Cashfree Payments receives RBI's PA-CB license, enabling comprehensive cross-border payment solutions.Learn more

UPI QR Code

Generate Unique UPI QR Code

for all your BranchesGenerate unique printable QR codes for each branch or franchisee, collect UPI payments via any UPI app and match all payments with your business entity.

cost

settlements

with multiple parties

What is a UPI QR Code?

A UPI QR code (Quick Response Code) is a machine-scannable code generated using NPCI's UPI infrastructure used for storing merchant's bank information. Users can scan code using any UPI app to make a payment.

UPI QR Code for businesses

-

Generate QR codes

in seconds - Print and display anywhere

- Pay zero transaction cost

- Stay compliant with government regulations

USERS

Who can use UPI QR Code?

Businesses with franchise model or having multiple branches or departments can generate unique UPI QR codes for each unit to collect UPI payments and match payments with individual units.

Multi - chain businesses like restaurants, travel agencies, jewelery showrooms, theaters, retail stores, pharmacies etc.

Multi - department institutions like hospitals, schools, universities and service centers like auto-mobile centers etc.

Benefits

Built for growing businesses

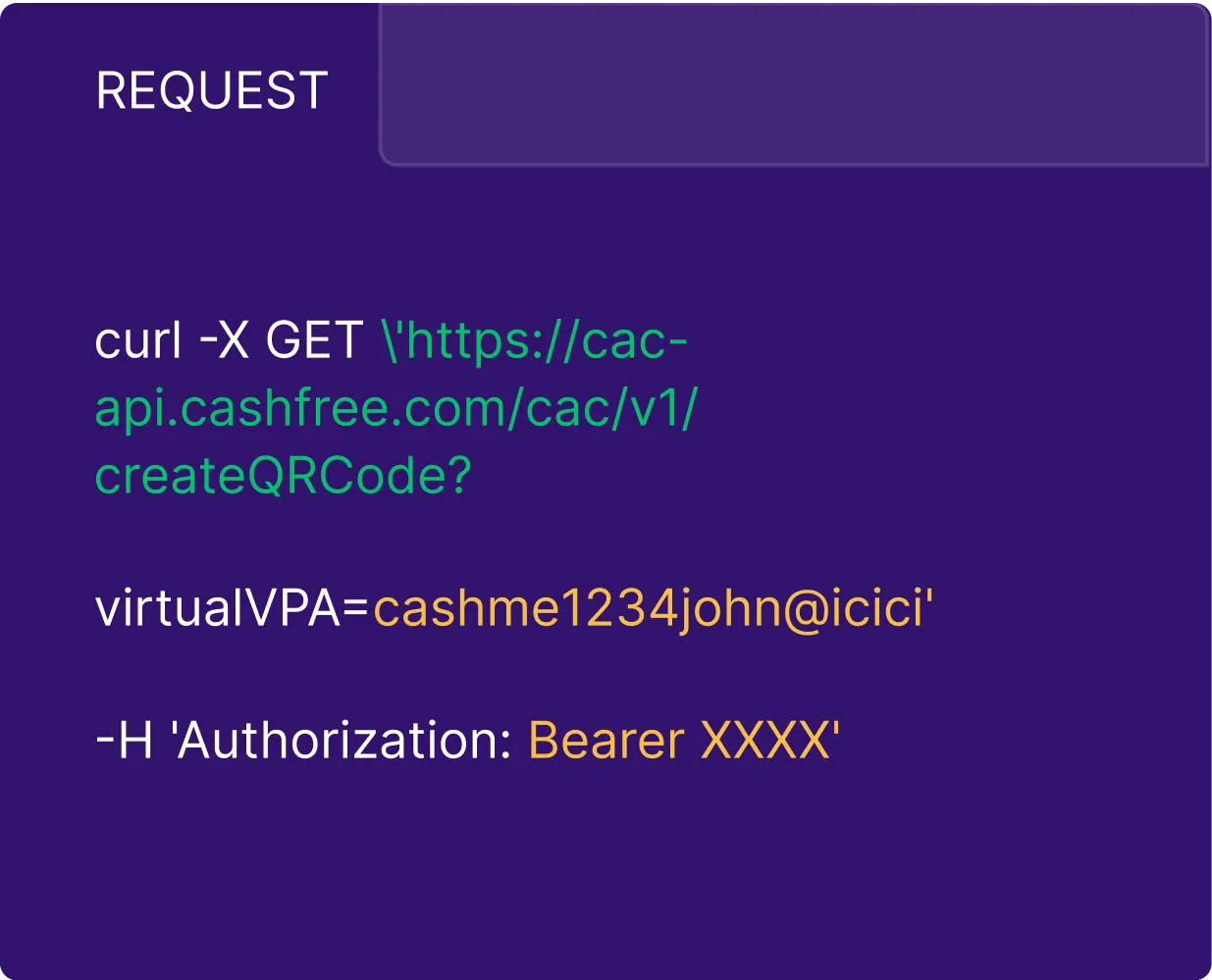

Use Powerful APIs

- Generate any number of unique UPI QR Codes in seconds

- Get notified on successful payment via webhook notifications instantly

- You can also generate custom reports for each UPI VPA ( branch / department / franchisee) using API calls

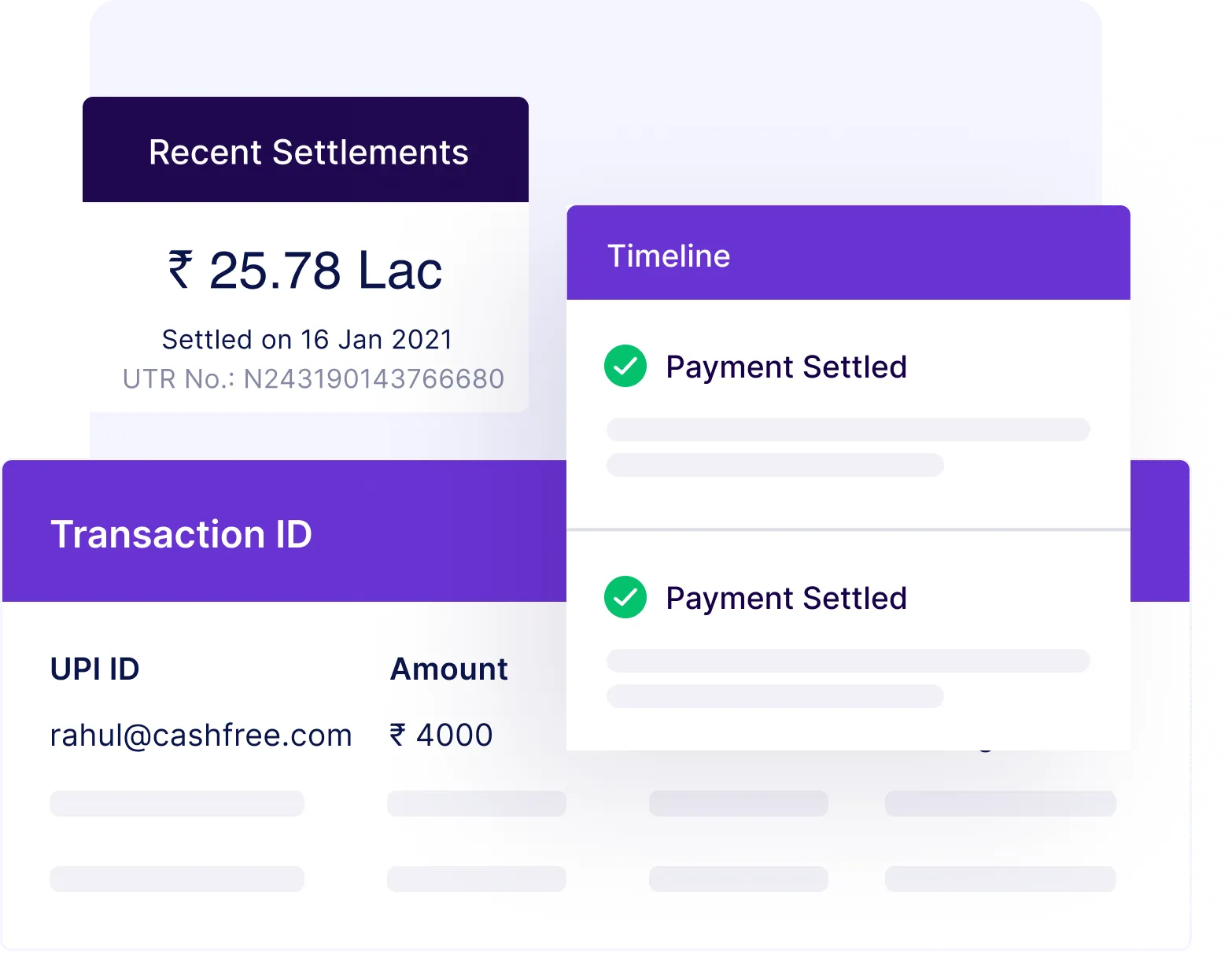

Centralised control with Dashboard

Stay on top of your daily, weekly and monthly sales of each business unit with easy to read graphs and downloadable reports

- Dive deep into history of each transaction - business unit's UPI ID, transaction ID, date, amount and payment status

- Stay on top of your daily, weekly and monthly sales with easy to read graphs and downloadable custom reports

- Track payment settlements in real-time

- Define split percentage for share between branch / franchisee / department and headquarter and make payouts

Have more questions?

Visit our support pageA UPI QR code (Quick Response Code) is a machine-scannable code generated using NPCI's UPI infrastructure used for storing merchant's bank information. Users can scan code using any UPI app to make a payment. It is a touch free way to collect payments.

Static QR code is an open QR. It can accept multiple payments and does not have any fixed amount assigned. The customer needs to enter the amount during payment. The Static QR Code can accept any amount. Cashfree Payments UPI QR Codes are static printable QR codes.

In the case of dynamic QR codes, for each transaction a unique QR code is generated with pre-defined payment amount. When the customer scans the UPI QR Code, the amount gets auto-filled. It is generated for a specific amount and expires once the payment has been made or if payment is not made within predefined time period. If you want to create dynamic QR code for each order you can use Desktop QR Code checkout using Cashfree Payment Gateway .

- Signup on Cashfree Payments

- Upload documents to activate Auto Collect account

- Generate multiple UPI VPAs using Dashboard or API, once VPAs are created, generate UPI QR code via API

- Download from Dashboard and print UPI QR code and collect payment

Businesses having an offline presence with multiple branches or franchisees that collect in-store or in-person collections use UPI QR codes.

Have more questions?

Visit our support pageAuto Collect

Accept payments directly in your bank account via UPI, NEFT, IMPS and RTGS. Match each payment to a customer or an order and reconcile automatically.

Learn MoresoftPOS

Generate UPI QR code on the phone, or let customers Tap & Pay using a card. Create Payment links, share over WhatsApp or SMS, and get paid instantly.

Learn MorePayouts

Send money to any bank account, UPI ID, card or wallet. Pay vendors, do customer refunds, disburse loans, etc instantly 24x7, even on a bank holiday.

Learn MoreReady to get started?

Collect customer payments, make payouts, manage international payments and so much more. Create your account or contact our experts to explore custom solutions.

Easy onboarding

Dedicated account manager

API access