This Festive Season get Lifetime Free* flowWise AccessSign up now!

UPI AUTOPAY

Collect recurring payments

at scale easily withUPI AutoPay

Automaterecurring transactions

up to ₹15,000 for your customers via any UPI app. Leverage 400 Million+ UPI users to grow revenue for your business.20+ UPI apps supported

35% higher success rate

10 seconds checkout

View detailed documentation here

UPI is the most preferred payment mode in India. In August, 2023, Indians did record high 1024 crore UPI transactions.

accept recurring payments

like loan repayments, tuition or course fees, rentals, etc.Supported Apps:

automatically collect payments

under the mandated amount limitUPI AutoPay

, which offers a 35% higher success rate compared to otherrecurring payment

methods

Security ensured, stay RBI compliant

At Cashfree Payments we ensure that all the UPI authentications initiated and auto-debits processed are as per latest government guidelines.

UPI AutoPay

NBFCs and Digital lending apps

Collect loan repayments easily. Set auto-reminders for customers and borrowers with non-revocable flags so that they don't default on their dues

Edtech

Create customized course plans, increase learner enrolments, and help your team make the best of the courses you offer

Educational institutions

Give your students the flexibility to pay tuition or course fees tri-mester/ half-yearly

Financial Services

Enable your customers to make SIP payments in time or auto-recharge their trading account once the amount goes below a set limit

Rental platforms

Increase customer retention and grow average user value by offering custom subscription plans that meet customer requirements and reduce user acquisition cost

OTT platforms

Create a customized subscription plan for your subscribers and provide them with uninterrupted services

Content subscription and publishing

Launch your media subscription business and offer different renewal cycles to attract maximum recurring revenue

Bill Payments

Allow your customers to opt for auto debit and collect all your recurring bill payments using UPI AutoPay

AutoPay

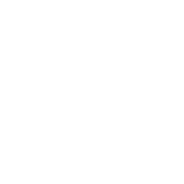

Create and update up to 10,000 subscriptions in one go directly from the dashboard and sell bulk subscriptions effortlessly

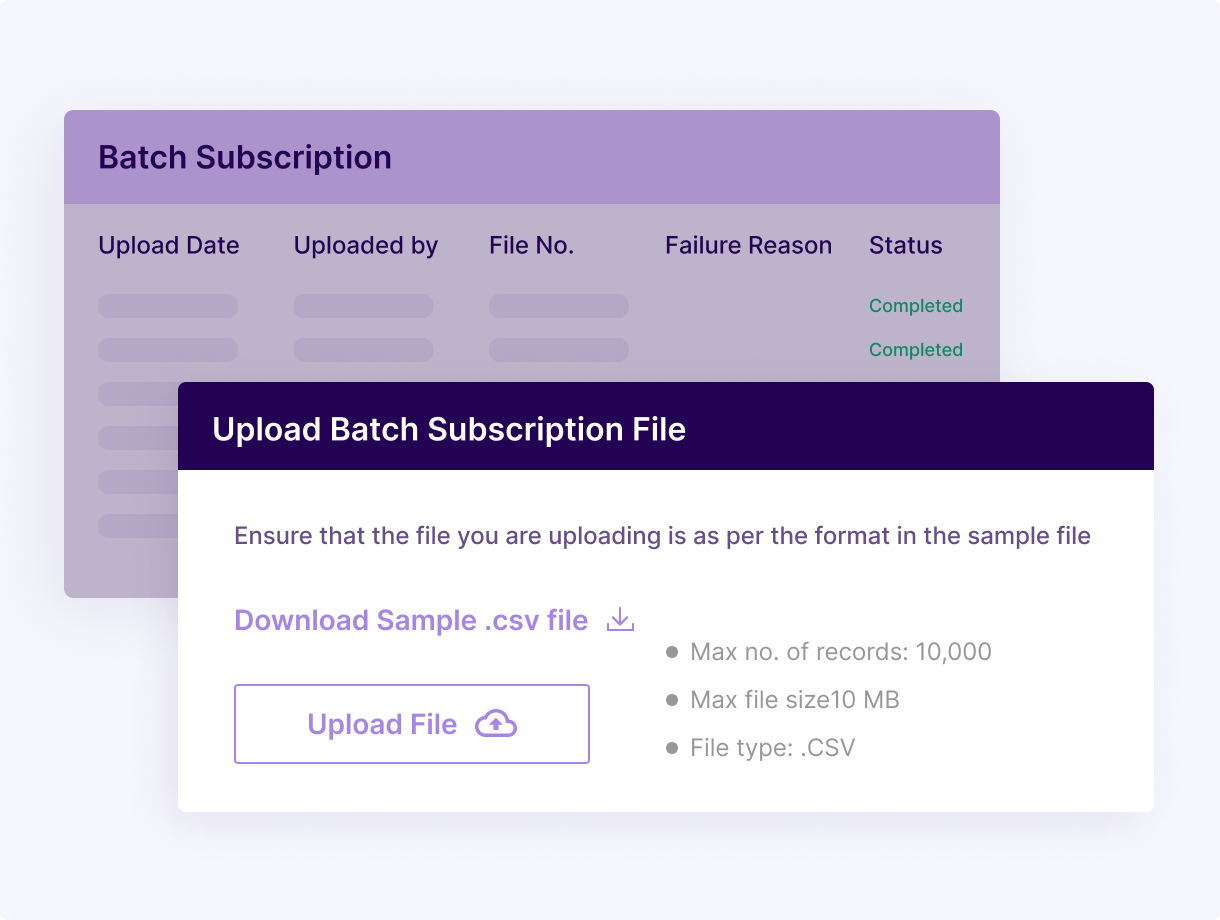

Customize checkout experience of your customers with the trust of Cashfree's UPI AutoPay in the backend using seamless APIs

Schedule charges 14 days prior to the actual auto-debit date - for on-demand subscriptions

Authorize UPI mandates only on KYC-approved bank accounts to avoid payment failures, especially in the case of EMI collection

We are now live with

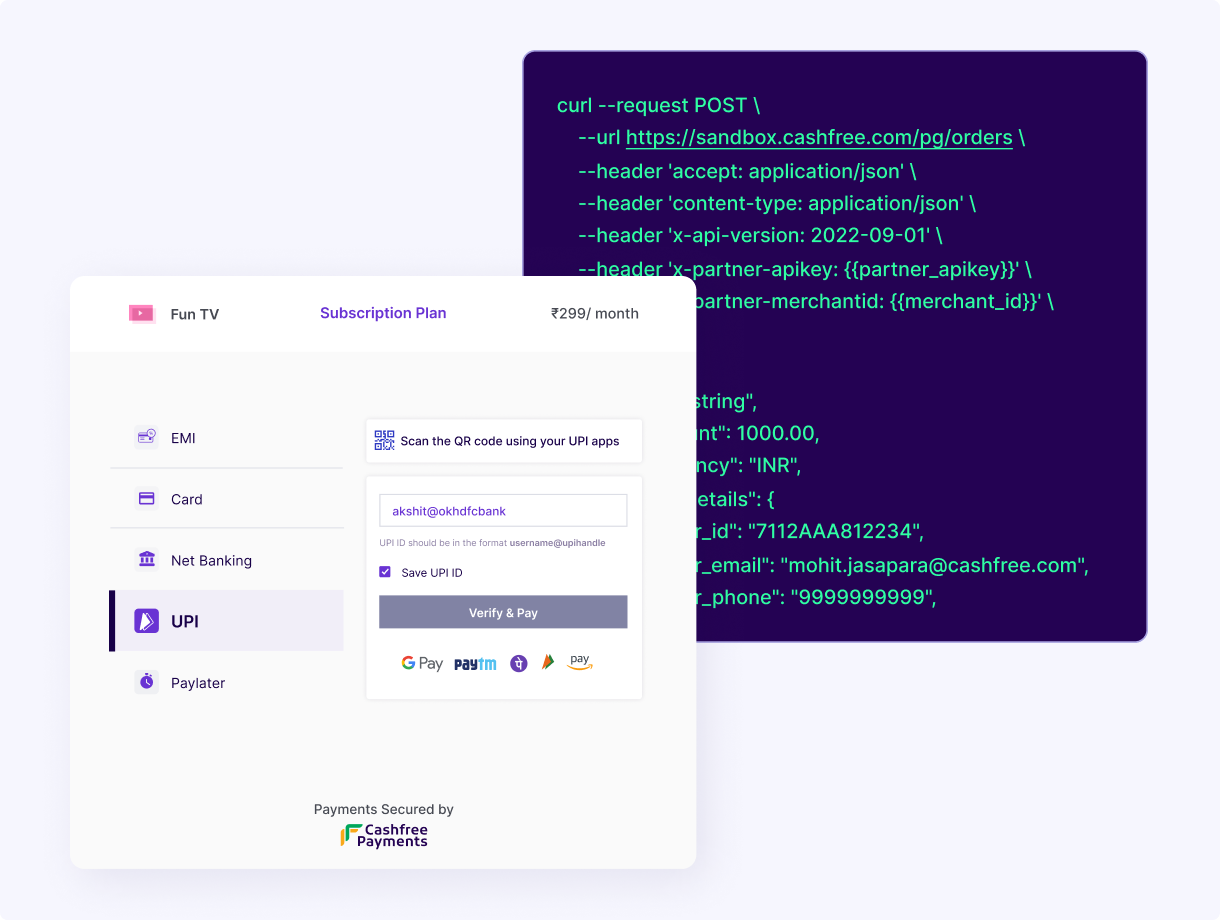

Autopay on QR

Convert and retain from your advertising spends like never before:

Acquire customers easily with a one-step QR scan - no app downloads or redirections

Connected call-to-action for high ROI

Clear attribution to your campaigns to help you make the most of your ad spends

Take the growth of your subscriptions business to the next level.

pricing

Convert one-time customers into paying subscribers with UPIAutoPay

Paperless and same day onboarding

Comprehensive Dashboard

Developer friendly integration kits

E-commerce Plugins

Best in class support

Easy Settlement

For questions around implementation, customised pricing and more, reach out to us here .

AutoPay

E-Mandate or Nach Mandate

Customer can activate one-time e-Mandate by entering debit card or net banking account details and authorize auto-debit up to ₹50 lakh across 50+ banks in India.

Physical Mandate

Auto-debit is possible to configure for customers who do not have access to net banking or a debit card through one-time physical signature approval.

SI on cards

Customers can enter credit or debit card details, give standing instruction (SI) for future automated payments. Businesses can collect recurring payments of up to ₹15,000/- without 2FA / OTPs.

Have more questions?

Visit our support pageTo create a plan, refer to these steps.

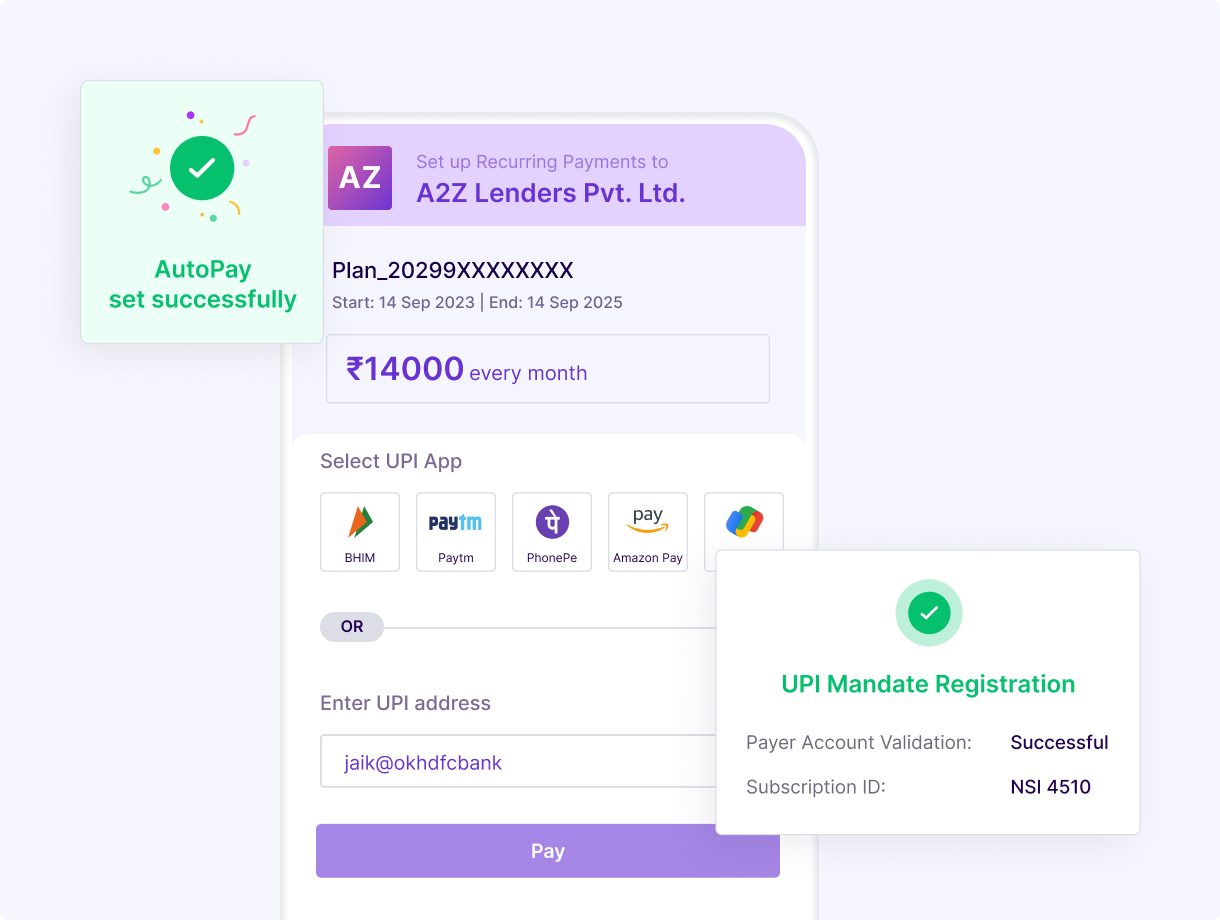

Once you have created a subscription plan and allow customers to subscribe to that plan, an authorization link is sent to your customer. Here is how a customer can create a UPI mandate and subscribe to your plan -

- Collect Flow

- The customer enters their VPA/UPI ID and clicks on Proceed

- A mandate summary is shown to your customer

- The customer opens their app and approves the mandate

- After the mandate is approved by the customer in their UPI App, a final success screen is displayed along with the Mandate summary

- Intent Flow

- The customer selects their UPI PSP app of choice

- Chosen UPI PSP app opens with a mandate summary

- Customer approves the mandate

- Customer is returned to the checkout where the Mandate summary is displayed

- QR Flow

- Customer scans the QR code shown on the checkout page via PSP app of choice

- A mandate summary is shown to your customer

- Customer approves the mandate

- After the mandate is approved by the customer in their UPI App, a final success screen is displayed along with the Mandate summary

Please find the list of supported UPI apps and banks here supported for UPI mandate creation via UPI AutoPay.

The maximum amount supported per transaction is ₹15,000/- without AFA and with a UPI pin authentication it can vary based on the bank accounts limits. However as per new circular issued by RBI on 14th December 2023, the following categories can accept recurring payments up to INR 1 lakh without AFA -

- Mutual fund subscriptions

- Insurance premiums

- Credit card bills

Yes, you can cancel the Subscription via Dashboard or API. Refer to our API docs for more information.

9 debit retries are automatically attempted, and within them 95% of all debits go through successfully. If the transaction still fails, it’s marked unsuccessful. The merchant receives a webhook with the reason for failure. They need to consult the customer before retrying to debit.

Reasons for persistent failure despite 9 debit retries is usually due to lack of funds or some other issue pertaining to the customer’s account.

Have more questions?

Visit our support pageAuto Collect

Collect and reconcile IMPS/NEFT/UPI payments using unique virtual accounts and UPI IDs.

Learn MoreReady to get started?

Collect customer payments, make payouts, manage international payments and so much more. Create your account or contact our experts to explore custom solutions.

Easy onboarding

Dedicated account manager

API access