Cashfree turns 10! Celebrate with 1.6%* gateway fee for new merchants – limited period!

Payouts

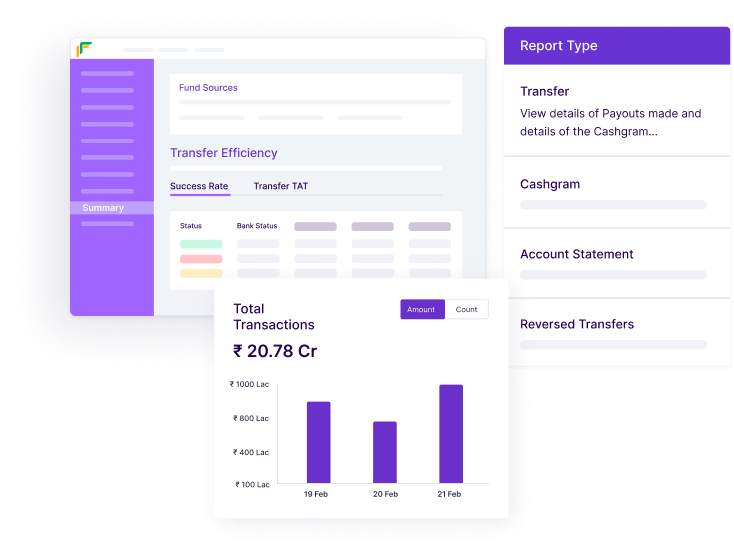

Payments Disbursal Platform

Payouts

helps businesses send money instantly, 24x7 - even on bank holidays. Pay your vendors, make customer refunds, disburse loans etc. with an industry-best success rate of 99.98%.

Payouts, reimagined.

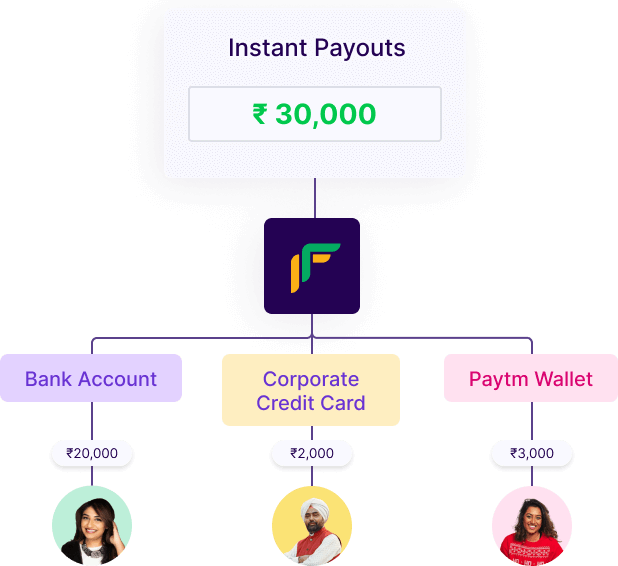

Add multiple Payout Fund Sources and pay your vendors, partners, employees, or customers into the destination payment mode of their choice.

Multiple Current Accounts

Do away with manual recharges

Make instant transfers

Increase success rate with multi-bank accounts

Escrow Accounts

Simplify your escrow setup with guided assistance

Automate direct fund transfers between accounts

Monitor transfer status, identify failures and ease reconciliation

Send money to your customer’s bank account via IMPS, NEFT, or RTGS instantly. No cool off period for beneficiary addition!

Initiate disbursals to customers UPI ID directly or add funds to their Paytm and Amazon Pay wallets.

Transfer money to any tokenised credit and debit cards instantly.

payments disbursal solution

Single Payouts Account

Vendor Payments

Vendor Verification

Customer Refunds

Highly reliable at scale

Payout Link

Cashgram

payout links

generation solution that helps businesses pay vendors, partners, customers or others instantly when only their mobile number or email address is known.1. Send

Create a Cashgram link and notify via email, SMS or WhatsApp.

2. Capture

Beneficiary enters their bank account/ debit card/ UPI/ Paytm/Amazon Pay details.

3. Redeem

Beneficiary receives a payout in their preferred account.

Engineered for you

Go live in minutes with our dedicated Plug-in and SDKs

Use sample integration kits to try out integrations using Test API credentials before going live. API libraries are available in multiple languages.

Get notified on transfer status - success, pending, etc. with webhooks in real time

1const cfSdk =require('cashfree-sdk');

2const {Transfers} = cfSdk.Payouts;

3const response = await Transfers.RequestBatchTransfer(

4{batchTransferId : 'PAY_14APRIL_2021',

5batchFormat : 'BANK_ACCOUNT' ,

6deleteBene : 1,

~batch : [

~{ transferId : 'VENDOR_512623_PAY_14APRIL',

~amount: '1023.4',

~phone : '9999999999',

~bankAccount : '1007766300076281' ,

~ifsc : 'HDFC0001007',

~email : 'johndoe@cashfree.com',

~name: 'John' }

~]

No code solutions

- Make

individual payouts

using Quick Transfer on Dashboard by entering beneficiary account details. - Make

bulk payouts

easily and quickly from the Dashboard by uploading excel sheets with beneficiary account details andmake payouts

in seconds.

INDUSTRY Use cases

Payouts

for innovative businessesbusiness payouts

challenges with our powerfulPayouts APIs

.TESTIMONIALS

PRICING

STANDARD

Pay as you go - for startups

| Transaction Amount | Up to ₹1,000 | ₹1,000 to ₹25,000 | Above ₹25,000 |

|---|---|---|---|

| NEFT | ₹ 3.00 | ₹ 5.00 | ₹ 8.00 |

| RTGS | ₹ 4.00 | ₹ 6.00 | ₹ 10.00 |

| IMPS/UPI/ Amazon Pay | ₹ 6.00 | ₹ 8.00 | ₹ 15.00 |

| Pay to Phone/ Pay to Phone + CC | ₹ 7.00 | ₹ 9.00 | ₹ 18.00 |

Visa

Mastercard

₹15.00

Up to ₹1,000 txn amount

₹20.00

Above ₹1,000 txn amount

Optimized payments infrastructure that helps you scale

Dedicated account manager

Volume discounts

Migration support

Dedicated support

Get in touch with our sales team to explore the right product(s) for your payment needs and get custom pricing.

Have more questions?

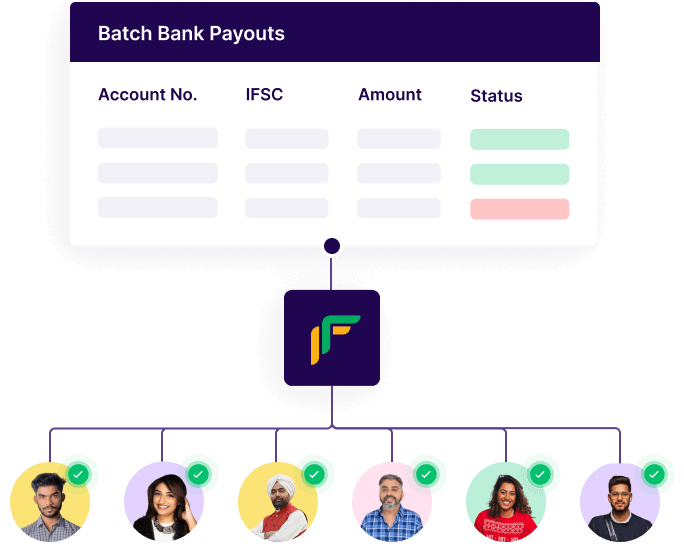

Payouts is a powerful and secure disbursement solution that empowers businesses to effortlessly transfer funds to multiple recipients. Whether you need to disburse payments to individuals, vendors, partners, or employees, Payouts simplify the process, saving you time and effort.

With Cashfree Payouts, you can automate your bulk payments, ensuring direct, timely and instant payouts. You can connect your bank accounts, and make direct payouts! You can use the Payouts dashboard to do single or bulk payouts via Excel upload or integrate Payouts APIs with your product or ERP to automate bulk payouts. It eliminates the complexities of manual disbursements by streamlining your payment workflow, ultimately boosting your operational efficiency.

You can use Cashfree Payouts for a wide range of business use cases. Here is how some of the leading businesses in India are using Payouts:

- Hyperlocal services like Grab use it for on-demand wage payouts.

- E-commerce platforms like Nykaa and Xiaomi use Payouts APIs for instant refund processing.

- Loan providers/NBFcs like DMI Finance and Branch use it for instant loan disbursals.

- Gaming websites like RummyCircle use Payouts for real-time player's winning cashouts.

- Marketplace platforms like Milaap and Tata Sky have integrated Payouts with their products for automated vendor payouts.

"For faster Payouts account activation, signup here. Once logged in, click on activate Payouts and add your business details and upload copies of your business documents. Follow the steps to complete your account activation.

In case of any queries or if you are looking for a customized solution, get in touch with our sales team here. Our team will connect with you in 24 working hours. Meanwhile, you can also explore the product in test environment and use test API credentials to try out the integration before going live. View developer documentation here.

Yes, Payouts can be used only by registered businesses. If you are not yet registered as a business but plan to start soon, you can signup and explore the product in test environment. We can also set up an account with limits on payout volume after understanding your business and future needs.

Transfers to bank accounts happen instantly. Transfers for amounts in excess of ₹2,00,000 are restricted by banking hours and can take longer. Payouts to other modes like Paytm, AmazonPay wallet, cards, UPI ID happen instantly.

Yes, it is possible to make payouts even on Sundays and bank holidays.

Yes, you can make payouts to any active savings or current bank account in India. However, NRE and NRO bank accounts are not supported.

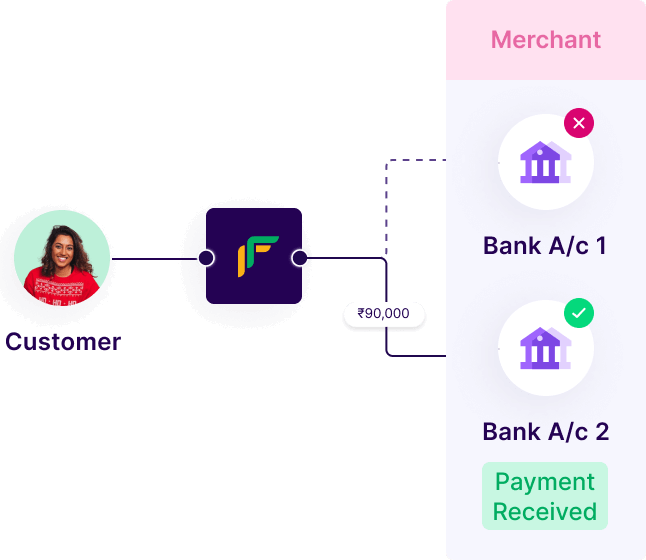

Cashfree Payouts offers the industry-best success rate at 99.98%. We have implemented various features and mechanisms to ensure that your transfers are successful at all times. With smart routing and queuing across multiple banks, we guarantee higher uptime and a higher success rate. In addition, our system intelligently re-routes failed transfers, increasing the likelihood of successful payouts.

"Bulk payouts via bank accounts happen by manually adding every beneficiary before transferring or by uploading a spfsheet on the banking portal. Cashfree automates bulk payouts fully via APIs and offers a much simpler alternative.

Unlike banks, where a single error in a payout file can block all the bulk payouts, using Cashfree, even if there are invalid records in a file, valid transfers go through. Reconciliation for failed and invalid transfers is automated so you always know which transfer failed out of hundreds of payouts, and why. At Cashfree, new beneficiary addition and activation is instant.

Cashfree also allows you to send money to any Paytm Wallet, Amazon Pay Wallet, UPI ID or native wallets in addition to bank accounts, even on holidays. Lastly, all of this can be automated and built into your product or internal systems using our powerful Payouts APIs."

Using bulk file uploads or manual transfers requires no technical expertise and is the quickest way to get started. However, if you want to automate the payouts from your product or ERP, APIs should be used. Integrating the API can take a day or two depending on the complexity of integration. Many businesses start by using the bulk file upload or manual transfer option, and gradually automate operations by integrating the API. View developer documentation here.

"Yes, it is possible to send bulk payouts to beneficiaries in India from another country using Global Payouts.The funds can be added by the businesses in USD, EUR and other freely convertible currencies. The purpose of the payment must be known while setting up the account.

An Indian business can also send a payout to other countries. However, there are restrictions around the volume of payments and the purpose of payments. Get in touch with us to learn more."

Yes, you, as an admin, can create aliases and assign different access to play specific roles. You can assign the created aliases as Approver and Initiator roles for direct and batch transfers. Once the Initiator requests a transfer, the request gets listed in the ‘Approve’ tab of the ‘Transfers’ screen. The Approver can view the details and approve or reject the request. This will help distribute responsibility and ensures accountability with respect to transfers.

Know more: https://www.cashfree.com/docs/payouts/payouts/make-payouts/initiator-approver

When you make a Payout to your party, there are various states that the transfers may go through before the amount reaches the beneficiary account.

- Pending

When the transfer status is yet to be confirmed, the payout is in the Pending state. At this point, the partner bank could be processing the payout and no further action is required from your end.

The Pending state can transition into:

- Success state, if the payout is successful.

- Failed state, if the payout fails.

- Failed

When the payout request fails, the payout is in the Failed state. Failed is a final state and does not allow transitioning to any other state. You can reinitiate the transfers which have failed.

For failed transfers, if any amount is debited, it will be reversed to you by the remitter bank within 24 hours.

A payout can indicate a Failed state due to various reasons, such as:

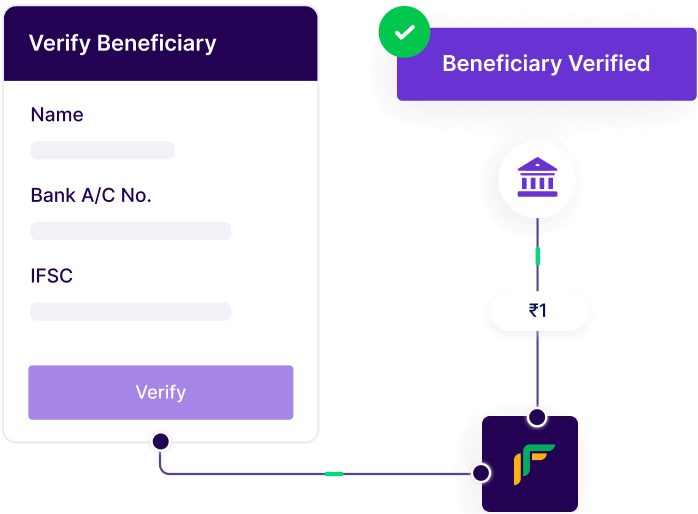

- The beneficiary account details are wrong and not validated. To avoid this, you can validate the beneficiary account details using the bank account verification feature.

- There is no sufficient balance in your Payouts recharge account. To avoid this, you can specify the balance in the Low Balance Alert section. If the balance goes below the amount specified, Cashfree Payments sends you a notification.

- Remitter or beneficiary bank servers are down.

- Success

When the remitter's bank has completed the transfer, the payout is in the Success state.

The Success state can transition into the Reversed state if the beneficiary bank reverses the transfer.

- Reversed

A payout can be in the Reversed state due to various reasons, such as:

- Incorrect account details

- Reversal by the clearinghouse

- Reversal by the beneficiary bank

Reversed is a final state and does not allow transitioning to any other state. Cashfree credits the original amount to your Payouts account.

Transfers to incorrect account details fail instantly. For certain banks, it may take up to 24 hours to receive a confirmation of failure. To ensure that account details are correct, you can activate Cashfree Bank Account Verification and verify the beneficiary account validity and beneficiary name at the bank.

"Yes. If you are a payouts account holder, you can request to recall funds transferred to a party if there was a mistake in the transfer made. For example, incorrect beneficiary account details entered the wrong amount specified, or any other valid reason.

To raise a recall request:

Write to Cashfree at dispute@cashfree.com and include all the payout-related details.

Cashfree raises the request with the partner bank.

The bank raises the request with NPCI or RBI, depending on the payment method.

It is ideal to raise the request within 45 days from the date of transfer. The recall process timeline depends on the payment mode.

Note: There is no surety or confirmation guaranteed on recall requests. Most of the cases require the end beneficiary's consent. At times, the bank requests an indemnity letter from the beneficiary."

Yes, with Webhooks.

Webhooks are events that notify you about the payment status. All Payout integrations should establish a webhook to listen to payout events, like status changes on payments.

Webhooks help you receive automatic updates and are significant for completing the integration with Cashfree Payments. Webhooks are triggered with a request from your side, for example, when a transfer fails or when a daily report is available. Requests get processed both synchronously and asynchronously. In rare scenarios, for some payment methods, the outcome may take a longer duration to confirm. Cashfree Payments notify you once we get updates from the bank about the payment status.

To configure webhooks, follow the steps here.

Yes. You can set your preferences to receive daily email updates about:

- The transfers made the previous day

- Payouts that are pending

- Credits and debits to your Payouts account

- Cashgrams that were created the previous day

- Credits made to your Payouts Account

- Transfer reversals made the previous day

To receive email notifications, follow the steps here.

Have more questions?

Visit our support pageGlobal Payouts

Add funds in USD, EUR and other currencies and send money to your sellers, service providers or freelancers in India directly to their local bank account in India.

Learn MoreBank Account Verification

Use complete verification suite for e-KYC and verify beneficiary bank account or UPI ID before sending money. IFSC verification API is now available [Free].

Learn MoreReady to get started?

Collect customer payments, make payouts, manage international payments and so much more. Create your account or contact our experts to explore custom solutions.

Easy onboarding

Dedicated account manager

API access