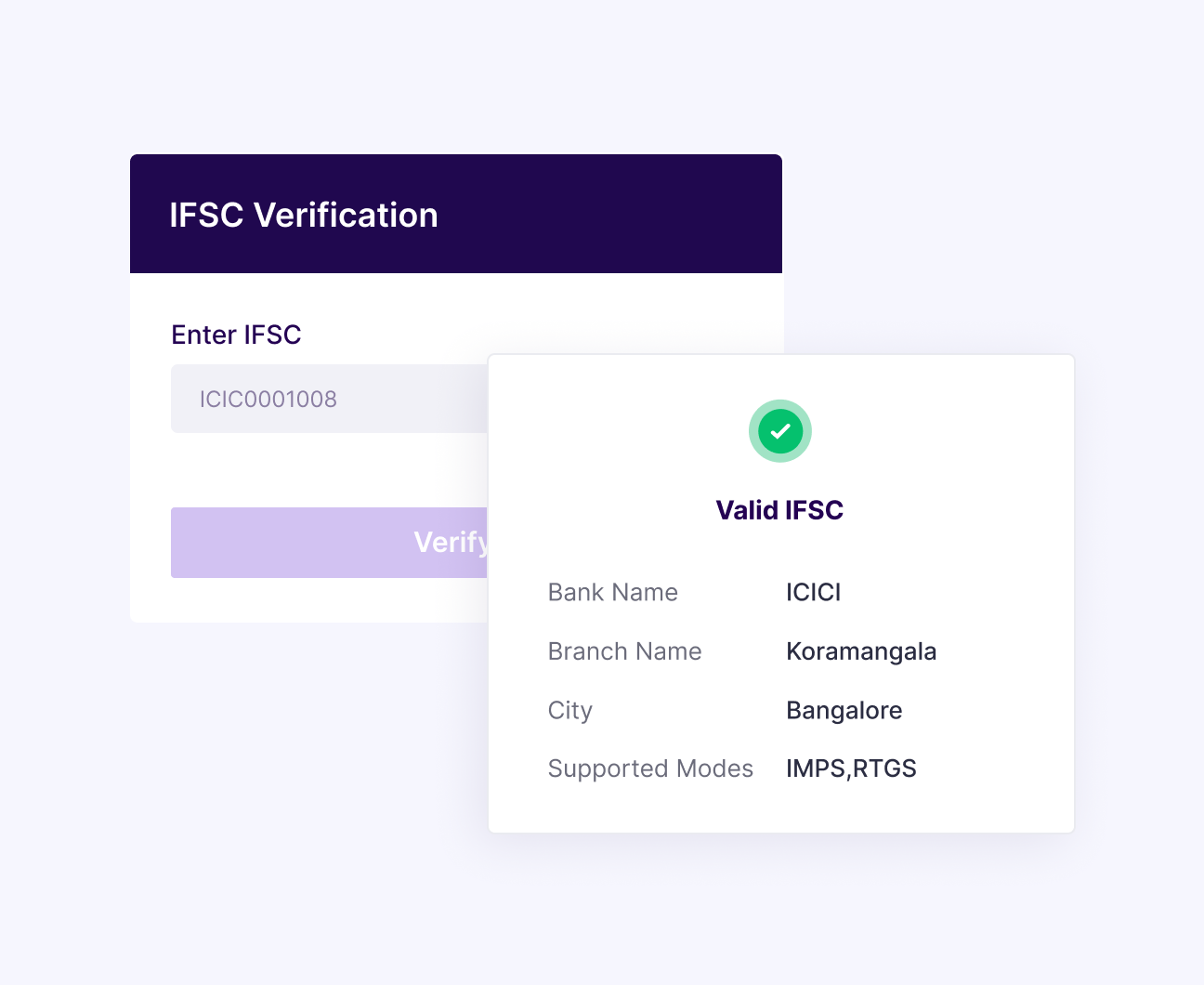

Use API to let your users verify their bank account at time of onboarding KYC or before receiving payouts. Know if the account is active, name as per bank records, and supported transfer modes.

Simplified user experience

No more user drop-offs

Enhanced Accuracy

Unrivaled Coverage Across 600+ Banks

Comprehensive User Bank Account Verification

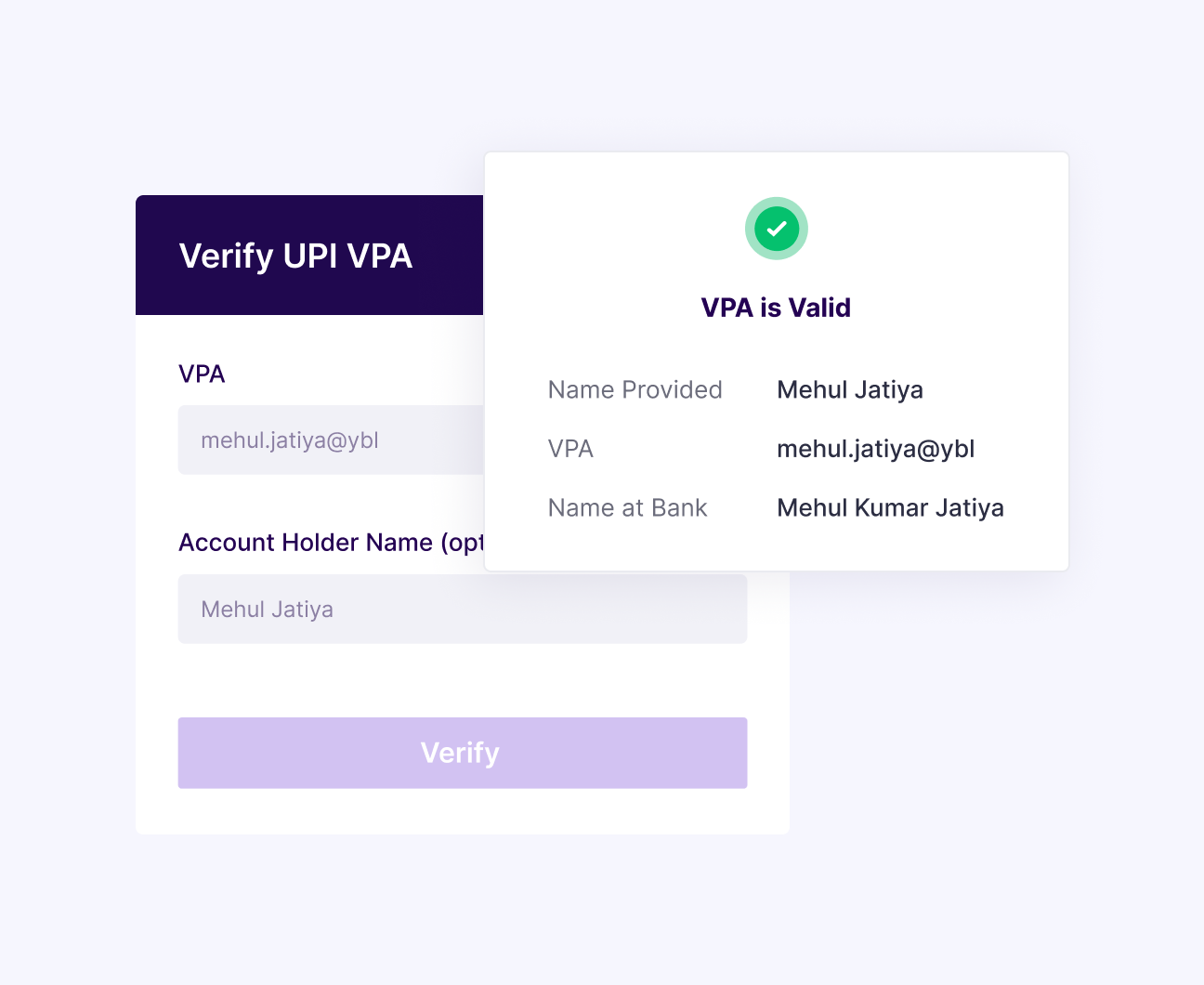

UPI ID from Phone Number API

Highly reliable and secure APIs

Use the official Cashfree libraries for different programming languages to integrate with your product and automate account verification flow

With webhooks, get notified on single or bulk verification status in real time

{

"signature":"signature",

"event_type":"RPD_BANK_ACCOUNT_VERIFICATION_SUCCESS",

"event_time":"2023-07-19 10:46:16",

"version":"v1",

"data":{

"bank_account":"026291800001191",

"ifsc":YESB0000262,

"upi": "",

"name_at_bank":"BHARATHTEST GKUMARUT",

"verification_id":"91",

"ref_id":"49",

"utr":"49" ,

"status":"SUCCESS",

"name_match_score":"",

"name_match_result:"",

"added_on":"2023-07-18T16:27:10+05:30",

"processed_on":"2023-07-19 10:46:16",

"penny_collected_on":"2022-10-27 12:40:09.530"

} Have more questions?

Visit our support pageYes, you can find more details and view the response codes by clicking on the provided link in the product documentation https://docs.cashfree.com/reference/reverse-pennydrop

To get started, you can sign up with Cashfree Payments and access the API documentation to learn more about integrating Reverse Penny Drop Verification into your application or website.

- Enhanced Security: Reverse Penny Drop Verification adds an extra layer of security to the onboarding process. It ensures that the bank account belongs to the user and reduces the risk of fraudulent activities.

- Reduced Chargebacks: By confirming the authenticity of the bank account, businesses can significantly reduce the likelihood of chargebacks due to unauthorized transactions or incorrect bank details.

- Compliance: Many industries, especially in finance and fintech, are subject to regulatory requirements that necessitate thorough identity and account verification. Reverse Penny Drop Verification helps businesses stay compliant with these regulations.

- Improved User Experience: It simplifies the verification process for users, making it convenient and efficient. Users don't need to provide extensive documentation, and verification can often be completed within minutes.

- Cost Savings: By reducing the need for manual verification processes and minimizing the risk of fraudulent accounts, businesses can save on operational costs and potential financial losses.

- Quick and Easy Verification: Users can verify their bank accounts without the need for lengthy paperwork or physical visits to a bank branch and getting a seal from the bank. It's a hassle-free process that can be completed online.

- Increased Trust: Users can have greater confidence in the business they are dealing with, knowing that their bank account details have been verified, which can lead to higher trust levels in the platform or service.

- Security: Knowing that their bank account is protected against unauthorized access or fraud provides peace of mind to users, making them more comfortable with sharing their banking information.

- Faster Access to Services: Verified users can access and use services more quickly, as they don't have to wait for manual verification processes to be completed.

- Reduced Errors: The penny drop method ensures that the bank account details provided are accurate, reducing the chances of errors in financial transactions.

Reverse Penny Drop Verification can be beneficial for a wide range of businesses, particularly those that involve financial transactions, online payments, or account-based services.

• Fintech Startups: Startups in the financial technology (fintech) sector can use Reverse Penny Drop Verification to ensure the authenticity of user bank accounts, reducing the risk of fraud and meeting compliance requirements.

• Online Marketplaces: E-commerce platforms and online marketplaces that facilitate transactions between buyers and sellers can use this verification method to enhance trust and reduce the incidence of fraudulent sellers or buyers.

• Peer-to-Peer (P2P) Lending Platforms: P2P lending platforms can use Reverse Penny Drop Verification to verify borrowers' bank accounts, ensuring that funds are disbursed to legitimate accounts.

• Digital Wallets: Digital wallet providers can use this method to verify users' linked bank accounts, adding an extra layer of security to the wallet's transactions.

• Subscription Services: Subscription-based businesses, such as streaming platforms or software-as-a-service (SaaS) providers, can use Reverse Penny Drop Verification to verify billing information and reduce payment disputes.

• Financial Institutions: Banks and credit unions can use this method to verify external bank accounts when customers link multiple accounts for transfers or bill payments.

• Cryptocurrency Exchanges: Cryptocurrency exchanges can use Reverse Penny Drop Verification to verify users' bank accounts before allowing them to deposit or withdraw fiat currencies.

• Insurance Companies: Insurance providers can use this method to verify policyholders' bank accounts for premium payments and claims disbursements.

• Online Gaming and Gambling: Platforms that involve real-money transactions, such as online casinos and sports betting sites, can use this verification method to ensure players' financial information is accurate.

• Government Agencies: Government agencies offering online services, such as tax refunds or benefit disbursements, can use Reverse Penny Drop Verification to verify recipients' bank accounts.

• Digital Payment Services: Mobile payment apps and digital payment service providers can use this method to verify users' linked bank accounts for seamless fund transfers.

Ultimately, any business that relies on the accuracy and security of bank account information can benefit from using Reverse Penny Drop Verification to enhance trust, reduce fraud, and streamline their operations. It's a versatile solution that can be adapted to various industries and use cases.

7322 : DEBT COLLECTION AGENCIES : Merchants engaged in collecting debts in default owed to others

6012 : FINANCIAL INSTITUTIONS - MERCHANDISE & SERVICES : Merchant with financial products, or services, loan and financial counselling service.

6211 : SECURITY BROKERS/DEALERS : Merchants that buy, sell, and broker securities, stocks, bonds, commodities, and mutual funds.

In brief BFSI merchant base

Have more questions?

Visit our support pageVerification Suite

Explore our comprehensive verification suite for user and business identity verification.

Learn MorePayouts

Easiest way to make payouts to any bank account, UPI ID, card, AmazonPay, Paytm or other native wallet 24*7 instantly even on a bank holiday.

Learn MoreSubscriptions

Accept recurring payments by auto-debiting customer’ accounts via standing instructions on cards or UPI e mandate.

Learn MoreReady to get started?

Collect customer payments, make payouts, manage international payments and so much more. Create your account or contact our experts to explore custom solutions.

Easy onboarding

Dedicated account manager

API access