Now available on Google Play Store

Download Cashfree merchant mobile app and access your payment gateway account from anywhere you go.

This Festive Season get Lifetime Free* flowWise AccessSign up now!

Accept online payments and grow your business. Delight customers with best success rates on mobile and UPI, and access payment gateway advanced features.

Grow your business

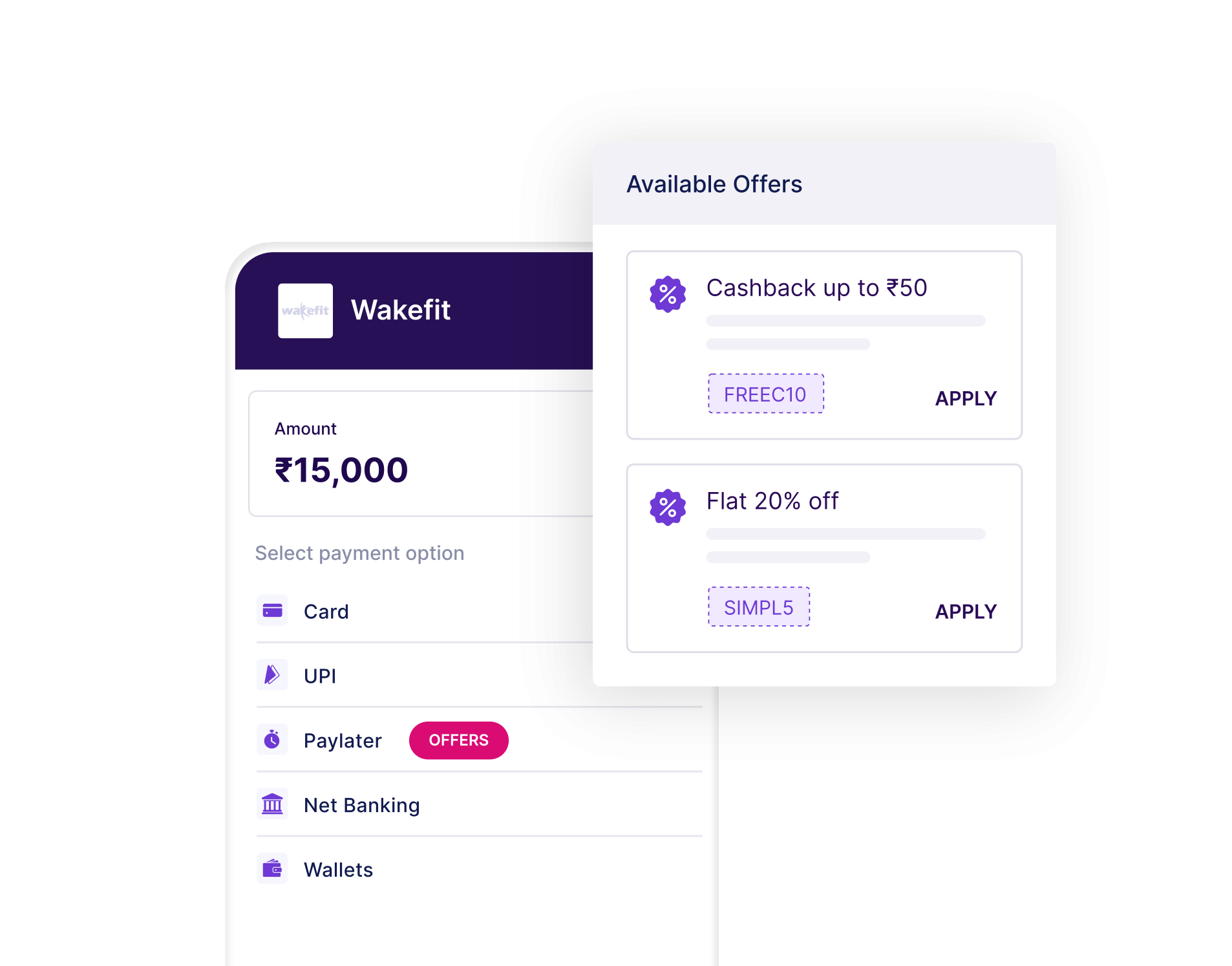

Let your customers pay via any card, 65+ netbanking options, UPI, Paytm & other wallets, EMI and Pay Later options.

Accept payments and get fast settlements even on bank holiday.

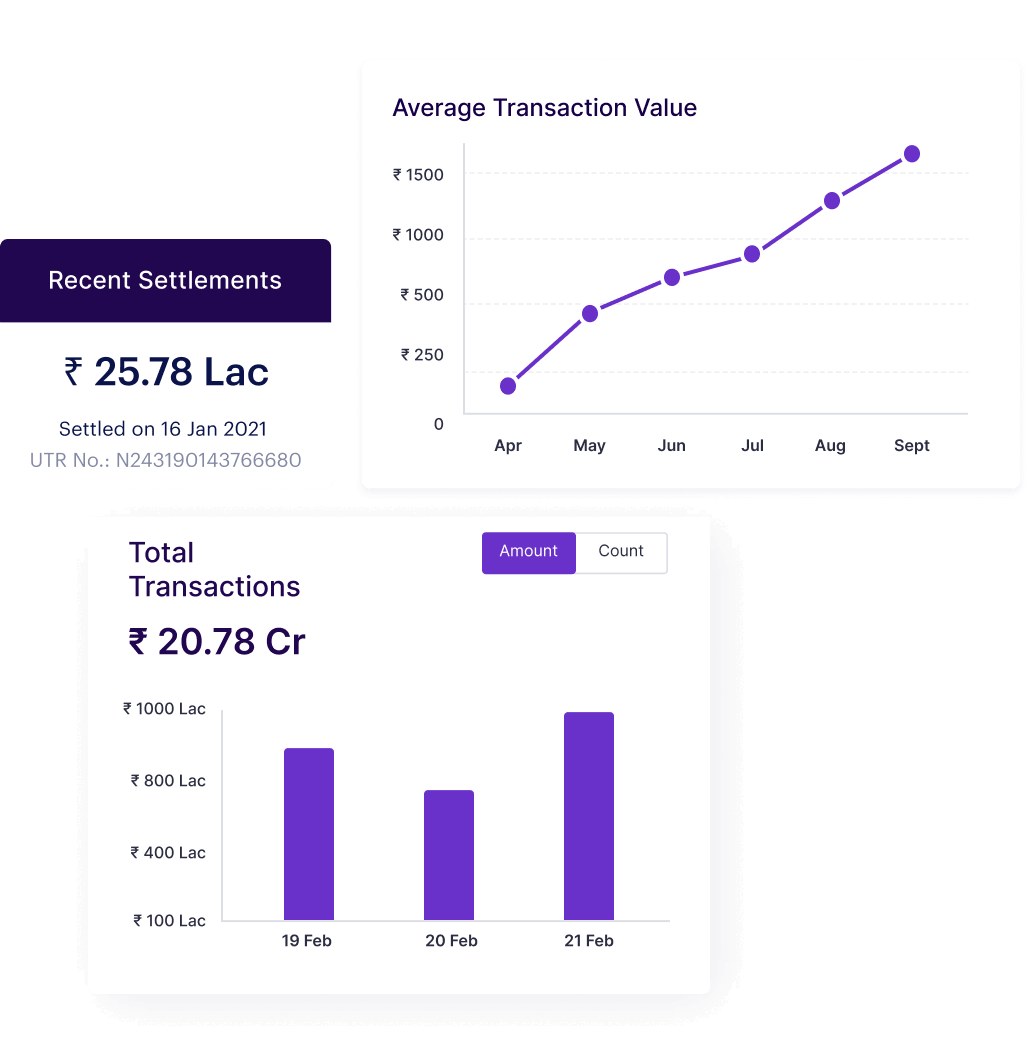

Instant Settlements

Access funds within 15 minutes of payment capture.

Reach customers across the globe by unlocking international payment options. Show items in 100+ foreign currencies. 2 days of settlements in INR.

PayPal Express Checkout

For enterprises

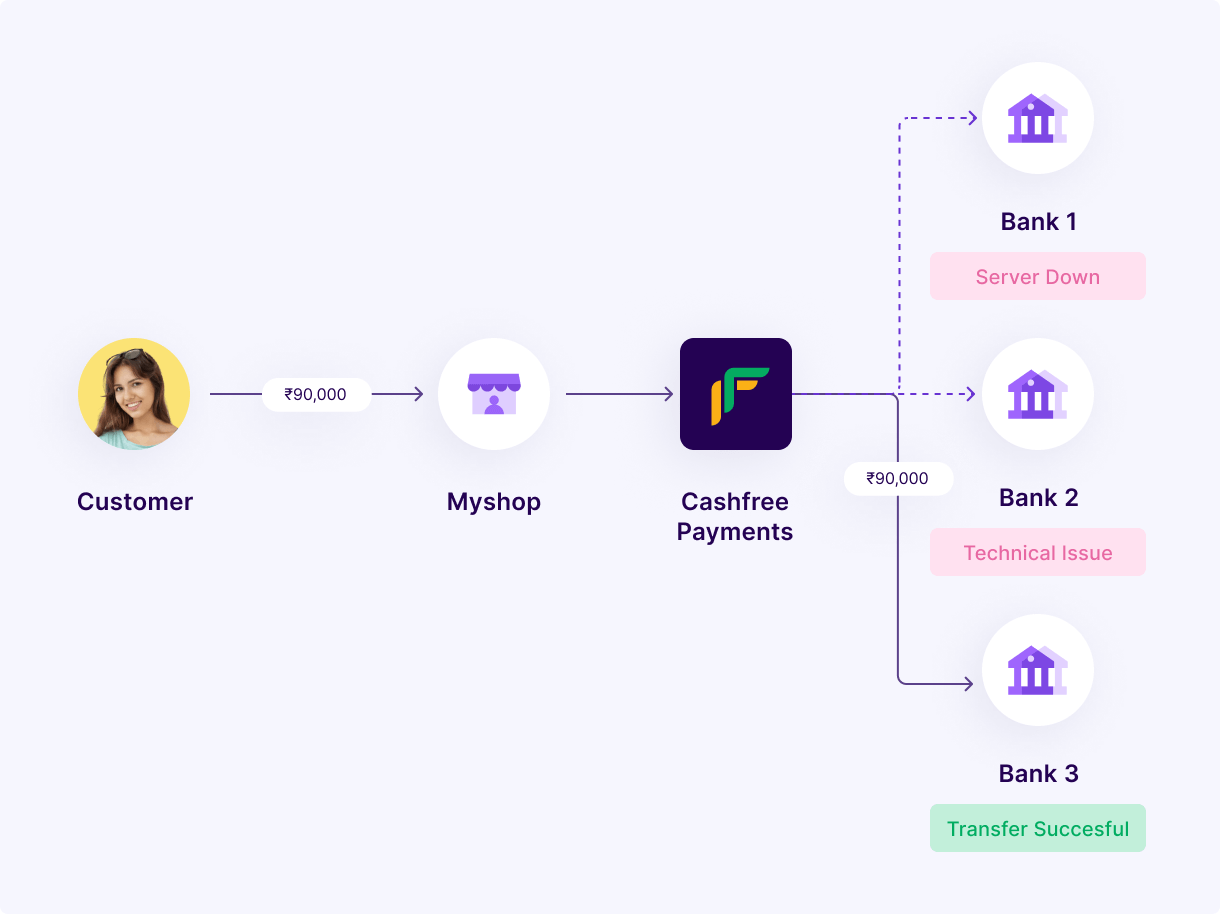

With direct integrations and smart 3 times auto-retry option, saved card option, smart routing among multiple banks and networks, and optimized integration flows for mobile and web, achieve higher success rates every time.

With dynamic routing across multiple acquiring banks and saved payment instrument details we optimize payment conversion rates by as much as 15%.

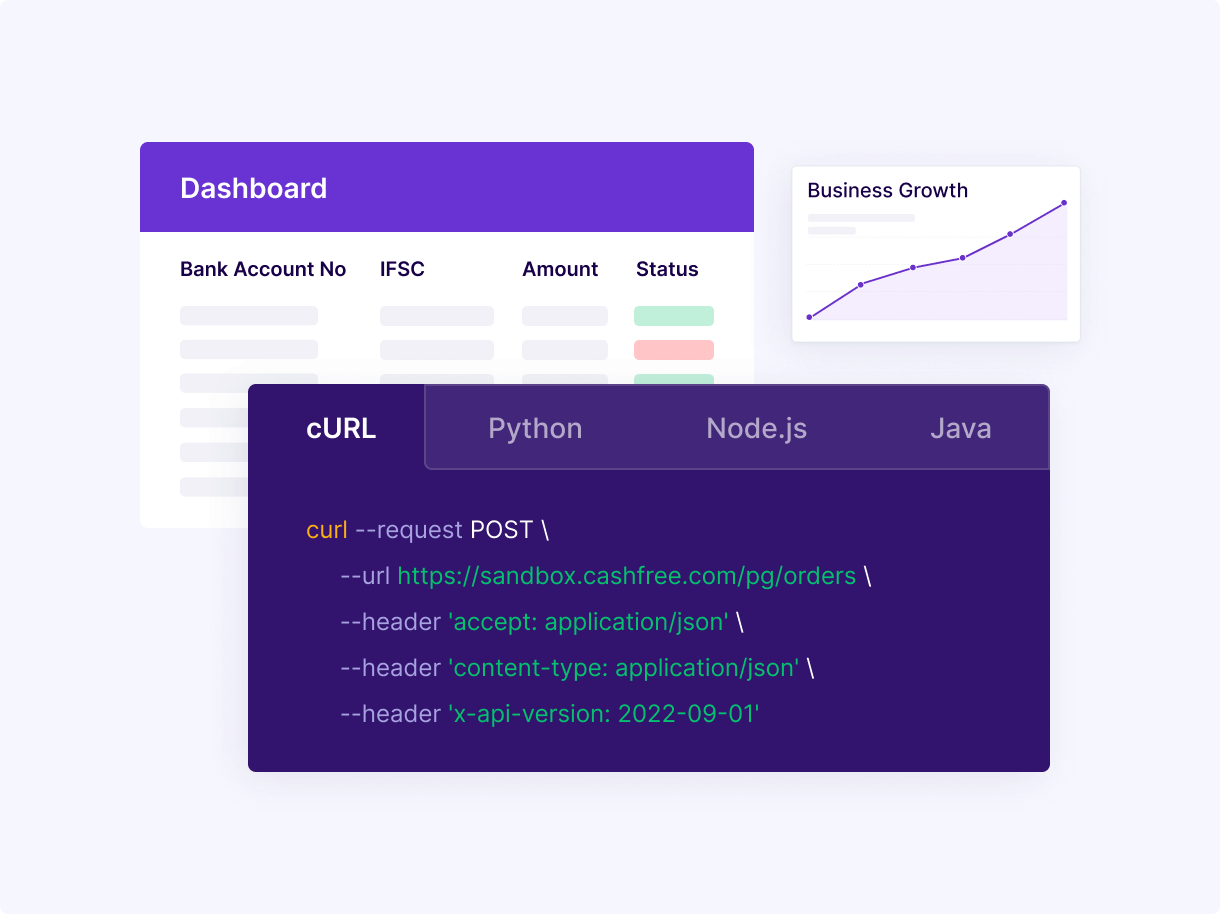

Powerful integrations

Optimized website and mobile integrations to give your customers the desired payment flow.

View Developer Documentation

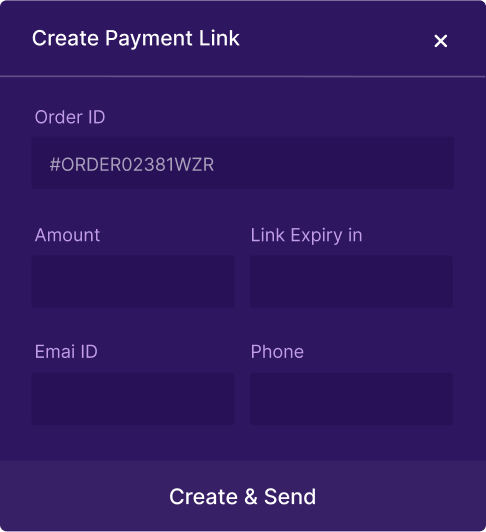

Use no-code payment links to collect payments over WhatsApp, SMS, Facebook, Twitter and other channels without writing any code.

In case of cart abandonment or failed transactions send payment links instantly to collect payments.

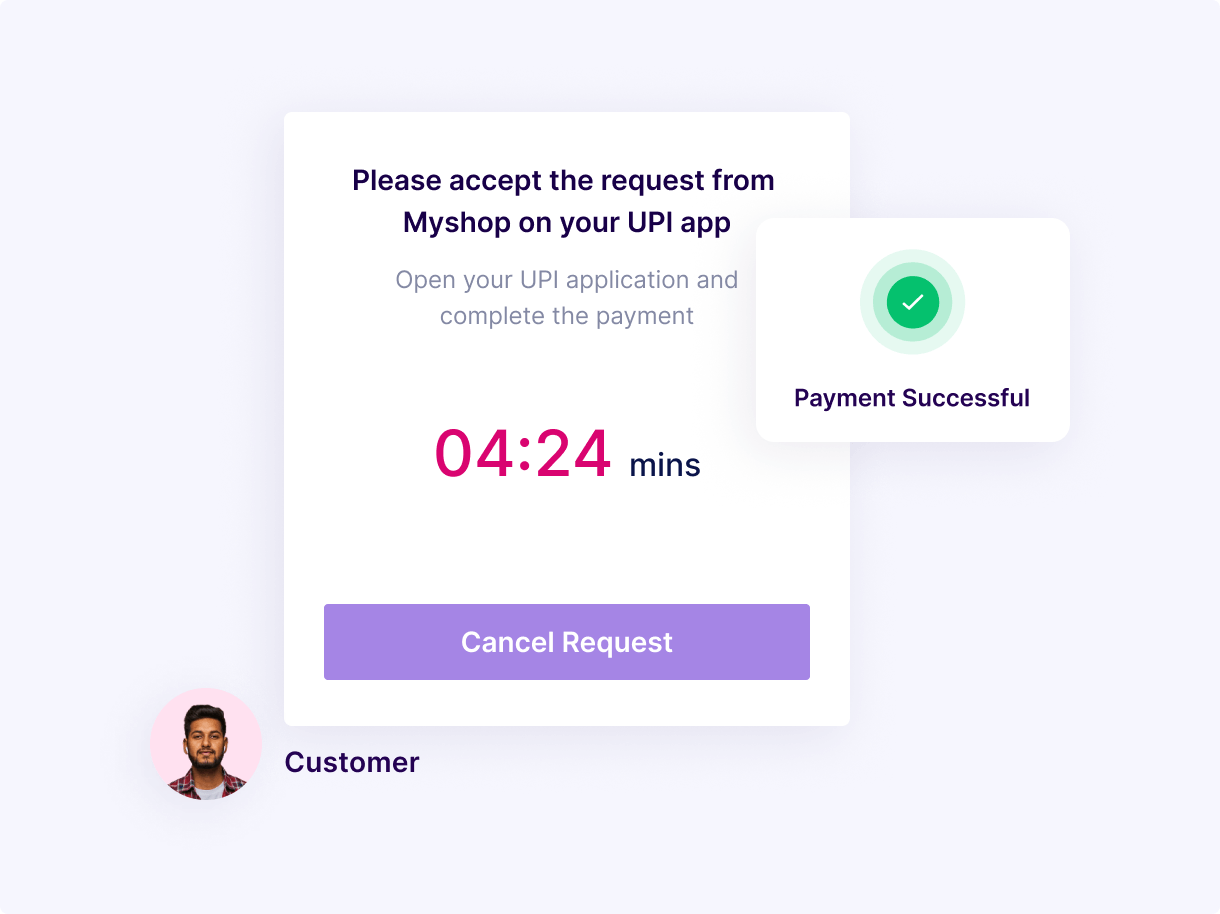

With Cashfree Payments, offer your customers the best UPI checkout experience, with the highest success rate.

“We saw that the UPI success percentages with other payment aggregators were a little low. With Cashfree’s Payment Gateway, we experienced a tremendous increase in our success rates in UPI. This has helped us increase our customer conversion ratio.”

Parasar Sarma , Vice President of Growth, Wakefit

PhonePe, Paytm, BHIM, GooglePay, all other UPI applications supported

Save UPI ID option for repeat customers

Auto-population of UPI ID based on mobile number and selected UPI app

Auto UPI ID validation at checkout

Generate QR code on your checkout page and let customers scan and pay using any UPI app.

Product features

Do instant customer refunds - online orders, COD orders and deposits with our advanced refund solutions and delight your customers.

Get access to your online payment gateway collections within 15 minutes even on bank holidays.

Temporarily block some amount of funds when a customer places an order and save payment gateway charges on canceled orders with Pre-auth.

Process saved card payments securely while being RBI compliant. Token Vault is India's first interoperable card tokenization solution that works across all card networks and payment gateways.

Use cases for various industries

Innovative businesses are using advanced payment gateway features to scale their business while delighting customers.

Lowest Pricing

Accept online payments in Indian Rupees (INR) and other 100+ foreign currencies with minimal integration effort and go live in no time.

No setup, maintenance or any other hidden fees

Pay only for actual transactions

Real-time transaction fees reporting

Paperless and same day onboarding

Faster settlements

Once your account is activated, you can monitor the status of all transactions and settlements. We also offer 15 minutes payment gateway settlements on request.

A payment gateway is a technology-driven digital platform which enables online businesses to collect digital payments from their end customers. When customers trigger a checkout on the website or application of an online business, their payment information is collected and passed through a payment gateway for authorization and processing.

Cashfree Payments supports the widest range of payment modes with a single integration. We support over 180+ payment modes such as Credit and Debit Card (Visa, Mastercard, Rupay, AMEX, Diners), Net Banking of more than 65 banks, Paytm and other wallets, UPI via BHIM UPI, Google Pay, PhonePe, EMI options, buy now paylater and so on.

Cards: All major card networks namely RuPay, VISA, MasterCard, Amex, DinersClub and Maestro.

Net Banking: Integrations with 90+ public and private banks in India.

UPI: 20+ UPI apps including PhonePe, Paytm, Google Pay, BHIM and Amazon Pay.

BNPL: 35+ Card and Cardless EMI providers and Pay Later partners Wallet: 9 Digital and Mobile Wallets including Paytm, Amazon Pay, Freecharge and MobiKwik For the complete list you can refer here:

https://docs.cashfree.com/docs/payment-methodsCashfree Payments supports a wide variety of integrations that enable different types of businesses leveraging different platforms to accept payments seamlessly. We support easy web and mobile integrations via RESTful APIs and mobile SDKs (Android, iOS, React Native, Flutter, Cordova, Xamarin, and Capacitor).

We also support integrations on businesses leveraging website platforms and partners via plugins such as Shopify, WooCommerce, Magento, PrestaShop, WHMCS, CS Cart, OpenCart, Wordpress, Zoho Books, and Wix.

Cashfree Payments, as an online payment gateway, offers a wide range of web integrations. You can choose easy-to-integrate Cashfree Payments hosted checkout form or go for customised checkout experience integrations like Seamless Basic or Seamless Pro as per your business need. You can integrate our Payment Gateway for website in any of the languages - PHP, Laravel, Java, Python or C++. Check our quick and easy quiz to determine which kind of integration is best for you herehttps://docs.cashfree.com/docs/discover

Cashfree Payments is the right payment gateway for businesses looking to take their brand global and collect payments from domestic and international customers. We support accepting payments from international customers via their credit and debit cards (Visa, Mastercard, American Express, Diner’s Club), or via PayPal. We are also working to add additional alternate payment methods so that your global customers can see payment modes that are local and familiar to them. Our checkout flow will also ensure that your international customers can see the prices of your products and services in the currency of their country, making the experience easier and better for them.

Our charges for payments processing are simple and user-friendly - 1.95% for all card, UPI, netbanking, and digital wallet transactions. For some payment modes (EMIs, Pay Later, and international cards), the charges differ. You can review the pricing for our payments services on our Pricing Page.

Yes, you can sign up as an individual for a payment gateway. Please share your personal address proof instead of the business registration details. Here is the list of documents required for setting up your Cashfree PG account -

https://www.cashfree.com/help/63/what-the-documents-needed-for-activating-cashfree-account

Cashfree Payments offers best-in-class payment gateway services with industry-highest success rates, a wide variety of payment modes, India's leading BNPL suite, and a cutting-edge checkout solution which makes accepting payments more rewarding for our customer businesses.

In addition to its industry-leading payments processing, Cashfree Payments offers many value-added services designed to help your business harness its potential better. With Instant Settlements, we enable businesses like yours to take complete control of your revenues and unlocks more working capital - get your payments in your account 15 minutes after you receive a customer payments, at the end of the day, or on-demand. Instant refunds allows you to issue refunds to your customers in <1 minute, versus the usual 4-6 working days wait.

Upfront TDR allows businesses like yours to push payment gateway charges to your customers and is useful for some lines of businesses.

We have payment gateway integration in PHP, Java, Python, NodeJS, Ruby and.Net.

With our ready-to-use integration kits, you will be able to integrate the best payment gateway in no time. Throughout your integration process our product experts will be available for any assistance you may need.

Yes, You can use our library to integrate our Payment Gateway directly into your Android or iOS app using Cashfree Payments SDK. Cashfree Payments SDK has been designed to offload the complexity of handling and integrating payments in your app.

Know more here: https://docs.cashfree.com/docs/mobile-integration

We do 100% paperless onboarding for merchants on our Payment Gateway. Following are the steps for integration

1. Signup on Cashfree Payments

2. Update your business profile and upload scanned copies of business documents

3. You can try out the payment gateway yourself. Login and switch to test account. Check integration documentation.

4. Our Payment expert will call you; share your business requirements and we will help you pick the right set of features.

5. Once the account is verified, our product team will help you with the integration.

Once you sign-up, to activate your payment gateway merchant account, you need to share business details along with scanned copies of the following business documents. Please refer to the list of documents here.

It depends on the type of integration you choose. Plugin-based integrations usually take less than 10 minutes to activate once the account has been set up and requires no coding or development effort. For API-based integrations, some development effort is required. An average business integrating with our APIs takes anywhere from 10-20 days.

On the Cashfree Payments dashboard, click on Settings -> Payment Gateway -> Payment methods to see which methods have been enabled for your account and which ones are still available. You can raise a request from that page to activate or deactivate a payment mode, as is required.

As a payments company we strive to cater to all businesses. However, there are some services and goods, for which we don't provide our payment gateway services.

Here is the list of restricted businesses.

Cashfree Payments supports NRO accounts of non-resident Indians, for individuals and organisations. We do not support NRE accounts.

1. Over 150+ payment modes with both domestic and international payment options.

2. India's widest BNPL suite with 35+ card and cardless EMIs and Pay Later options.

3. Industry highest success rates on transactions achieved through dynamic routing, direct bank integrations and payment retries.

4. Robust UPI payments stack with 8+ direct bank integrations that guarantees faster payments with higher success rates.

5. The most advanced card payments system with Tokenization, CVV-free payments and 3DS 2.0.

6. Innovative solutions like BNPL and Offers Widget, Instant Settlements and Easy Split to cater to fast growing business payment needs.

7. Highly reliable customer support available 24*7 to quickly resolve your queries.

Businesses usually get their revenue deposited in their designated bank accounts in T+2* working days. What this means is that for a transaction processed on Monday, the settlement amount will reflect in your account on Thursday. However, if you would prefer to receive your payments early, you can explore our Instant Settlements product to control your settlement flow. Get your revenues settled into your account in 15 minutes after receiving the payment, at the end of the working day, or on-demand on the click of a button. To know more, check out our Instant Settlements product.https://www.cashfree.com/instant-settlements/

PCI-DSS is a globally recognised security standard and protocol, and businesses with a PCI-DSS certificate have the ability to securely store card information. Cashfree Payments has a PCI-DSS Level 1 certification, which recognizes that our technology meets the highest level of safety and security in managing protected payment information. You need a PCI-DSS certificate to accept card payments only when you are operating your own checkout and using Payment 's hosted checkout options, our PCI-DSS certificate will cover you and you will not need the certificate to accept payments via credit and debit cards.

Yes. We've our own RBI compliant card tokenization solution called Token Vault. Token Vault is India's first interoperable card tokenization solution that helps you process your customer's saved card payments across mutliple card networks and payment gateways. Know more about Token Vault. https://www.cashfree.com/card-tokenization/ .

Yes. To help merchants like you delight their customers with instant refund processing on their orders, we do provide the most advanced Instant Refunds offering. Learn more about it here: https://www.cashfree.com/instant-refunds/

We also support stand refunds that take 4-5 working days to reach your customer's account.

Cashfree Payment Gateway offers industry-leading success rates across payment modes. We're able to deliver higher success rates than other payment gateway providers through direct bank integration, dynamic routing with AI/ML modelling, auto retry, CVV-less payment flow and Flash UPI offering.

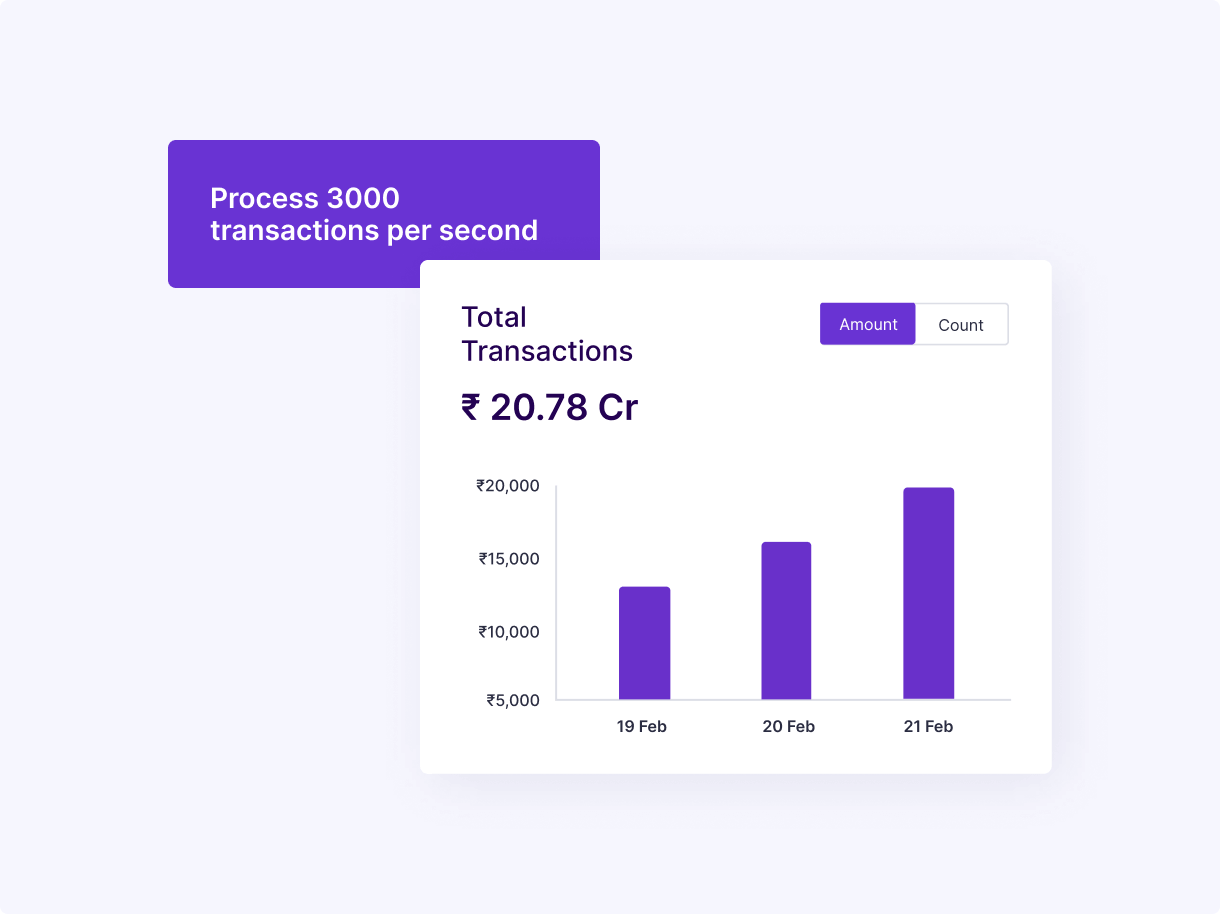

Cashfree Payment Gateway has industry-leading infrastructure that supports a very high rate of transactions per second. We are proud to partner with some of India's biggest businesses, and are able to support them seamlessly without hitting our transaction limit. For example, we were able to support a huge spike in payments during shopping festivals and occasions, which is 5x-8x higher than the usual traffic without any additional effort.

No, you do not need a website or app to accept payments. Cashfree Payments has two no-code solutions for entities that want to accept payments without a website or application - Payment Links and Payment Forms.

Thank you for considering us as your payments partner! You can reach out to us here to set up a call with our sales representatives.

https://www.cashfree.com/contact-sales/

We're sorry to hear that you're having some trouble. Please reach out to us here to get support. You can also raise a ticket from your Cashfree Payments dashboard via the Help Center or by dropping an email to your account manager or care@cashfree.com

Cashfree Payments is highly secure, with PCI-DSS, ISO/IEC 27001:2013 certifications and an in-house card tokenization solution, to always safeguard your payments. We have also received in-principle approval as a payment aggregator from the RBI, and have recently upgraded our systems to be compliant with the latest security protocols, including 3DS 2.0.

Yes, we have a mobile application for our partner businesses to access their dashboard and manage their payments via their smartphones. You can access our mobile application here..

Yes, we support multi-user logins via account aliases. Once your Cashfree Payments account has been set up, you can enable access for other members of your team by providing them access to your account. You can find out more here..

No-code payment links to collect payments over WhatsApp, SMS, Facebook, Twitter and other channels

Learn moreAccept recurring payments by auto-debiting customers’ accounts via standing instructions on card, e-mandate via net banking option or UPI AutoPay.

Learn moreCollect and reconcile IMPS/NEFT/UPI payments using unique virtual accounts and UPI IDs.

Learn more* Settlement cycle is subject to bank approval and can vary based on transaction type, business category/model, risk parameters and other factors.

Collect customer payments, make payouts, manage international payments and so much more. Create your account or contact our experts to explore custom solutions.

Easy onboarding

Dedicated account manager

API access