Cashfree Payments receives RBI's PA-CB license, enabling comprehensive cross-border payment solutions.Learn more

Connected Banking

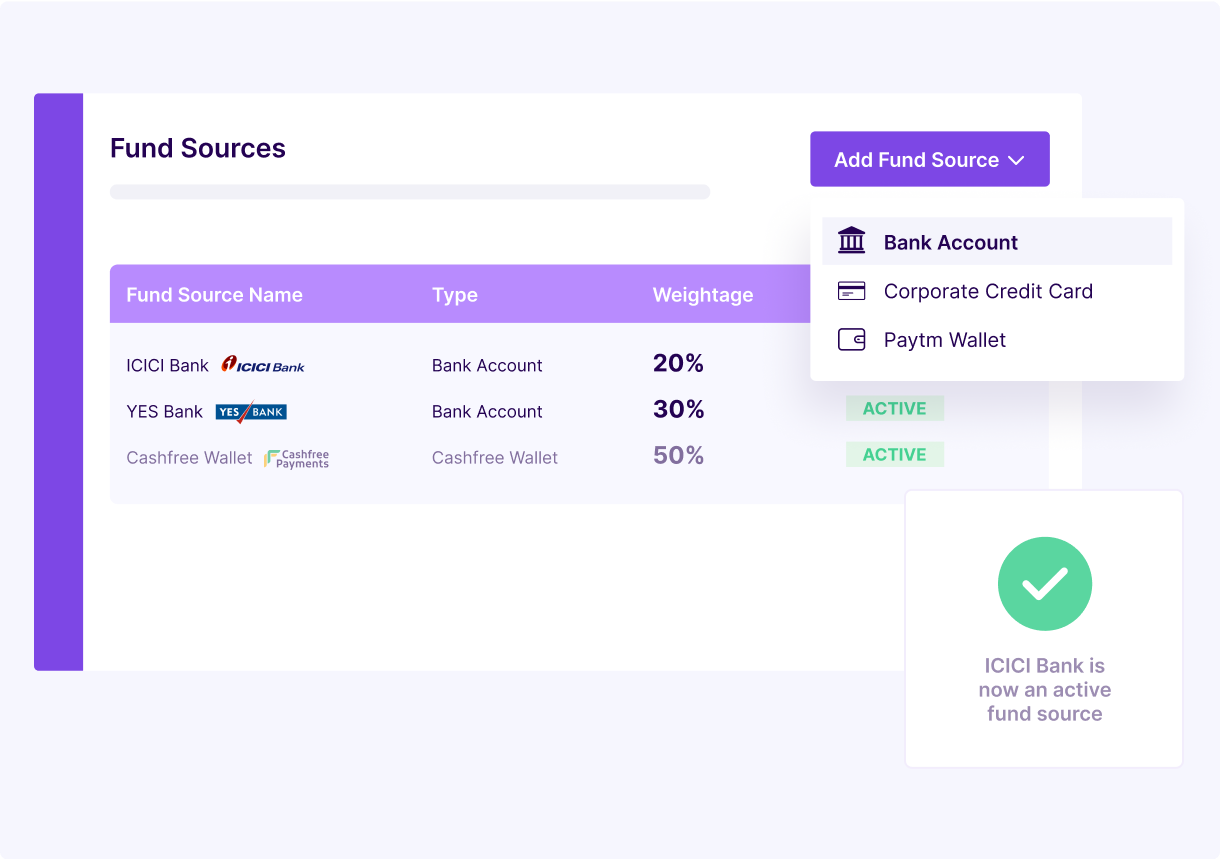

Addmultiple fund sources

and make payouts directlyFund sources

disbursing from any fund source

, easily plugged into Cashfree Payouts.What is a Fund Source?

A fund source is an account from which you can initiate payouts to your beneficiaries.

manage multiple Fund Sources

including multiple current accounts, Paytm wallet, corporate credit card [Mastercard and Visa], escrow account, or Cashfree wallet [Virtual Account]. Specify your choice of fund source before making payouts!

Drive a smarter and connected banking

experience for your business

connected banking

experience for your businessAdd your current bank accounts, and make payouts directly from your Cashfree Payouts Dashboard/API without having to login to your corporate portal.

Switch between connected bank accounts. Avoid any unforeseen exigencies of bank downtimes & reduce dependency on a single bank as a payout source.

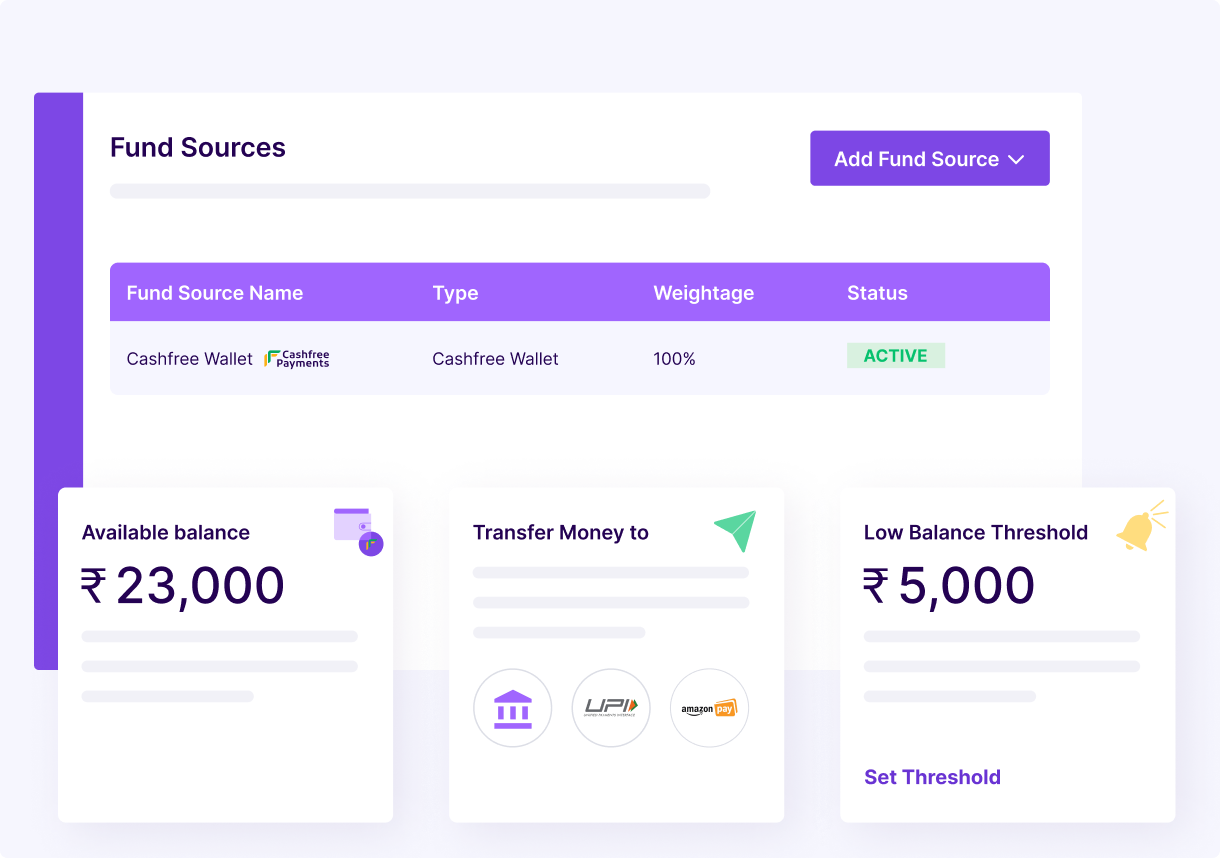

Ensure Quick Payouts using Cashfree Payments’s virtual wallet

A virtual account is created as soon as you activate your Payouts account. Add funds, make payouts, and check available balance in real time.

Send money to any bank accounts, UPI, & digital wallets [Amazon Pay].

Avoid any payment failures. Set a low balance alert and get notified if your balance drops below the threshold limit.

External Credit Line ![]()

Revolutionising

Payouts with Fund Sources

Payouts' Fund Sources

stack up against industry peers.| Capability | The Payouts Fund Sources Way | Others |

|---|---|---|

| Dedicated Wallet - Virtual Account | ||

| Direct payout from bank accounts | ||

| Ability to connect bank accounts via dashboard | ||

| Payout from Paytm Wallet | ||

| Ability to connect paytm wallet as a fund source via dashboard | ||

| Payout from corporate credit card | ||

| Ability to connect corporate credit card as a fund source via dashboard | ||

| Managing payout load between fund sources |

PRICING

STANDARD

Pay as you go - for startups

| Transaction Amount | Up to ₹1,000 | ₹1,000 to ₹25,000 | Above ₹25,000 |

|---|---|---|---|

| NEFT | ₹ 3.00 | ₹ 5.00 | ₹ 8.00 |

| RTGS | ₹ 4.00 | ₹ 6.00 | ₹ 10.00 |

| IMPS/UPI/ Amazon Pay | ₹ 6.00 | ₹ 8.00 | ₹ 15.00 |

| Pay to Phone/ Pay to Phone + CC | ₹ 7.00 | ₹ 9.00 | ₹ 18.00 |

| Transaction Amount | Up to ₹1,000 | ₹1,000 to ₹25,000 | Above ₹25,000 |

|---|---|---|---|

| NEFT | ₹ 0.21 | ₹ 0.35 | ₹ 0.50 |

| RTGS | ₹ 0.28 | ₹ 0.35 | ₹ 0.50 |

| IMPS/UPI/ Amazon Pay | ₹ 0.40 | ₹ 0.50 | ₹ 1.00 |

| Pay to Phone/ Pay to Phone + CC | ₹ 1.00 | ₹ 1.50 | ₹ 2.00 |

Visa

Mastercard

₹15.00

Up to ₹1,000 txn amount

₹20.00

Above ₹1,000 txn amount

Custom pricing designed for enterprises

Early access to new features

Dedicated account manager

Discounted pricing

Support over WhatsApp in addition to other channels

Get in touch with our sales team to explore the right product(s) for your payment needs and get custom pricing.

Have more questions?

Visit our support pageBusinesses using traditional corporate banking portals login to different banking portals for different payment needs. Cashfree Payments’s connected Payout APIs help businesses process all types of transactions using a single account like refund processing, vendor payouts etc.

Integrate only once with Cashfree Payments to get connected to all our banks – Yes, ICICI, Kotak, IndusInd, Axis & RBL!

Payouts Direct allows you to make instant and automated payments directly from your bank account. Cashfree’s Payouts Direct integrates directly with your bank account, eliminating the need to maintain funds in the Recharge account. The balance in your account is available to make the payments.

A fund source is any wallet/bank account or card from which you can initiate payouts to your beneficiaries. Cashfree Payments Payouts account now supports adding multiple fund sources, i.e., your bank accounts, corporate credit cards [Coming soon], Paytm wallet in addition to Cashfree Payments’ virtual account, to help you make payouts directly to your beneficiary accounts. This feature will allow you to add and manage multiple fund sources with just a few clicks from the dashboard.

To use Cashfree Wallet for disbursals, you must first add Cashfree Payments as a beneficiary in your registered bank account. You can add funds to Cashfree Wallet from your registered bank account only. You have the flexibility to add funds to any of the bank accounts displayed in the Recharge Account section.

ICICI Bank, Yes Bank, IndusInd Bank, Kotak are currently available to make payouts directly from your current account. Axis & RBL - coming soon. Write to care@cashfree.com if you want to make payments directly from other bank accounts.

By default, when you sign up for Payouts, Cashfree Payments creates a Wallet which is a virtual account, to help you initiate instant payouts.

To know the available balance in your Cashfree Wallet, go to Payouts Dashboard > Fund Sources > select Cashfree Wallet.

Transfers made using IMPS are instant, and the balance is immediately available in your Payouts Account. NEFT and RTGS are processed between 8 AM and 6:45 PM on all NEFT working days (Monday to Saturday, except 2nd and 4th Saturday). RTGS is not available for amounts less than ₹2 lakhs.

To use Cashfree Wallet for disbursals, you must first add Cashfree Payments as a beneficiary in your registered bank account. You can add funds to Cashfree Wallet from your registered bank account only. You have the flexibility to add funds to any of the bank accounts including ICICI Bank, Yes Bank, IndusInd Bank, Kotak. Axis & RBL - coming soon.

- Beneficiary should have completed the KYC validation for the Paytm payout to go through, or it fails.

- The maximum limit is up to ₹1 Lakh if the customer has completed the KYC registration.

- You only need the beneficiary phone number for making the payouts.

Payouts can be processed 24*7 even on bank holidays with all leading banks. For the rest, the transfer will get settled on the next working day. Here's a list of all payment modes that are supported by Payouts.

No. Multiple transactions can be routed to different Fund Sources. One transaction cannot be routed through multiple Fund Sources.

Have more questions?

Visit our support pagePayouts

Make payouts to any bank account / UPI ID / card/ AmazonPay / Paytm instantly even on a bank holiday.

Learn MoreVerification Suite

Verify and validate users before onboarding. Ensure successful fund transfer to beneficiaries.

Learn MoreCashgram

Payout links to send money without collecting receiver bank account details or UPI details.

Learn MoreGlobal Payouts

Send money to your sellers, service providers or freelancers in India directly to their local bank accounts.

Learn MoreReady to get started?

Collect customer payments, make payouts, manage international payments and so much more. Create your account or contact our experts to explore custom solutions.

Easy onboarding

Dedicated account manager

API access