What are settlements?

What are settlements?

What are the different types of settlements?

What are the different types of settlements?

- Standard settlements (Default): Standard settlements are processed on a T+1 or T+2 basis, depending on your configured settlement cycle:

- T+1: The amount is settled on the next business day after the transaction.

- T+2: The amount is settled two business days after the transaction.

Business days exclude weekends and bank holidays. If the scheduled settlement day falls on a non-working day, the settlement will occur on the next working day.

- If a transaction occurs on Friday, June 3:

- For T+1 settlement, funds will be settled on Monday, June 6, as Saturday and Sunday are non-working days.

- For T+2 settlement, funds will be settled on Tuesday, June 7.

- Instant settlements: Instant Settlements enable you to access your funds within 15 minutes, significantly faster than the standard T+2 settlement cycle.

- On-demand settlements: On-demand settlements allow instant fund transfers to your bank 24x7, including holidays, for a small fee. Activation is required, as the default cycle is T+2 days.

How do I check settlements in my bank account?

How do I check settlements in my bank account?

Which account receives the settlement amount, and how can I view it?

Which account receives the settlement amount, and how can I view it?

My Settlement isn't credited yet, what do I do?

My Settlement isn't credited yet, what do I do?

If my settlement failed previously, can it be attempted again?

If my settlement failed previously, can it be attempted again?

The status of my settlement shows as failed on the Dashboard. What do I do?

The status of my settlement shows as failed on the Dashboard. What do I do?

How does on-demand settlement work, and what are the steps to activate it?

How does on-demand settlement work, and what are the steps to activate it?

Activate on-demand settlements

To enable instant settlement from the Cashfree Payments dashboard:- Go to the Payment Gateway Dashboard.

- Navigate to the Settlements section. 3.Look for the On-Demand Settlements option. If you’re eligible, you’ll see options to configure On-Demand settlements.

How to initiate On-Demand Settlements?

How to initiate On-Demand Settlements?

- Go to Payment Gateway Dashboard > Settlements > On-Demand.

- In the On-Demand settlement screen, click Request Activation. The feature activation request will be sent to your Cashfree Payments account manager, and they will enable it for you. You will receive an email after the feature has been activated.

Initiate on-demand settlement

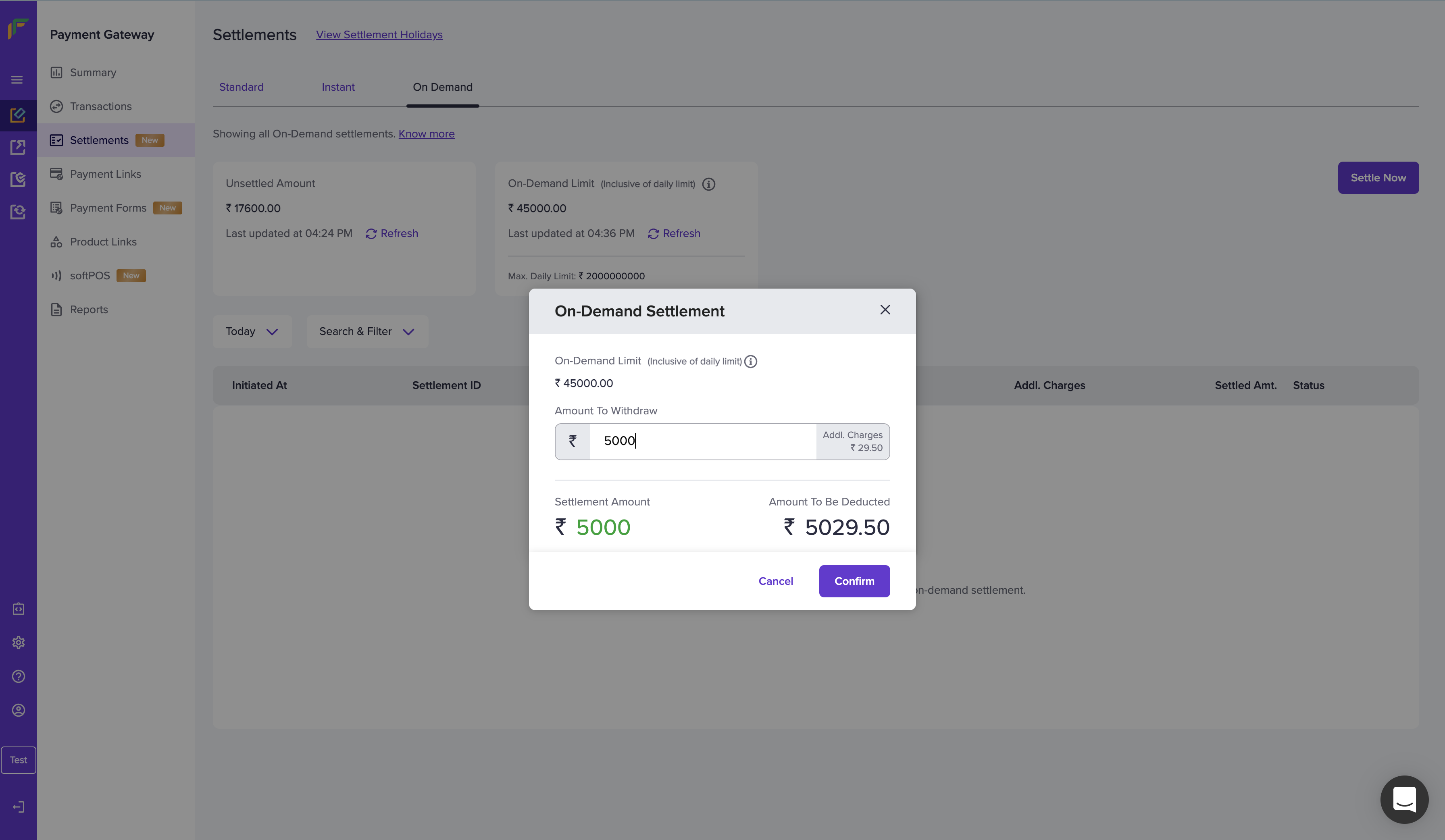

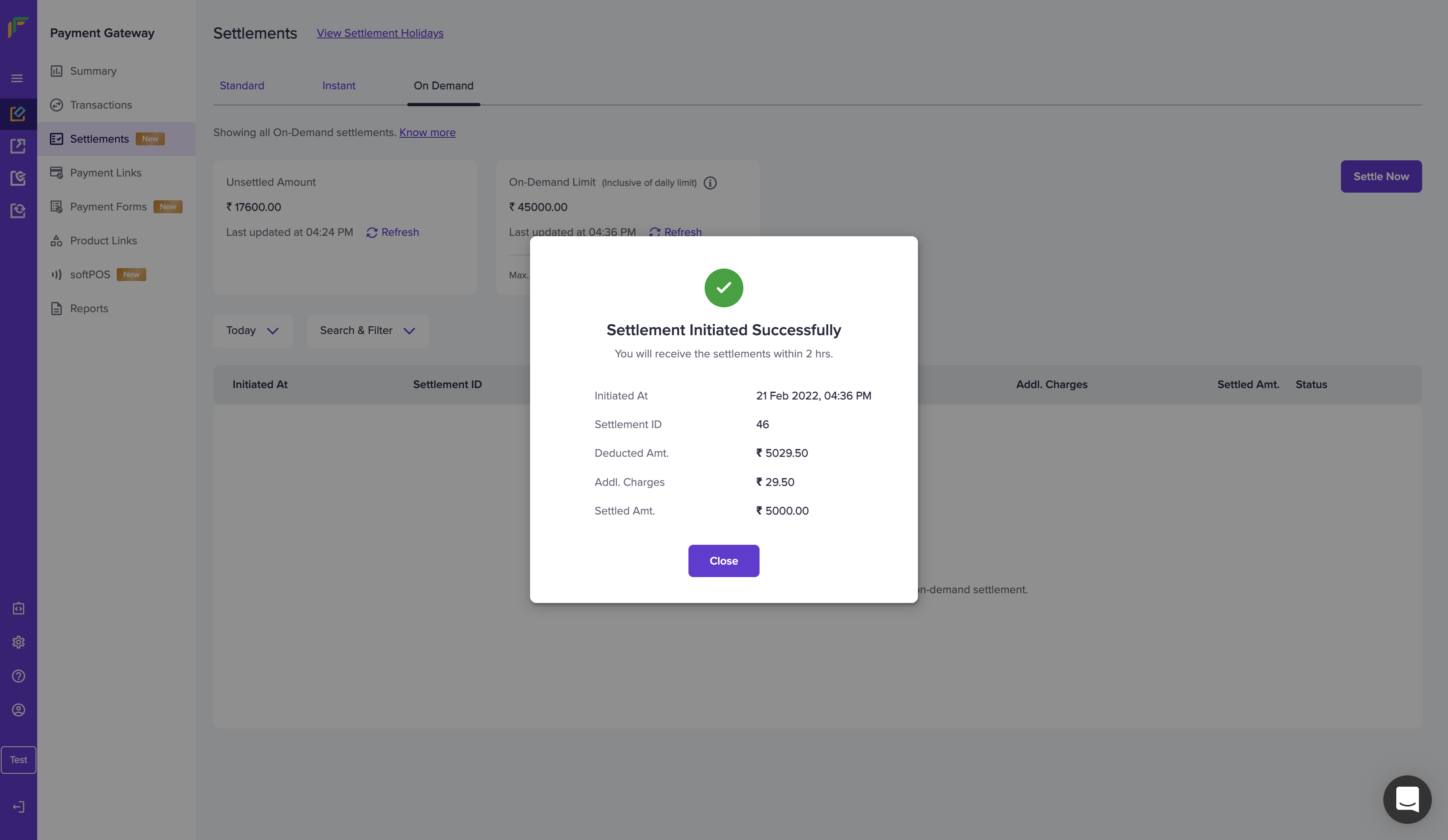

To initiate an on-demand settlement, you must first get the feature activated. After activation, you can request settlements instantly 24x7 including holidays.To initiate on-demand settlement,- Go to Payment Gateway Dashboard > Settlements > On-Demand > click Settle Now.

-

In the On-Demand Settlement screen, specify the amount you want to withdraw and click Confirm. You will see the amount you are allowed to withdraw and the additional charges applicable is also shown.

Is there a bank holidays list I can refer to for settlement purpose?

Is there a bank holidays list I can refer to for settlement purpose?

How are settlements processed?

How are settlements processed?

What is an instant settlement?

What is an instant settlement?

How instant settlements will help you grow your businesses?

How instant settlements will help you grow your businesses?

- Manage your working capital better: With instant access to your funds, you can plan your business expenditure better and drive your business towards growth. This can also help avoid the dependency on costly short-term loans to meet business needs.

- Make fool-proof projections: You can now plan your short-term business goals better without the need to assume the revenue you are yet to receive. You can take calculated risks based on your liquidity and not shoot in the dark.

-

Handle refunds and chargebacks better: The uncertainty around the usual settlement cycles often affect transactions where the customer has requested for a refund or a chargeback immediately. With instant settlements, you get instant access to those funds and in case of refunds or chargebacks, you can happily reverse the payments instantly, without the need to incur any loss for those transactions.

Are there any processing fees for instant settlements?

Are there any processing fees for instant settlements?

Is there any limit on instant settlements?

Is there any limit on instant settlements?

- Settle a specified amount up to the assigned limit until the next working day.

- Benefit from faster and higher success rates throughout the working day.

How do I enable instant settlements?

How do I enable instant settlements?

- Your account already comes with a ₹50,000/- settlement limit auto-activated for instant settlements.

- If you want to increase this limit, you can request it by clicking here. This will take you to the Merchant Dashboard, where you can request activation of instant settlements for your account.

- Once the request is submitted, your account will be reviewed and, if eligible, instant settlements will be enabled for you.

What are the eligibility criteria and activation requirements for instant settlements?

What are the eligibility criteria and activation requirements for instant settlements?

- Your merchant account must be fully onboarded and KYC-verified (business details, bank account, etc).

- Your transaction history, business category, risk profile and bank approval must satisfy the criteria for instant settlements.

- The feature is subject to the account being configured and the merchant being deemed eligible; once your request is submitted, it will be reviewed and enabled where applicable.

How do I check unsettled amount?

How do I check unsettled amount?

- Log in to your account on the Merchant Dashboard.

-

Navigate to the Summary section on the Payment Gateway module. This section displays:

- The total transaction amount for the day.

- The amount to be settled (unsettled amount).

-

For a detailed view:

- Navigate to the Settlement section.

- Select the Standard option.