Cashfree Payments receives RBI's PA-CB license, enabling comprehensive cross-border payment solutions.Learn more

Why Choose Cashfree Payments?

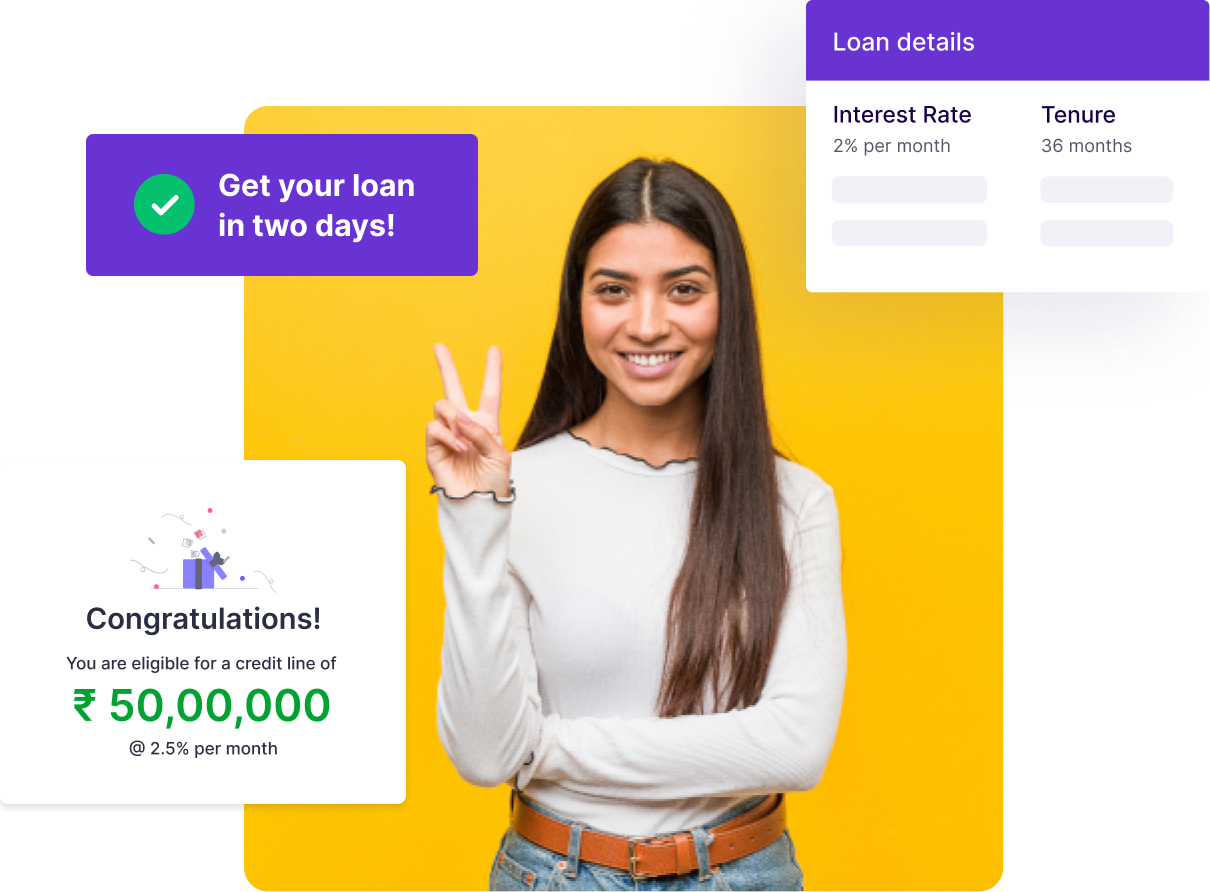

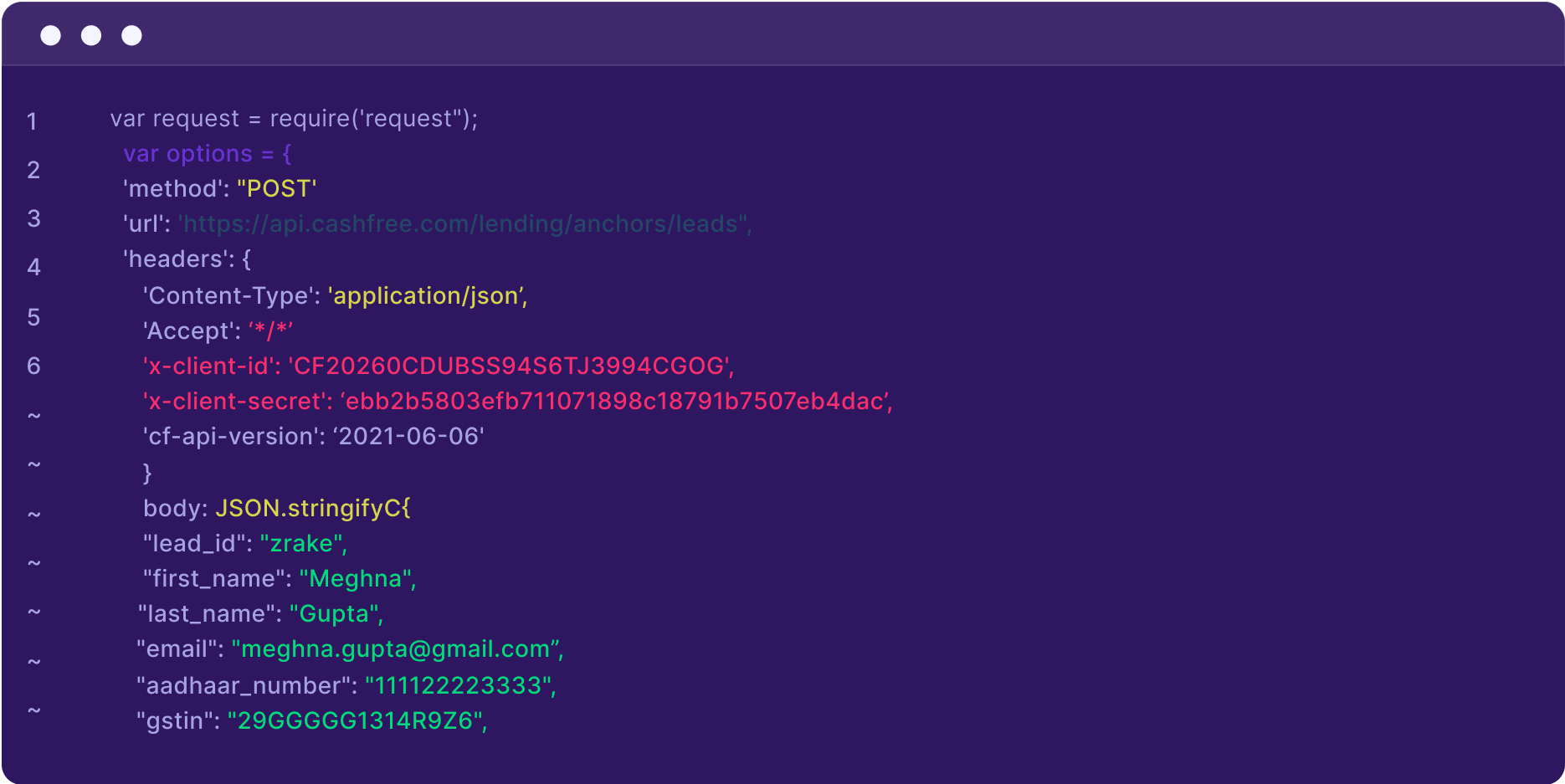

Automate loan disbursals through low-code yet powerful APIs. Offer personal loans, business loans, short term loans and credit lines with minimal tech and operational effort.

End to End API stack and white-labelled UI available for fast integration with your interface.

Tailor the credit offerings to meet your users’ specific needs. Be it ₹1,000 or ₹10 Lakh+.

Get complete visibility of the funnel through CRM with zero redirections to any third parties.

Help your users avail loans at lowest interest rates and minimal processing fees with Cashfree Payments lending partners.

Highest approval rates in the industry. Let our advanced machine learning systems do the work.

Power disbursements, repayments and ledger management through Cashfree Payments infrastructure.

Get complete visibility of the funnel through CRM with zero redirections to any third parties.

Cashfree Embedded Lending?

Automate your credit disbursals through low-code yet powerful APIs.

Types of lending products

we supportWe offer custom-tailored lending products as well. Reach out to us to learn more.

Have more questions?

Visit our support pageLending as a Service allows service providers like Cashfree Payments to enables businesses extending credit services to their user base.

Embedded lending can help you:

1 .Offer higher customer satisfaction

2. Access higher revenue margins

3. Retain customers and build loyalty

Depending on the integration and specific requirements, you can go live from anywhere between 2-6 weeks.

Bank statement and KYC documents are needed to apply for a loan.

There are two kinds of integrations offered by Cashfree Payments:

1. Native journey - Here, the UI is completely built by you and and Cashfree Payments APIs are used to create the loan journey. This tentatively takes ~ 2-3 weeks of development effort.

2. Using Cashfree Payments Plug-n-play solution - Cashfree Payments offers its own UI so you can just integrate 1 simple solution within a matter of 2 days.

Have more questions?

Visit our support pagePayouts

Make payouts to any bank account / UPI ID / card/ AmazonPay / Paytm instantly even on a bank holiday.

Learn MoreCard Issuance

Built for businesses and platforms. Launch your own card program within weeks.

Learn MoreReady to get started?

Collect customer payments, make payouts, manage international payments and so much more. Create your account or contact our experts to explore custom solutions.

Easy onboarding

Dedicated account manager

API access