This Festive Season get Lifetime Free* flowWise AccessSign up now!

UPI Payment Gateway

Collect UPI Payment

s easily from your customersUPI integration

for the desired payment flow and achieve highestUPI success rates

.UPI Payment Gateway

UPI payments

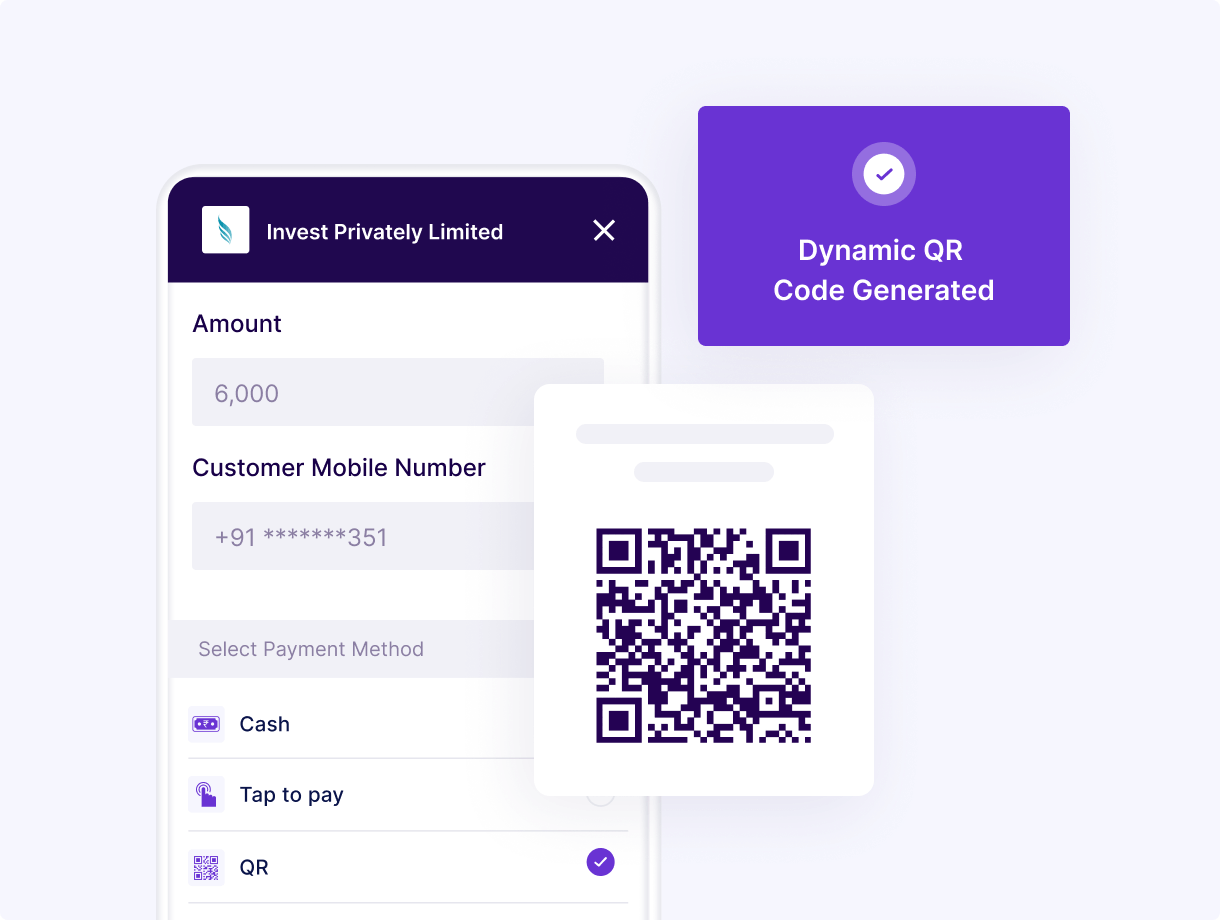

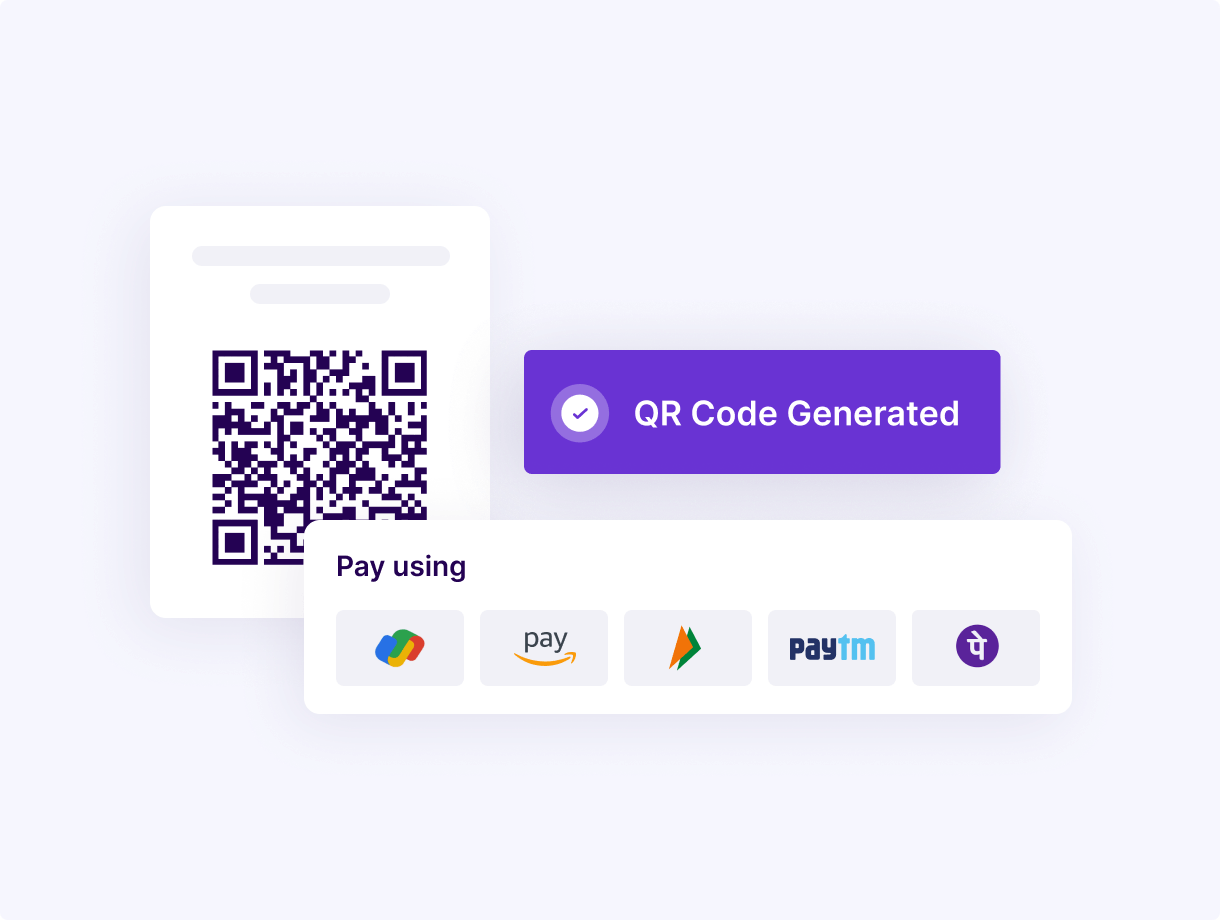

for your customer by automatically opening UPI apps installed in customer’s mobile for faster checkout.Generate QR code

on your website checkout page and let customers scan and pay using any UPI app.Generate UPI link

and share with customers over WhatsApp and get paid instantly.UPI Payment Gateway

suite tailor-made for your business needs

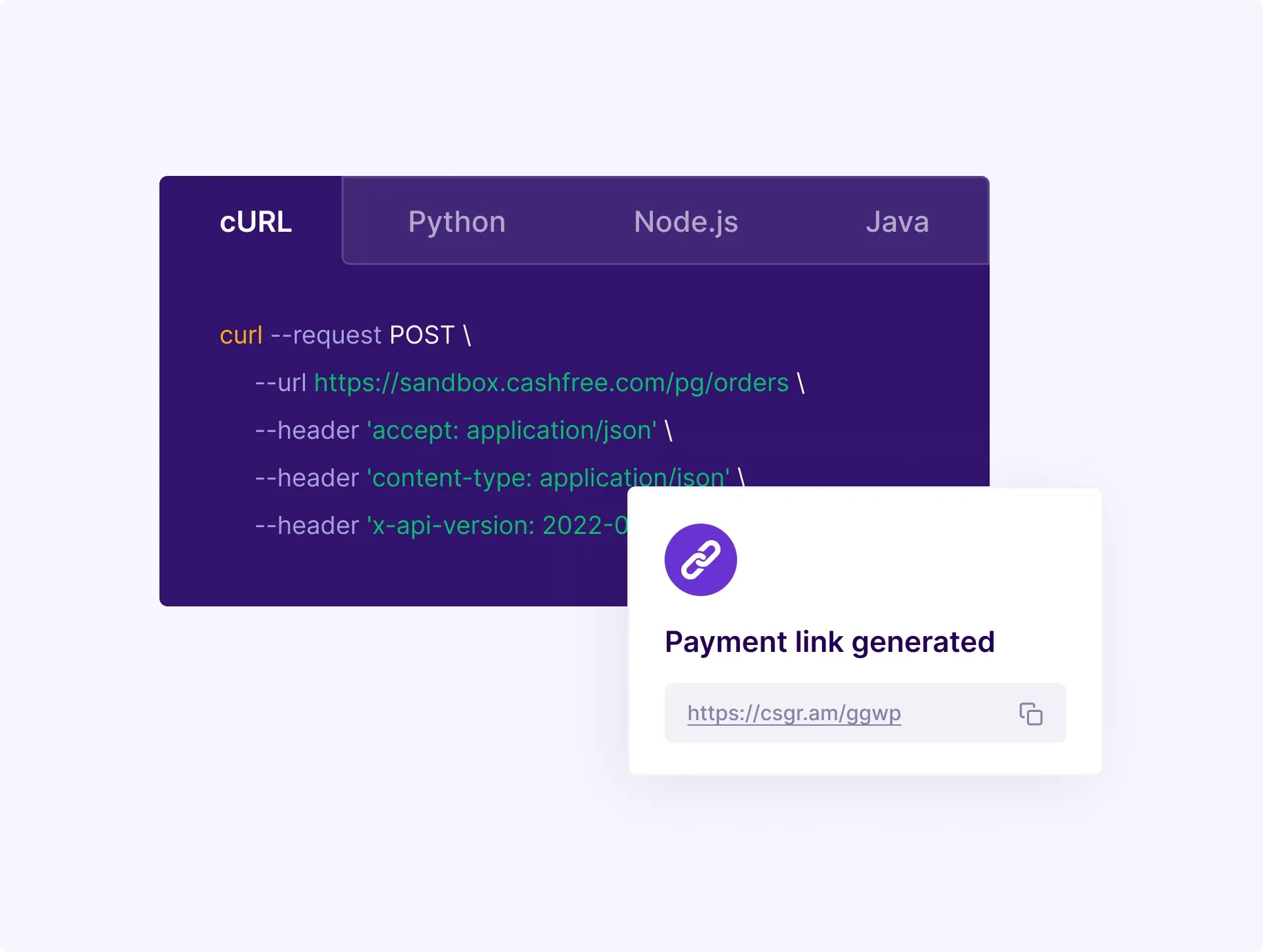

UPI Payment Links API

APIs that are easy to integrate

Embed links on your website or mobile app

Allow your users to pay without entering the amount

Generate and display dynamic QR code on your website or softPOS app

Use our APIs and make it easy for your customers to pay

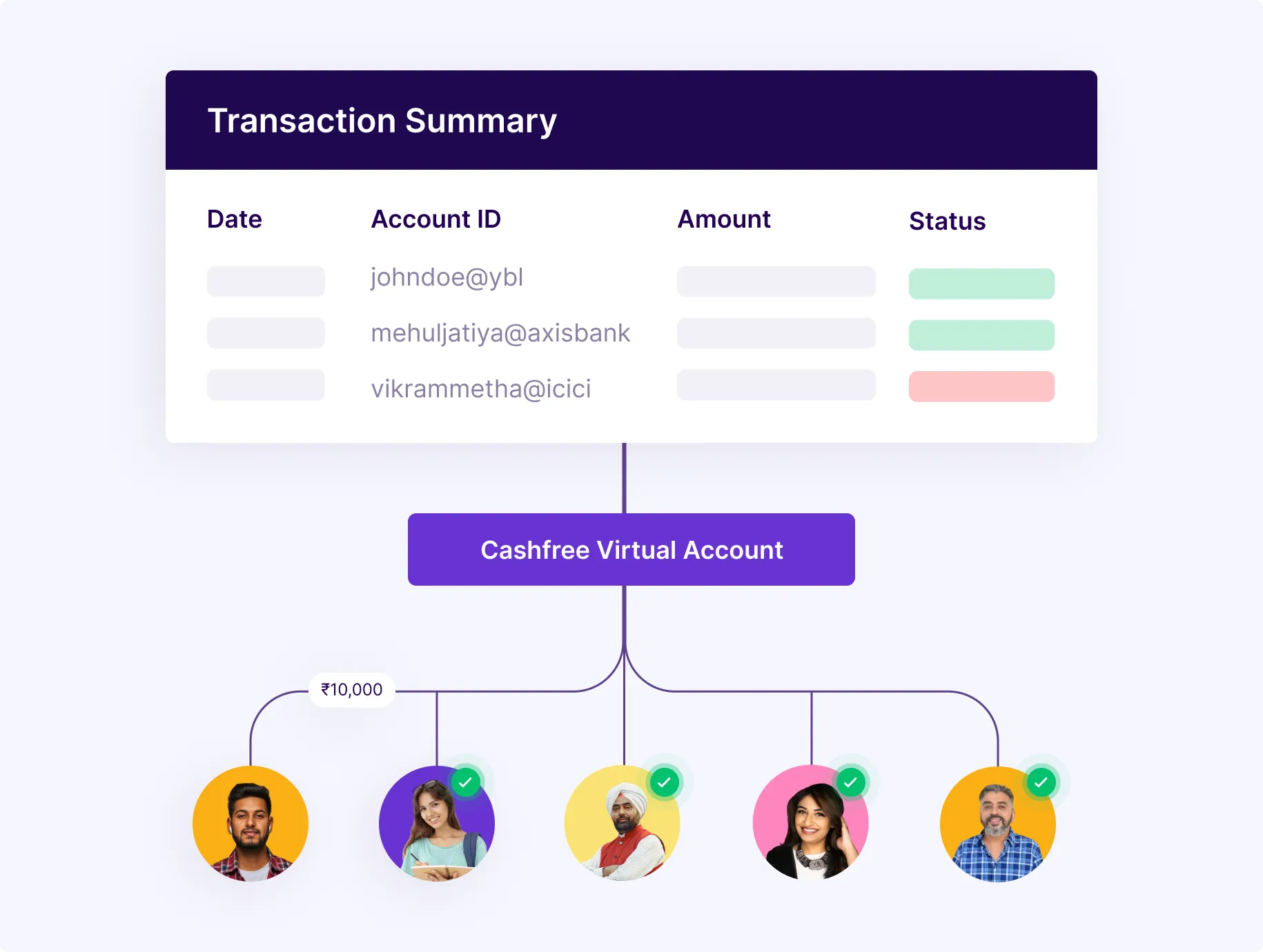

Create unique virtual UPI IDs assigned to every payer

Automatically reconcile all the UPI payments received from different customers

Allow your users to pay without entering the amount

Unified Payments Interface (UPI) is real-time, secure payment system developed by National Payments Corporation of India (NPCI). It helps in immediate money transfer easily through mobile device 24*7 and 365 days.

UPI ID is a unique identifier to each UPI linked bank account and are used to facilitate payments between customers and merchants. It provides a Virtual Payments Address (UPI VPA) to enter when transferring money to the account linked to a UPI ID.

UPI PIN is a unique 4 or 6 digit pin that the user has to set to authenticate every payment made via UPI apps.

Have more questions?

Visit our support pageA UPI (Unified Payments Interface) payment gateway is a digital service that facilitates online transactions via the UPI infrastructure. It's essentially a bridge between a customer's bank account and a merchant's bank account, allowing for instant money transfers through a secure, real-time system.

The following stages are involved in a UPI transaction -

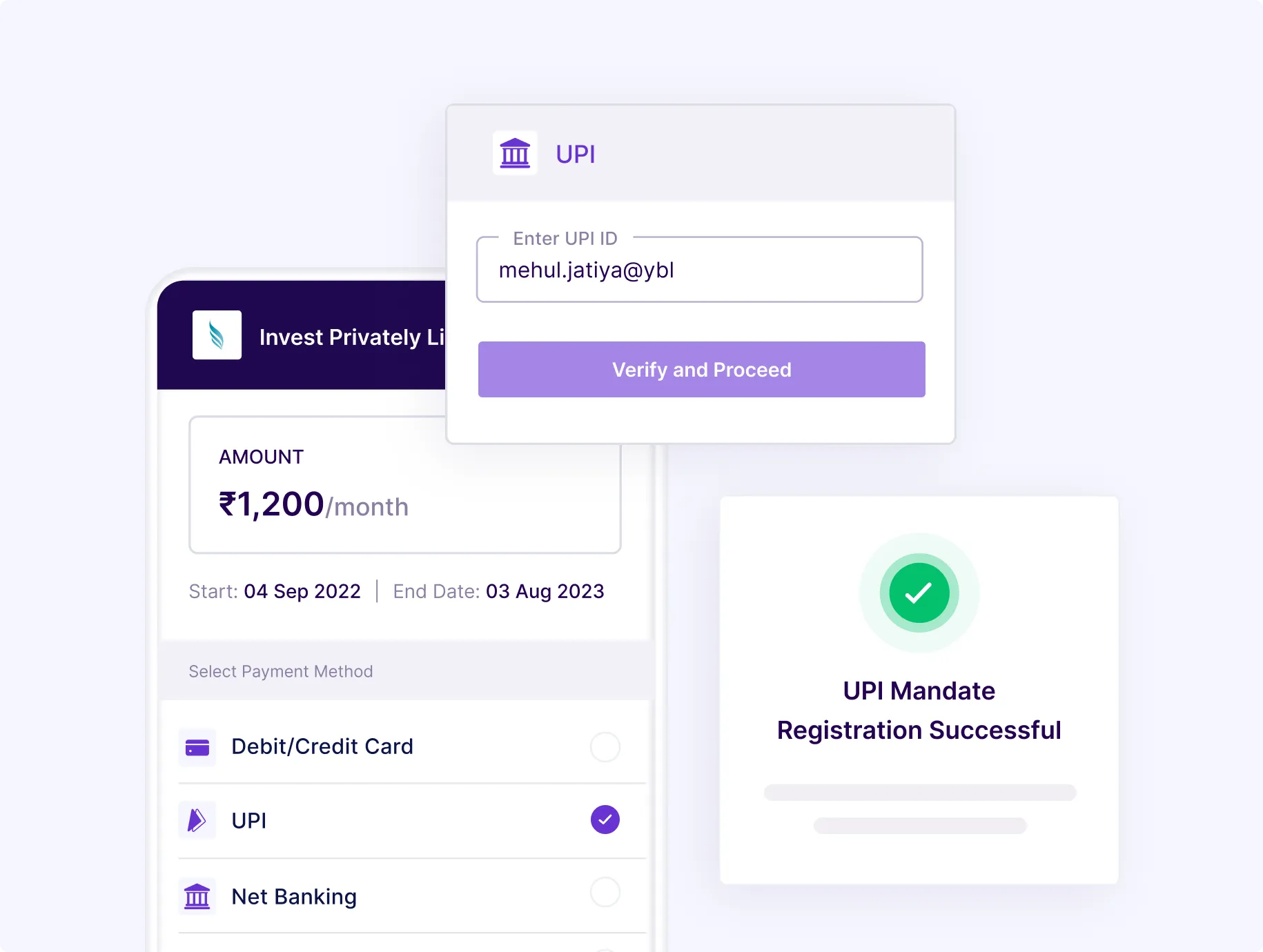

Initiation: A customer initiates a transaction on a website or app, selecting UPI as their preferred payment method.

UPI Interface: The UPI payment gateway presents the customer with an interface to enter their UPI ID (also known as a Virtual Payment Address or VPA). Alternatively, the customer may be presented with a QR code to scan using their UPI-enabled mobile app.

Authorization: The customer authorizes the transaction on their UPI app, typically by entering a secure PIN.

Completion: Once authorized, the transaction is processed in real time. The funds are transferred directly from the customer's bank account to the merchant's bank account.

Confirmation: The merchant and the customer receive confirmation of the transaction.

A UPI payment gateway is useful for businesses because it allows them to accept payments directly from a customer's bank account, simplifying the payment process and reducing the reliance on physical card infrastructure. It also enables customers to make payments anytime, anywhere, using just their mobile device.

The UPI transaction limit can vary from bank to bank, but generally, the UPI transaction limit per day is set at ₹ 1 lakh, as defined by the National Payments Corporation of India (NPCI). The limit can be categorized into two aspects:

Limit of the transaction amount: the maximum amount of money that can be transferred via UPI.

Frequency: the number of UPI transactions a person can do in a day.

For instance, State Bank of India (SBI) has a UPI limit per day of ₹ 1,00,000. Some banks also set a limit for how much can be transferred through UPI in a week. For example, IDFC bank has a UPI limit per week of ₹ 1,00,000. For more details, read here.

For merchants using Cashfree's Payment Gateway,we charge 0% MDR per transaction on collections using UPI payment mode. Read mode wise pricing here in detail.

As a merchant, you don’t have to integrate with different UPI apps separately. You can integrate Cashfree Payments UPI Payment Gateway with your website or mobile app to offer 20+ UPI apps to your customers in one place. For step-wise integration guide, watch this video.

In UPI, the money is settled as per mutually agreed upon settlement terms. Default settlement cycle is (T+2)* days where (T) is the day of transaction. Many businesses with Cashfree opt for instant settlements to manage their working capital effectively.

The UPI Payment Gateway provided by Cashfree is compatible with all PSPs such as PhonePe, Google Pay, Paytm, CRED, among others. For a comprehensive list, please visit https://www.npci.org.in/what-we-do/upi/3rd-party-apps

To support the requirements of omni-channel merchants which has both offline and online presence, Cashfree Payments offers Static QR under Payment Gateway where merchant can generate one (or) multiple Static QR codes, where they can accept payment of any amount. A dynamic QR code, on the other hand, has a fixed amount linked to it. Customers can pay only the fixed amount assigned to the QR code. For each transaction, a unique dynamic QR code is generated with a pre-defined payment amount.

Based on your customer use case, you can choose between static and dynamic QR codes to accept payments. Read more about UPI QR code here.

Cashfree's UPI Payment Gateway has deep integration with 8+banks and uses state-of-the-art real time dynamic routing between multiple banks to maximise the success rate for its customers.

Absolutely not! If you are a merchant using Cashfree Payment Gateway, no additional activation is required to start using UPI for accepting payments. To get access to merchant dashboard of Payment Gateway, connect with us.

Unified Payments Interface (UPI) transactions are generally considered safe due to several security features and protocols established by NPCI -

Two-Factor Authentication: UPI transactions require two-factor authentication, which typically involves a combination of something the user knows (like a password) and something the user has (like a mobile phone). This significantly reduces the risk of unauthorized transactions.

Encryption: UPI transactions are encrypted, which means that the data sent over the network is scrambled and can only be read by the intended recipient.

Regulation: UPI is regulated by the Reserve Bank of India and developed by the National Payments Corporation of India (NPCI), ensuring a high standard of security and regulatory oversight.

Transaction Limits: UPI has daily transaction limits which provide an additional layer of protection against fraud.

Immediate Alerts: Users receive instant notifications for all transactions, allowing them to quickly detect and report any suspicious activity.

However, users can mitigate risks by being vigilant, never sharing their UPI PIN with anyone, keeping their mobile operating system and UPI apps up-to-date, and only conducting transactions with trusted parties.

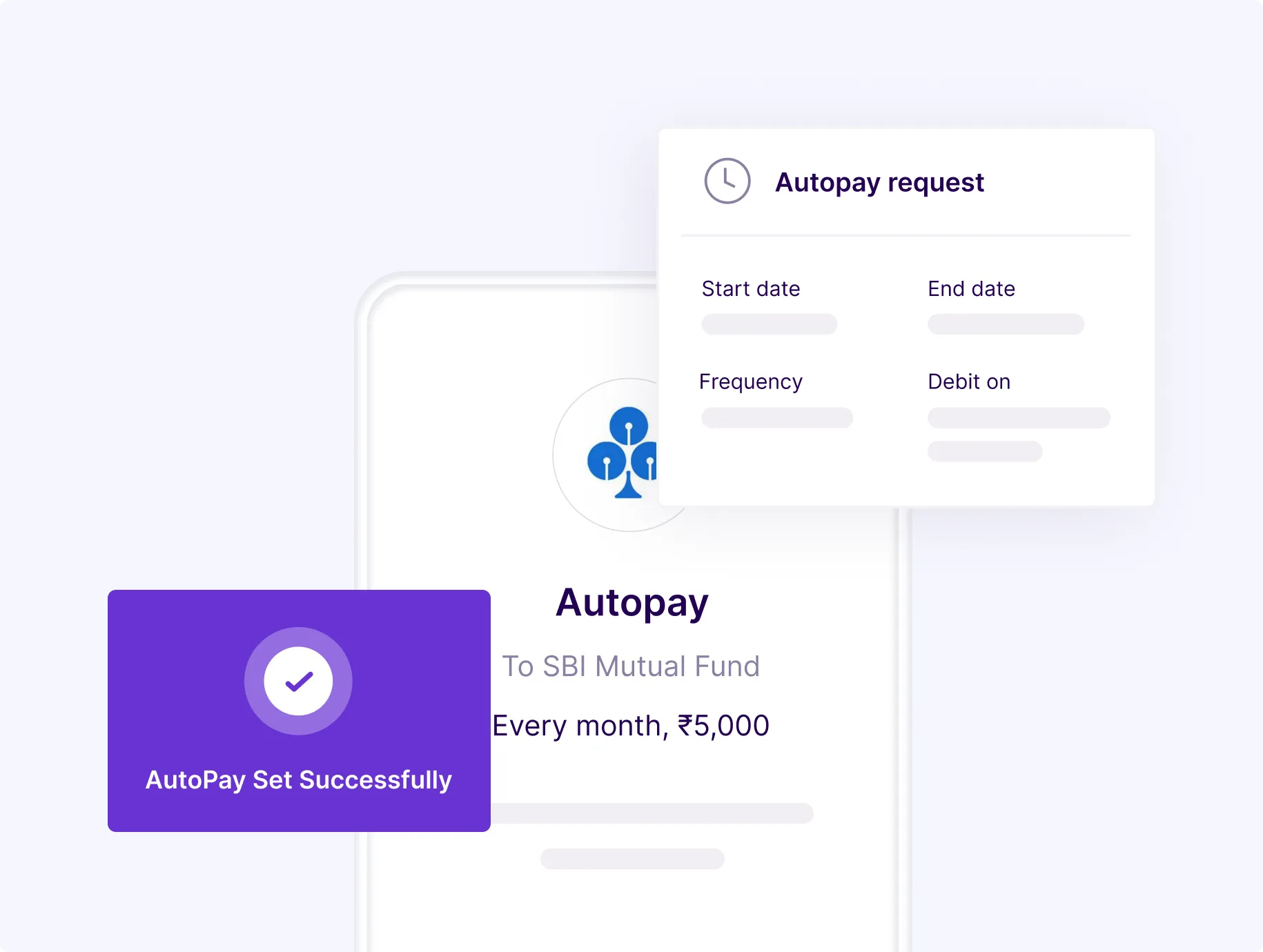

Cashfree UPI Payment Gateway is built to serve all business needs effectively. The 4 workflows supported for UPI checkout experience include -

- UPI Intent flow

- UPI Dynamic QR code

- Whatsapp UPI Links

- Collect UPI flow

Have more questions?

Visit our support page* Settlement cycle is subject to bank approval and can vary based on transaction type, business category/model, risk parameters and other factors.

Ready to get started?

Collect customer payments, make payouts, manage international payments and so much more. Create your account or contact our experts to explore custom solutions.

Easy onboarding

Dedicated account manager

API access